Global Growth Leaders With High Insider Ownership

In a week marked by heightened trade tensions and fluctuating investor sentiment, global markets have experienced significant volatility. Despite these challenges, growth companies with high insider ownership often stand out as they align management interests with shareholder value, making them appealing in uncertain economic climates.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.4% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 60.7% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's explore several standout options from the results in the screener.

Ubtech Robotics (SEHK:9880)

Simply Wall St Growth Rating: ★★★★★☆

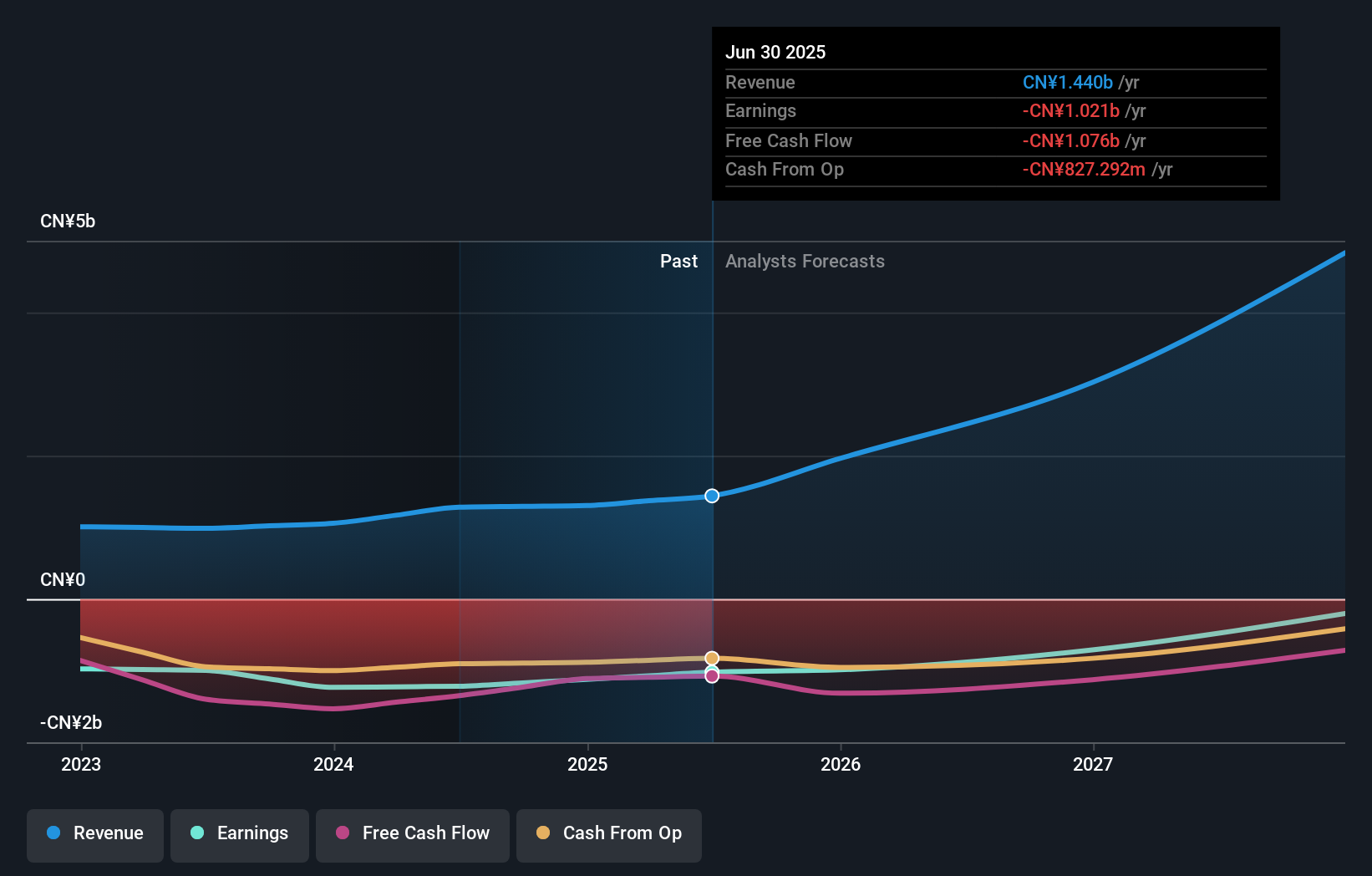

Overview: Ubtech Robotics Corp Ltd focuses on the research, design, development, production, commercialization, marketing, and sale of robotic products and services both in China and internationally with a market cap of HK$30.98 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated CN¥1.31 billion.

Insider Ownership: 36.9%

Ubtech Robotics demonstrates significant growth potential with expected revenue growth of 51.8% annually, outpacing the Hong Kong market. Despite past net losses, forecasts suggest profitability within three years. Recent insider activities show more shares bought than sold, indicating confidence in future prospects. The company reported CNY 1,305.36 million in sales for 2024 and reduced its net loss compared to the previous year. However, its share price remains highly volatile over recent months.

- Unlock comprehensive insights into our analysis of Ubtech Robotics stock in this growth report.

- Our expertly prepared valuation report Ubtech Robotics implies its share price may be too high.

Southchip Semiconductor Technology(Shanghai) (SHSE:688484)

Simply Wall St Growth Rating: ★★★★★☆

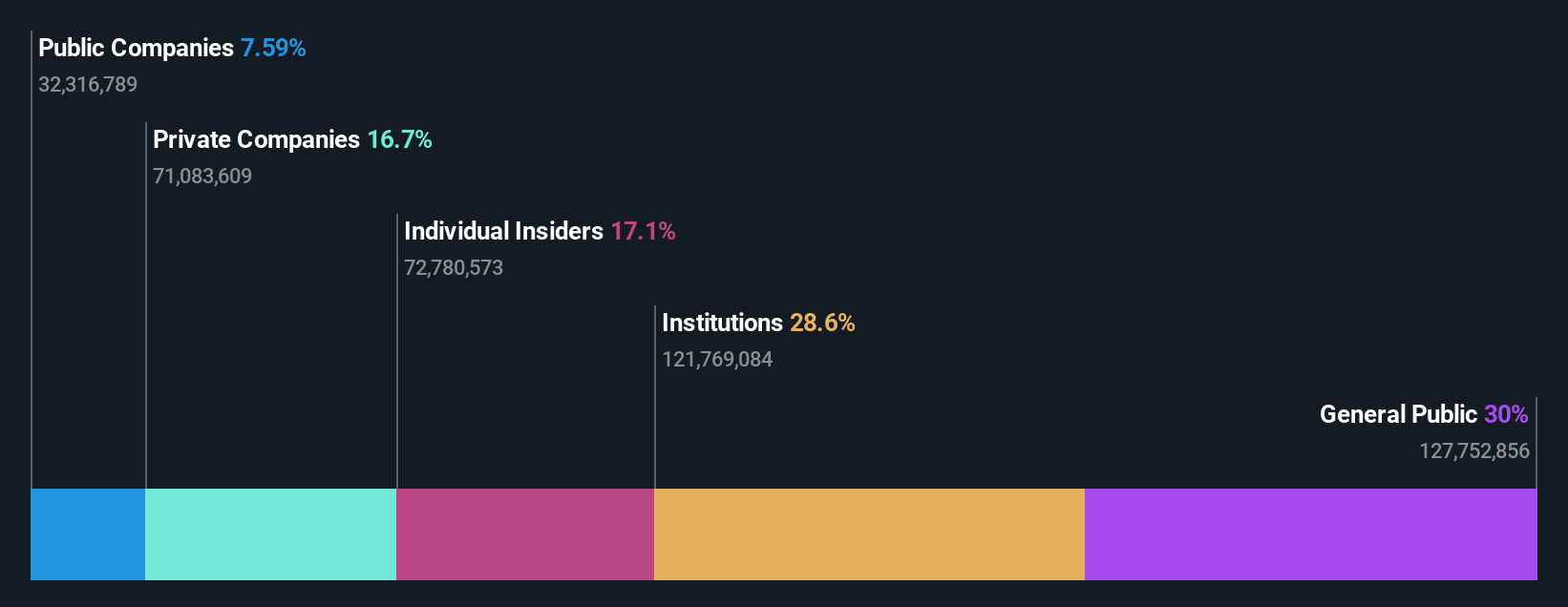

Overview: Southchip Semiconductor Technology(Shanghai) Co., Ltd. is a semiconductor design company specializing in power and battery management solutions in China, with a market cap of CN¥14.41 billion.

Operations: The company's revenue primarily comes from its semiconductors segment, generating CN¥2.57 billion.

Insider Ownership: 17.1%

Southchip Semiconductor Technology (Shanghai) is positioned for robust growth, with earnings forecast to increase by 36.61% annually, surpassing the broader Chinese market. Revenue is also expected to grow at 22.4% per year. Despite a relatively low forecasted return on equity of 13.9%, the company's price-to-earnings ratio of 49.7x is attractive compared to industry averages. Recent earnings showed sales rising to CNY 2.57 billion and net income improving slightly, while share buybacks indicate management's confidence in future prospects.

- Get an in-depth perspective on Southchip Semiconductor Technology(Shanghai)'s performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Southchip Semiconductor Technology(Shanghai) is trading behind its estimated value.

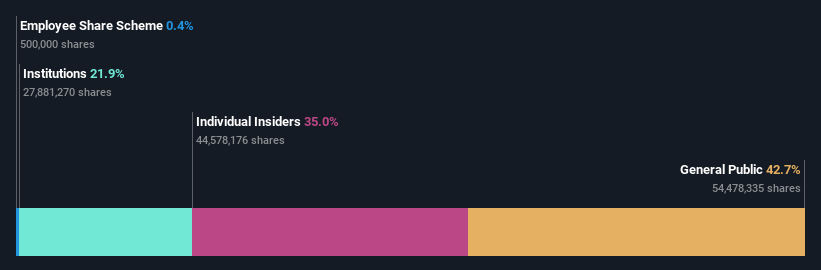

Wuxi Chipown Micro-electronics (SHSE:688508)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Chipown Micro-electronics Limited focuses on the research, development, and sale of semiconductor products in China, with a market cap of CN¥6.67 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 35%

Wuxi Chipown Micro-electronics demonstrates strong growth potential, with earnings expected to rise significantly at 24.9% annually, outpacing the Chinese market. Recent Q1 results showed sales of CNY 301.41 million and net income of CNY 41.07 million, reflecting a robust year-over-year increase. The company's price-to-earnings ratio of 58.6x is below the semiconductor industry average, suggesting value for investors despite a low forecasted return on equity of 8.1%.

- Click here to discover the nuances of Wuxi Chipown Micro-electronics with our detailed analytical future growth report.

- The analysis detailed in our Wuxi Chipown Micro-electronics valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Unlock more gems! Our Fast Growing Global Companies With High Insider Ownership screener has unearthed 869 more companies for you to explore.Click here to unveil our expertly curated list of 872 Fast Growing Global Companies With High Insider Ownership.

- Ready For A Different Approach? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal