3 European Stocks Estimated To Be Trading Below Their Intrinsic Value In April 2025

In April 2025, the European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by nearly 4% over a week, buoyed by the European Central Bank's decision to cut rates amid trade uncertainties. As investors navigate these shifting economic conditions, identifying undervalued stocks becomes crucial; such opportunities often lie in companies whose intrinsic value is not yet reflected in their current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Cenergy Holdings (ENXTBR:CENER) | €8.42 | €16.43 | 48.8% |

| Mips (OM:MIPS) | SEK352.60 | SEK692.82 | 49.1% |

| LPP (WSE:LPP) | PLN15610.00 | PLN30723.31 | 49.2% |

| Lindab International (OM:LIAB) | SEK186.80 | SEK371.74 | 49.8% |

| Verbio (XTRA:VBK) | €9.24 | €18.22 | 49.3% |

| TF Bank (OM:TFBANK) | SEK345.50 | SEK669.05 | 48.4% |

| Etteplan Oyj (HLSE:ETTE) | €11.55 | €23.07 | 49.9% |

| Stille (OM:STIL) | SEK209.00 | SEK400.76 | 47.8% |

| Komplett (OB:KOMPL) | NOK11.50 | NOK22.67 | 49.3% |

| Fodelia Oyj (HLSE:FODELIA) | €7.14 | €13.91 | 48.7% |

Let's take a closer look at a couple of our picks from the screened companies.

AddLife (OM:ALIF B)

Overview: AddLife AB (publ) and its subsidiaries supply equipment, consumables, and reagents mainly to the healthcare sector, research institutions, colleges, universities, as well as the food and pharmaceutical industries; it has a market cap of approximately SEK18.77 billion.

Operations: The company's revenue is primarily derived from its Labtech segment, which contributes SEK3.80 billion, and its Medtech segment, which generates SEK6.50 billion.

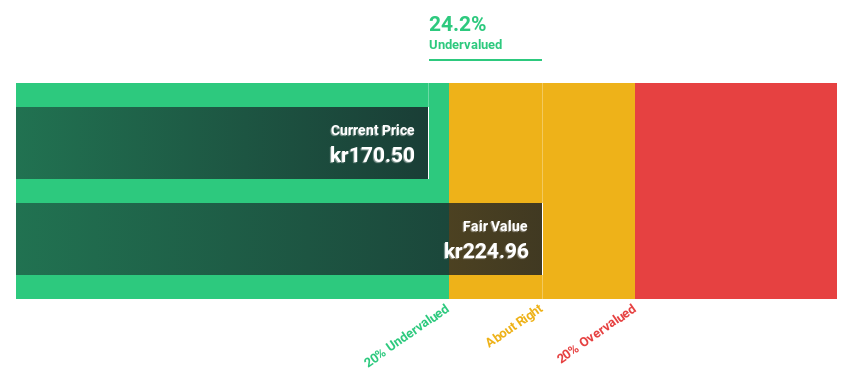

Estimated Discount To Fair Value: 26.9%

AddLife is trading at SEK 154, significantly below its estimated fair value of SEK 210.76, presenting a potential undervaluation based on discounted cash flow analysis. Despite low forecasted return on equity and interest payments not being well covered by earnings, the company has shown strong profit growth with net income improving to SEK 94 million from a loss last year. Future earnings are expected to grow significantly faster than the Swedish market average.

- Our earnings growth report unveils the potential for significant increases in AddLife's future results.

- Delve into the full analysis health report here for a deeper understanding of AddLife.

Mayr-Melnhof Karton (WBAG:MMK)

Overview: Mayr-Melnhof Karton AG manufactures and sells cartonboard and folding cartons in Germany, Austria, and internationally, with a market cap of €1.56 billion.

Operations: The company's revenue segments include MM Board & Paper with €1.95 billion, MM Food & Premium Packaging at €1.70 billion, and MM Pharma & Healthcare Packaging contributing €615.69 million.

Estimated Discount To Fair Value: 38.2%

Mayr-Melnhof Karton is trading at €77.8, significantly below its estimated fair value of €125.91, highlighting a potential undervaluation based on discounted cash flow analysis. Despite having a high level of debt and a forecasted low return on equity, the company's earnings are expected to grow significantly faster than the Austrian market over the next three years. Analysts anticipate a stock price rise by 30.9%, supported by recent dividend increases to €1.80 per share.

- The growth report we've compiled suggests that Mayr-Melnhof Karton's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Mayr-Melnhof Karton's balance sheet health report.

Verbio (XTRA:VBK)

Overview: Verbio SE is involved in the production and distribution of fuels and finished products across Germany, Europe, North America, and internationally, with a market cap of €588.73 million.

Operations: The company's revenue is primarily derived from its Biodiesel segment, which generated €856.58 million, and its Bioethanol (including Biomethane) segment, which contributed €636.48 million.

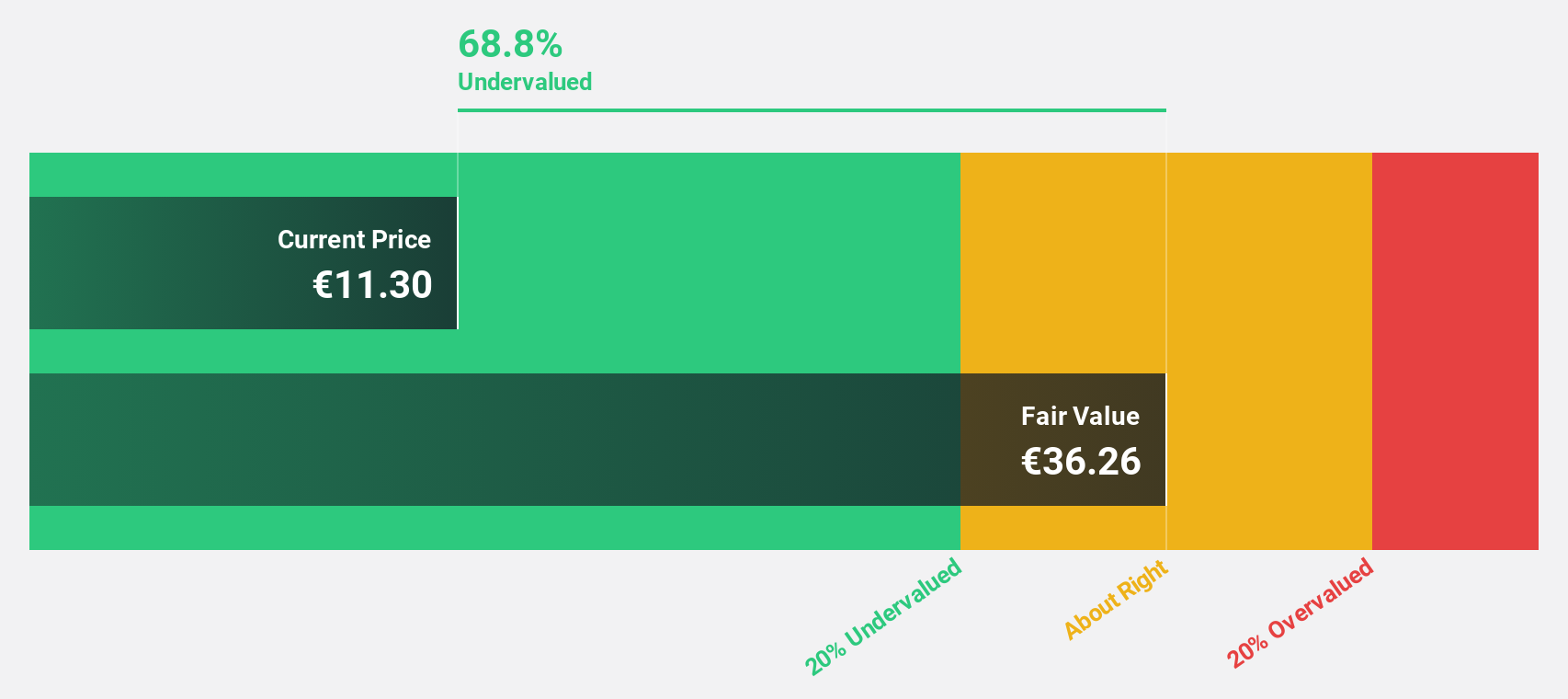

Estimated Discount To Fair Value: 49.3%

Verbio SE is trading at €9.24, well below its estimated fair value of €18.22, suggesting a potential undervaluation based on cash flow analysis. Despite recent earnings setbacks with a net loss reported for the latest quarter and six months, production of biodiesel, bioethanol, and biomethane has increased compared to last year. Analysts expect Verbio to become profitable within three years and forecast revenue growth above the German market average.

- Our expertly prepared growth report on Verbio implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Verbio's balance sheet by reading our health report here.

Taking Advantage

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 179 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal