3 Promising UK Penny Stocks With Under £800M Market Cap

The UK market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors might consider exploring opportunities in smaller or newer companies where penny stocks—despite their somewhat outdated label—remain a relevant investment area. These stocks can offer surprising value when backed by strong financial health and may present potential for growth even amidst broader market uncertainties.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.64 | £54.04M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.74 | £282.92M | ✅ 4 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.20 | £159.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.41 | £386.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.67 | £353.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.612 | £999.84M | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £155.66M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.866 | £2.13B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 385 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kodal Minerals (AIM:KOD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kodal Minerals PLC, with a market cap of £77.95 million, is involved in the exploration and evaluation of mineral resources in the United Kingdom and West Africa through its subsidiaries.

Operations: Kodal Minerals PLC does not report any revenue segments.

Market Cap: £77.95M

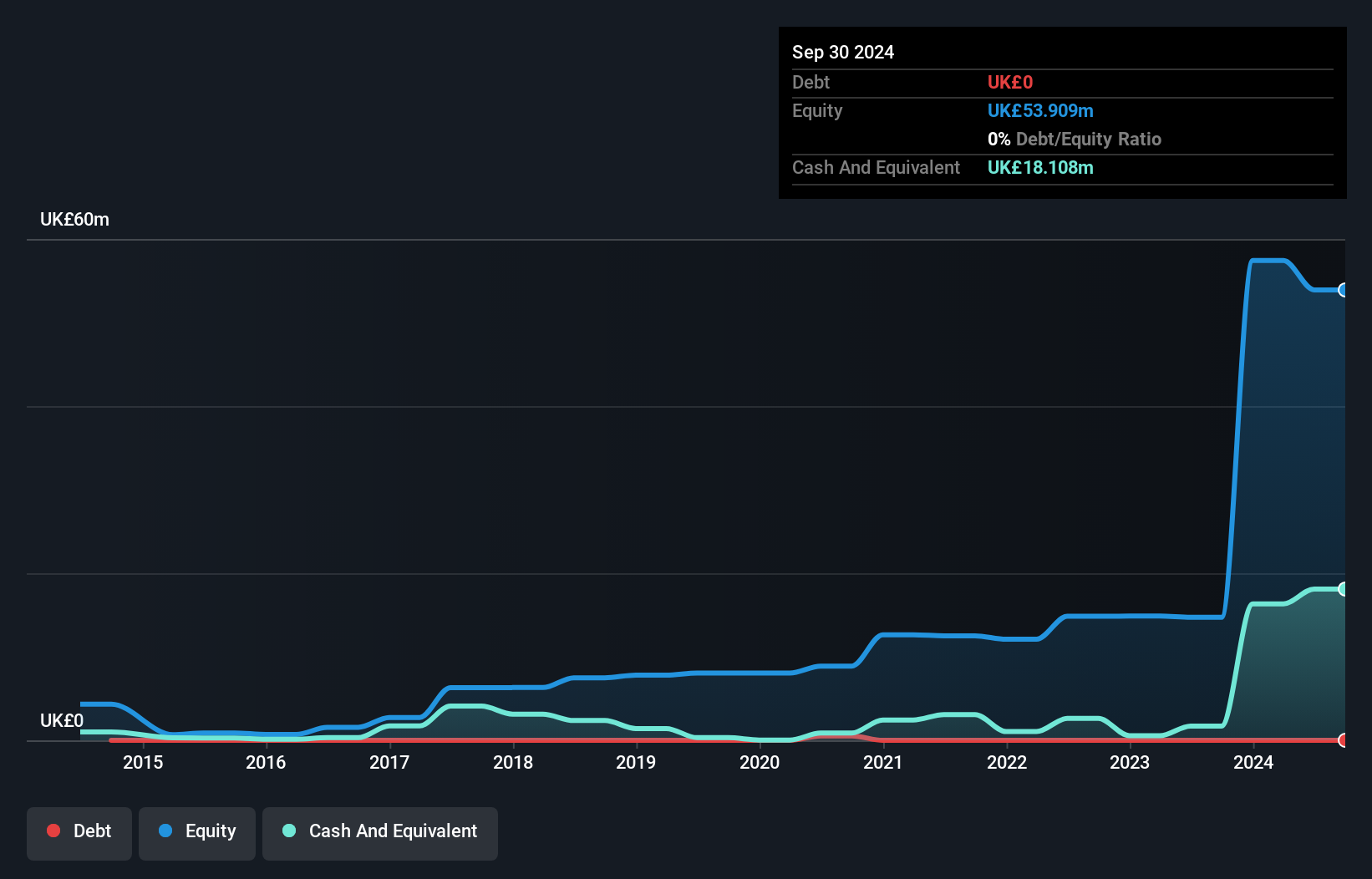

Kodal Minerals, a pre-revenue company with a market cap of £77.95 million, is advancing its Bougouni Lithium Project in Southern Mali. The project has produced over 11,000 tonnes of spodumene concentrate and is nearing commercial production despite delays in the mining licence transfer. Kodal's financials show strong potential: it is debt-free with short-term assets significantly exceeding liabilities and has recently achieved profitability, although earnings are forecast to decline by an average of 38.9% per year over the next three years. The board and management team are experienced, yet the stock remains highly volatile.

- Dive into the specifics of Kodal Minerals here with our thorough balance sheet health report.

- Learn about Kodal Minerals' future growth trajectory here.

Irish Continental Group (LSE:ICGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Irish Continental Group plc is a maritime transport company serving Ireland, the United Kingdom, and Continental Europe with a market cap of £713.95 million.

Operations: The company's revenue is derived from two main segments: Ferries, which generated €433.5 million, and Container and Terminal operations, contributing €203.5 million.

Market Cap: £713.95M

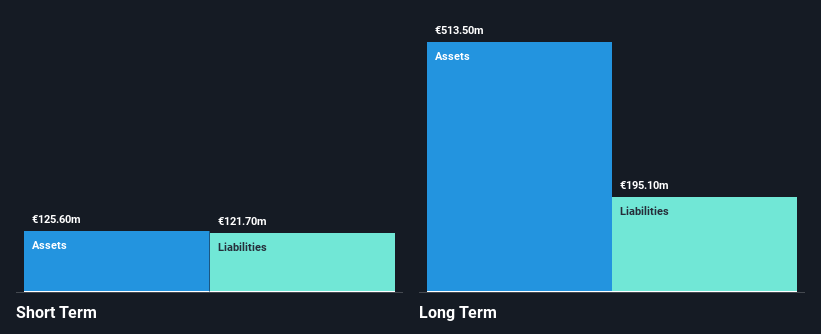

Irish Continental Group, with a market cap of £713.95 million, has exhibited stable financial performance despite recent challenges. The company reported €603.8 million in sales for 2024, a modest increase from the previous year, though net income slightly declined to €59.9 million. While earnings growth was negative over the past year, its five-year profit growth is significant at 32.6% annually. The company maintains satisfactory debt levels and well-covered interest payments but faces issues with long-term liabilities exceeding short-term assets. Though trading below estimated fair value and offering a proposed dividend increase, its dividend track record remains unstable.

- Click to explore a detailed breakdown of our findings in Irish Continental Group's financial health report.

- Explore Irish Continental Group's analyst forecasts in our growth report.

PensionBee Group (LSE:PBEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market cap of £361.93 million.

Operations: The company generates revenue of £33.20 million from its Internet Information Providers segment.

Market Cap: £361.93M

PensionBee Group plc, with a market cap of £361.93 million, has shown resilience despite being unprofitable. The company reported revenue growth to £33.20 million for 2024, reducing its net loss significantly from the previous year. It benefits from a debt-free status and sufficient cash runway for over three years due to positive free cash flow growth at 8.5% annually. Analysts anticipate a stock price increase of 32.4%. The management team and board are experienced, contributing to strategic stability while short-term assets comfortably cover both short and long-term liabilities, supporting its operational sustainability amidst volatility concerns.

- Click here to discover the nuances of PensionBee Group with our detailed analytical financial health report.

- Examine PensionBee Group's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Access the full spectrum of 385 UK Penny Stocks by clicking on this link.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal