Discovering Opportunities: China Wantian Holdings And 2 Other Promising Asian Penny Stocks

Amid global trade uncertainties and mixed performances in major stock indexes, Asian markets are navigating a complex economic landscape. Despite these challenges, the potential for growth remains, particularly in niche areas like penny stocks. Though often overlooked, these smaller or newer companies can provide unique opportunities when backed by strong financials. In this article, we explore three promising Asian penny stocks that combine balance sheet strength with potential for significant returns.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.70 | THB1.71B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.45 | SGD182.38M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.101 | SGD42.92M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.193 | SGD38.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.33 | HK$1.37B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.67B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.03 | HK$649.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.04 | HK$1.73B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.97 | CN¥3.44B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,152 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Wantian Holdings (SEHK:1854)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Wantian Holdings Limited operates in the green food supply and catering chain, as well as environmental protection and technology sectors in Hong Kong and China, with a market cap of HK$2.75 billion.

Operations: The company's revenue segments include HK$750.39 million from food supply, HK$37.42 million from catering services, and HK$0.82 million from environmental protection and technology services.

Market Cap: HK$2.75B

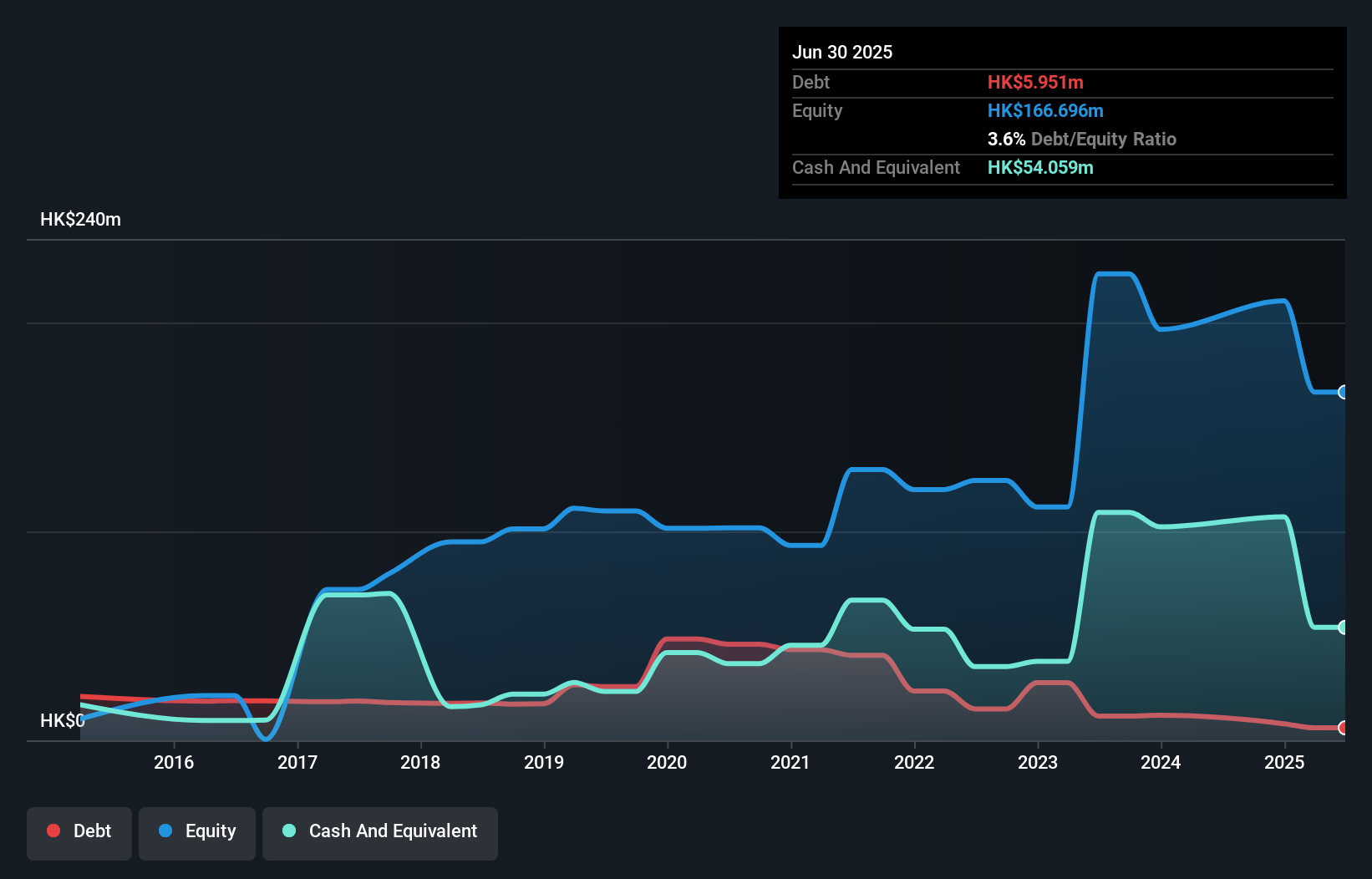

China Wantian Holdings, with a market cap of HK$2.75 billion, operates in the food supply and environmental sectors. Despite generating HK$788.63 million in sales for 2024, it remains unprofitable with a net loss of HK$41.99 million and declining earnings over the past five years at 57.9% annually. The company has reduced its debt to equity ratio significantly from 47.8% to 3.4%. Recent management changes include appointing Ms. Shum Ching Yee Jennifer as Company Secretary and CFO, bringing over 17 years of experience in finance and accounting to the role amidst ongoing financial challenges.

- Navigate through the intricacies of China Wantian Holdings with our comprehensive balance sheet health report here.

- Learn about China Wantian Holdings' historical performance here.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Overseas Grand Oceans Group Limited is an investment holding company that focuses on investing in, developing, and leasing real estate properties in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$6.48 billion.

Operations: The company generates its revenue primarily through property development, which accounts for CN¥45.41 billion, and commercial property operations, contributing CN¥484.31 million.

Market Cap: HK$6.48B

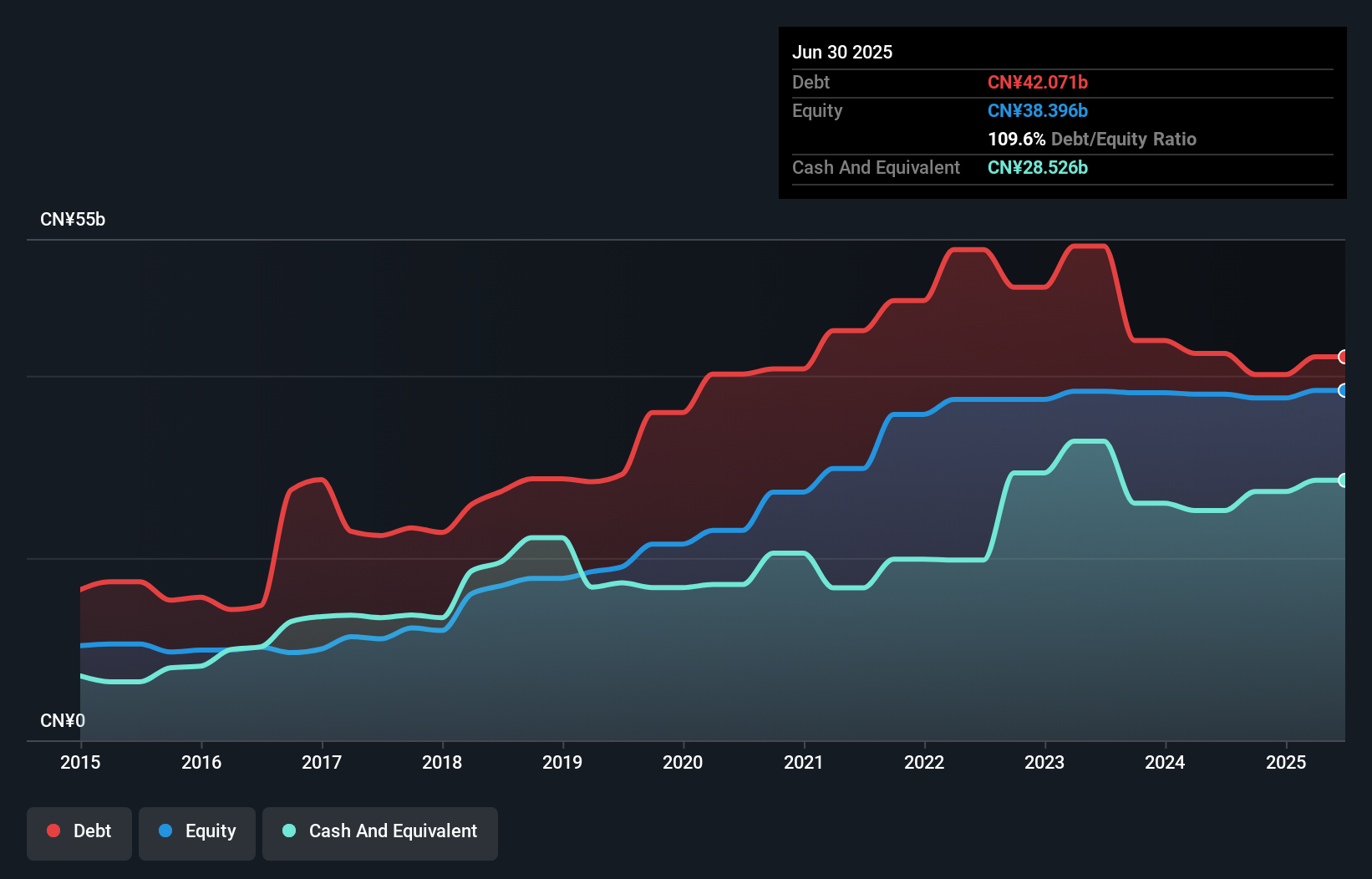

China Overseas Grand Oceans Group, with a market cap of HK$6.48 billion, is navigating challenges in the real estate sector. The company's property development revenue stands at CN¥45.41 billion, but recent earnings show a decline to CN¥954.05 million from CN¥2.30 billion the previous year, reflecting lower profit margins and negative earnings growth of 58.5%. Despite this, it maintains good relative value with a price-to-earnings ratio of 6.4x against the Hong Kong market's 10.4x and has reduced its debt-to-equity ratio from 167% to 107% over five years, indicating improved financial stability amidst volatile sales performance.

- Take a closer look at China Overseas Grand Oceans Group's potential here in our financial health report.

- Review our growth performance report to gain insights into China Overseas Grand Oceans Group's future.

Geo Energy Resources (SGX:RE4)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Geo Energy Resources Limited is an investment holding company involved in the mining, production, and trading of coal with a market cap of SGD473.76 million.

Operations: The company generates revenue primarily from its coal mining operations, amounting to $401.90 million.

Market Cap: SGD473.76M

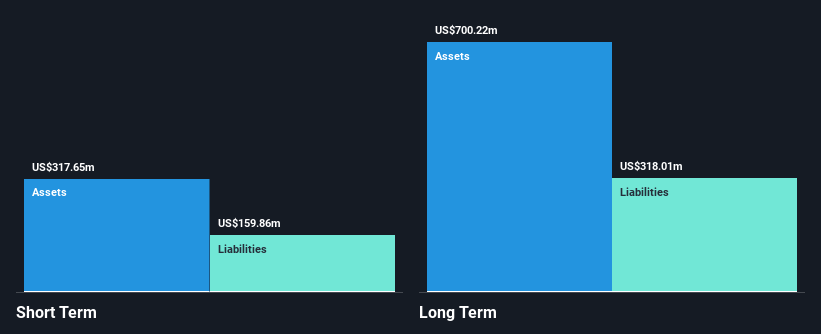

Geo Energy Resources, with a market cap of SGD473.76 million, faces challenges in maintaining profitability amidst declining revenue and earnings. The company reported US$401.9 million in sales for 2024, down from US$488.97 million the previous year, with net income also falling to US$37.14 million from US$61.98 million. While its debt is well covered by operating cash flow and short-term assets exceed liabilities, interest coverage remains weak at 1.2x EBIT. Despite a satisfactory net debt to equity ratio of 14.8%, the board's lack of experience may impact strategic decisions as it navigates volatile market conditions and an unstable dividend history.

- Jump into the full analysis health report here for a deeper understanding of Geo Energy Resources.

- Gain insights into Geo Energy Resources' future direction by reviewing our growth report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1,149 Asian Penny Stocks now.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 20 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal