Goldman Sachs Research Report: Reshaping the market pattern of myasthenia gravis? Strongly optimistic about Zaiding Pharmaceutical (09688) Agamod's absolute competitiveness

At the recently concluded annual meeting of the American Society of Neurology (AAN), an annual event in the neurological field, many cutting-edge advances in neurological fields were showcased brilliantly. Among them, research progress on myasthenia gravis (MG) was even more fruitful. A number of novel targeted biologics have announced the latest clinical research results, which not only pushes MG therapy into the era of molecular immunity, but also heralds a change in the competitive landscape of MG therapeutics.

The Zhitong Finance App learned that on April 14, the international investment bank Goldman Sachs released an in-depth research report focusing on the latest developments in the field of this disease. In the report, Goldman Sachs analyzed in detail the comparison between Zaiding Pharmaceuticals' (09688) FcRN antagonist agamod and Rongchang Biotech's dual-target inhibitor taitasip (RC18), and discussed future market trends and key possible influencing factors.

The competitive landscape in gMg therapy

At the 2025 AAN conference, Rongchang Biotech's APRIL/BAFF dual-target biologic RC18 obtained positive treatment data in phase III clinical trials. RC18 demonstrated deep patient responsiveness and sparked widespread market discussions on the comparison of the effects of April/Baff dual-target biologics and FCRN antagonists (including agamod, bartolizumab, and rozeliximab, etc.).

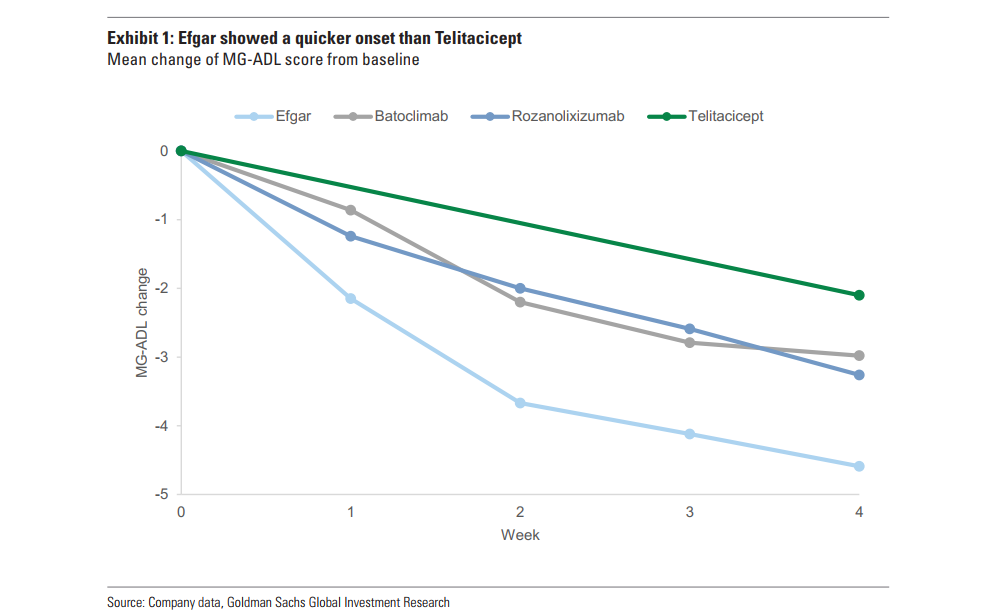

Goldman Sachs believes that due to differences in mechanism of action (MOA), fCRN drugs will have an advantage in the speed of effectiveness in GMG treatment, thus bringing a competitive advantage in the market. Goldman Sachs emphasized the importance of rapid efficacy in GMg treatment by comparing clinical data between RC18 and Agamod.

For example, Agamod's MG-ADL score dropped 4.6 points in week 4, which was more than double the efficacy of RC18 at the same point in time. The fast-acting nature of agamod makes it particularly popular among acute and refractory patients.

Goldman Sachs notes that RC18 requires at least 12 weeks of continuous treatment to achieve the level of efficacy achieved with agamod within 4 weeks, and in acute or severe GMg patients, rapid onset is critical to improving quality of life. Goldman Sachs further pointed out that real-world usage data for Agamod in the US and China shows that its fast-acting properties make it widely used in acute and refractory GMg patients. This may be an important factor driving the expansion of Agamod's market share in the future competitive landscape.

Picture: Goldman Sachs compared several biologics for GMG, and the efficacy rate of agamod was the most remarkable

Maintain treatment or become the focus of future competition

As a chronic disease, MG disease progresses and can recur many times. Patients often require long-term management. Goldman Sachs judged in the report that maintaining treatment may be the focus of future competition in the MG drug market.

Currently, Agamod mainly uses an intermittent treatment model (fixed cycle) of “4 weeks of treatment+3 week withdrawal”. However, Agamod is exploring a more flexible biweekly (Q2W) long-term maintenance treatment plan through the ADAPT-NXT phase 3 study. According to clinical data quoted by Goldman Sachs, the two treatment models of agamod showed good safety and sustained efficacy over a period of 21 weeks. This suggests that agamod can be a reliable maintenance treatment.

Factors “outside of research” cannot be ignored

Goldman Sachs's report points out that as myasthenia gravis drug choices become more abundant, in addition to clinical data, there are many factors “other than clinical research” that may affect the competitive landscape. Goldman Sachs, for example, emphasized that health insurance access is an important factor affecting competition in the GMG market. Agamod has been included in China's National Health Insurance Catalogue (NRDL) since 2023, and RC18 is not expected to be covered by health insurance until 2026 at the earliest. Goldman Sachs believes that this time difference provided Agamod with a first-mover advantage in the market for at least two years.

The diversity of dosage methods is also an important factor to consider in the future. On April 11, Agamod's prefilled subcutaneous injection form was approved by the FDA. This dosage form takes only 20-30 seconds per injection and is operated by patients, caregivers, or healthcare professionals. Patients can self-administer medication after receiving instructions for subcutaneous injections. This further enhances the convenience of using the drug. In the future, agamod will have three dosage forms to meet the needs of different patients and clinical scenarios, while RC18 is currently limited to the subcutaneous injection mode.

In terms of clinical approval, agamod has been widely recommended by GMG treatment guidelines in the US and China. This international recognition not only enhances Agamod's brand value, but may also further strengthen its trust among doctors and patients.

Overall, Goldman Sachs believes that although RC18 excels in terms of in-depth efficacy, Agamod still has a significant competitive advantage in the GMG treatment field due to its rapid efficacy, flexible treatment model, and market first-mover advantage.

However, Goldman Sachs made it clear in its report that it should be cautious when making horizontal comparisons of new drugs with different mechanisms. Because although the baseline data is basically the same, the placebo groups in each clinical study lacked consistency in terms of efficacy data from MG-ADL scores or safety data such as upper respiratory infections, etc., and a simple numerical comparison was not perfect in terms of rigor.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal