3 Asian Penny Stocks With At Least US$800M Market Cap

Amid escalating trade tensions between the U.S. and China, Asian markets are navigating a complex landscape marked by economic uncertainty and fluctuating investor sentiment. Despite these challenges, certain investment opportunities continue to stand out, particularly in the realm of penny stocks—a term that may feel outdated but remains relevant for investors seeking affordable entry points into potentially high-growth companies. In this article, we explore three Asian penny stocks that exhibit strong financial foundations, offering a blend of stability and potential growth for those interested in smaller or newer market players.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.60 | THB1.65B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.46 | SGD186.43M | ✅ 4 ⚠️ 2 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.101 | SGD42.92M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.184 | SGD36.66M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.06 | SGD8.11B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.15 | HK$1.29B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.84 | HK$43.98B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.03 | HK$649.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.02 | HK$1.7B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.95 | CN¥3.42B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,152 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Vobile Group (SEHK:3738)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company offering software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and other international markets with a market cap of HK$7.65 billion.

Operations: The company's revenue is derived from its SaaS offerings, totaling HK$2.40 billion.

Market Cap: HK$7.65B

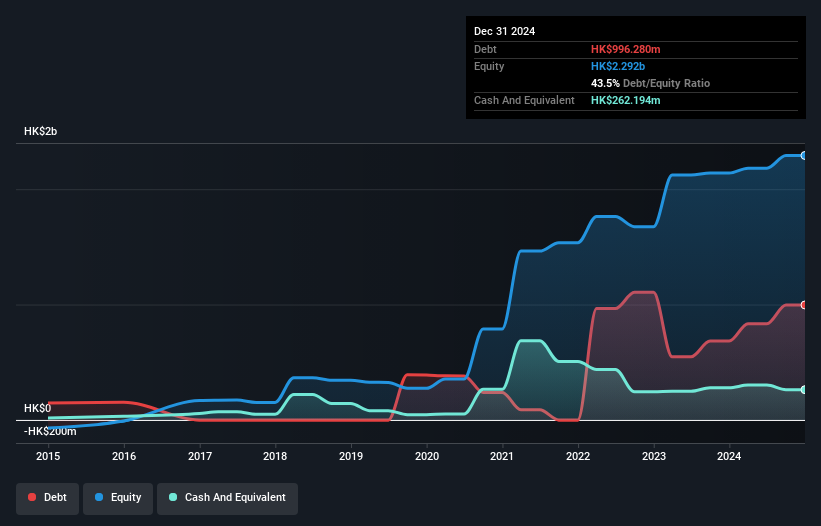

Vobile Group Limited has shown promising growth, transitioning from a net loss to a net income of HK$142.73 million in 2024, supported by robust revenue of HK$2.40 billion. The company has become profitable, with earnings forecasted to grow significantly at 25% annually. Despite its low return on equity at 6.9%, Vobile's seasoned management and reduced debt levels contribute positively to its financial health. Recent product innovations like DreamMaker leverage AI for content creation and monetization, potentially enhancing revenue streams for creators while bolstering Vobile's market position in digital content solutions across international markets.

- Click here to discover the nuances of Vobile Group with our detailed analytical financial health report.

- Assess Vobile Group's future earnings estimates with our detailed growth reports.

Guangdong DFP New Material Group (SHSE:601515)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guangdong DFP New Material Group Co., Ltd. operates in the materials industry, focusing on the production and distribution of new material products, with a market cap of CN¥6.20 billion.

Operations: No specific revenue segments are reported for Guangdong DFP New Material Group Co., Ltd.

Market Cap: CN¥6.2B

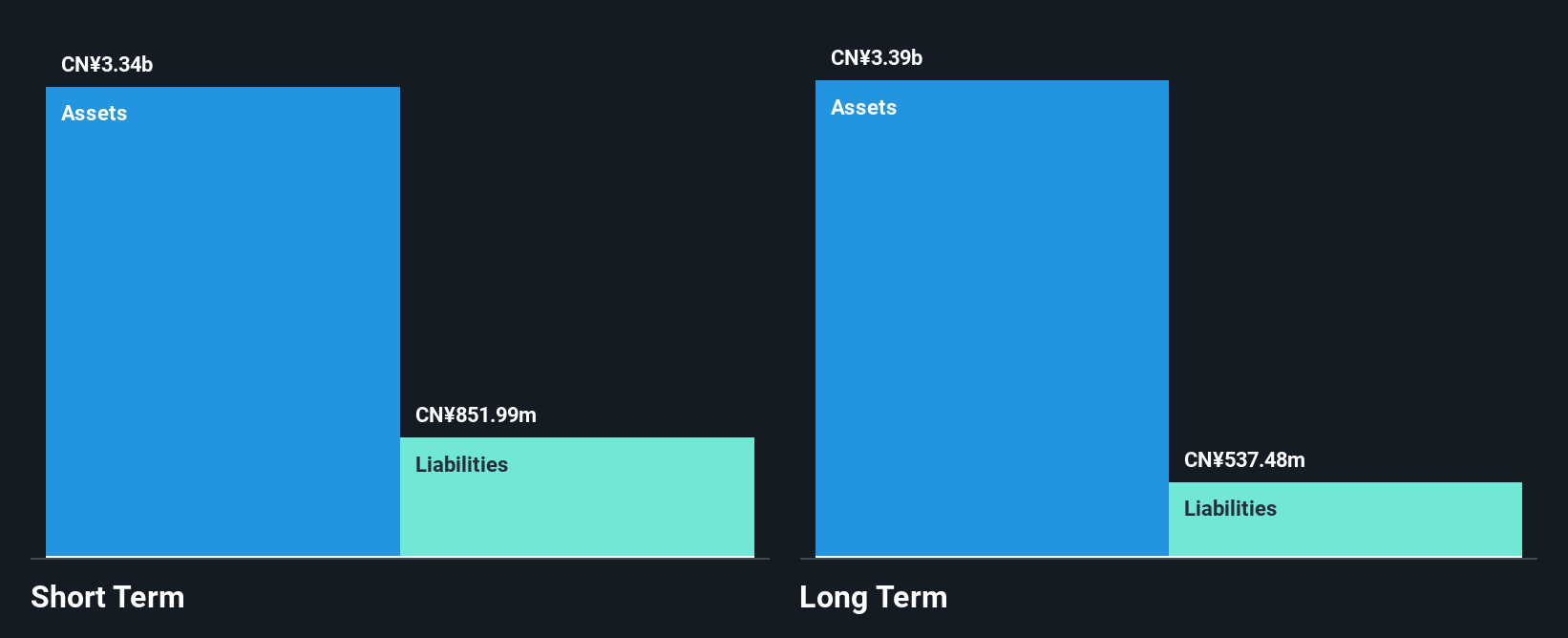

Guangdong DFP New Material Group Co., Ltd. is navigating challenges typical of penny stocks, with a current unprofitable status and negative return on equity at -5.76%. The company has improved its financial structure by reducing its debt to equity ratio from 19.6% to 8.4% over five years and maintains more cash than total debt, indicating prudent financial management. Despite short-term liabilities being well-covered by assets, operational cash flow inadequately covers debt obligations at only 12.4%. Recent M&A activity involving a CNY 1.9 billion stake acquisition could impact future strategic direction pending regulatory approval.

- Get an in-depth perspective on Guangdong DFP New Material Group's performance by reading our balance sheet health report here.

- Evaluate Guangdong DFP New Material Group's prospects by accessing our earnings growth report.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aotecar New Energy Technology Co., Ltd. specializes in the research, development, design, manufacture, and sale of automotive AC compressors and HVAC systems with a market cap of CN¥7.63 billion.

Operations: The company generates its revenue primarily from the manufacturing of thermal management components, amounting to CN¥7.51 billion.

Market Cap: CN¥7.63B

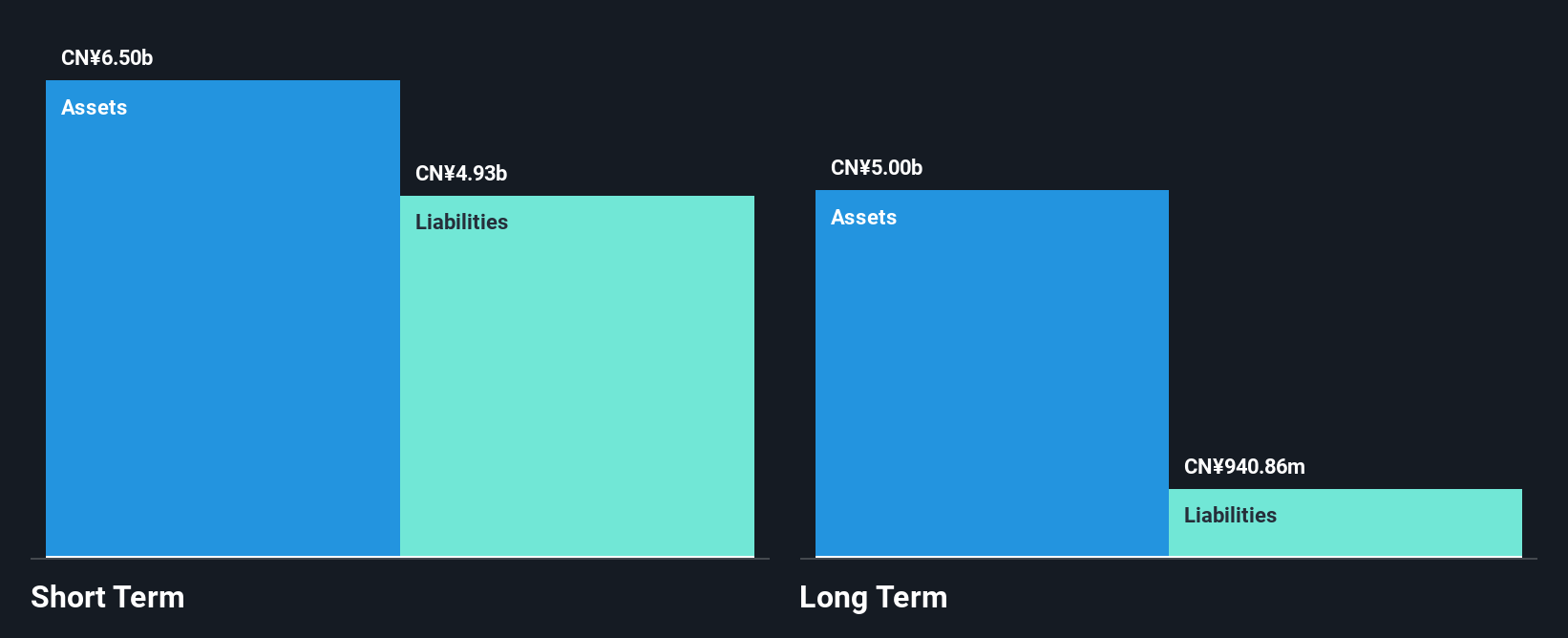

Aotecar New Energy Technology Co., Ltd. demonstrates characteristics common to penny stocks, with recent earnings volatility and a low return on equity at 1.7%. Despite negative earnings growth of -25.6% over the past year, the company maintains financial stability with short-term assets exceeding liabilities and more cash than total debt. Recent developments include a private placement agreement to issue A shares for approximately CN¥590 million, pending regulatory approvals, which could influence its capital structure. The company's board is experienced, though profit margins have decreased from last year’s figures, reflecting ongoing operational challenges in maintaining profitability growth.

- Jump into the full analysis health report here for a deeper understanding of Aotecar New Energy Technology.

- Understand Aotecar New Energy Technology's track record by examining our performance history report.

Summing It All Up

- Investigate our full lineup of 1,152 Asian Penny Stocks right here.

- Looking For Alternative Opportunities? We've found 28 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal