China's ADR delisting risk reappears in Damo: over 80% of companies are double listed in Hong Kong, and the risk is manageable

The Zhitong Finance App learned that at the time of tariff negotiations between the US and China, the risk of ADR delisting once again surfaced. On April 13, Morgan Stanley analyst Laura Wang said that more than 80% of the companies in Morgan Stanley Capital International (MSCI) China's ADR constituents are double listed in Hong Kong, which ensures smooth trading even in the case of delisting. Looking at the time span of 6 to 12 months, downside risks in terms of valuation and liquidity are easier to control, especially for stocks that are eligible to invest in southbound capital.

China's ADR delisting risk “returning to sight”, details to be clarified

The risk of Chinese ADR companies being forced to delist from the US stock market has once again raised concerns. During the Biden administration, under the Foreign Company Accountability Act (HFCA), ADR companies were forced to delist from the US stock exchange if they failed to comply with US audit regulations for three consecutive years. Compliance will be investigated and assessed by the US government auditing agency, the Public Company Accounting Supervisory Board (PCAOB). At the end of 2022, Chinese and US government agencies cooperated to finally resolve the dispute over China's ADR audit regulations.

Unlike previous ADR delisting disputes arising from audit regulations, there are currently no audit disputes, and no widespread violations of current US accounting/auditing regulations have been found. Instead, the issue was included in recent extensive discussions on tariff-like measures, which suggests that the ADR delisting could be used as a potential non-tariff tool to escalate tension between the US and China.

It's unclear under what circumstances ADR delisting will be triggered, what conditions need to be met to avoid this outcome, what actions can be taken to resolve outstanding issues, and no specific timeline for potential delisting has been given.

ADR currently accounts for 25% of the MSCI China Index weight, and over 80% has been double listed in Hong Kong

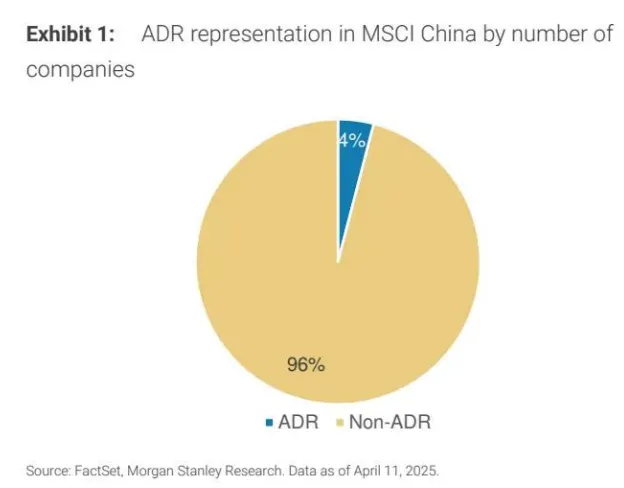

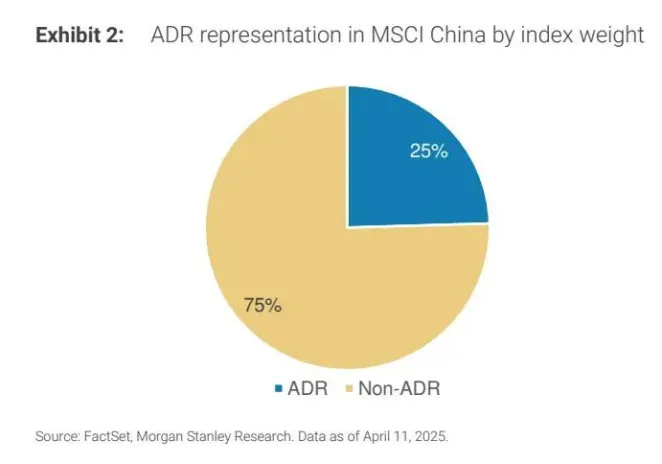

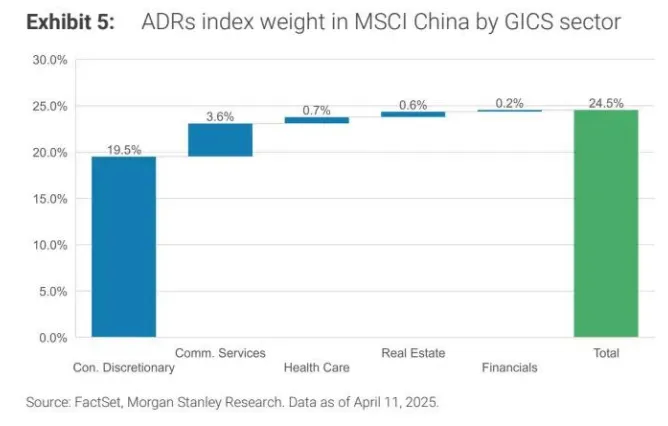

Damo wanted to know exactly how much the forced ADR delisting scenario would affect the Chinese stock market. Currently, around 120 Chinese ADR companies trade in the US market. Of these, only 23 companies are large and active enough to be included in the overall MSCI China Index, accounting for 4% of the index's constituent stocks by number of companies (Chart 1) and 25% by total index weight (Chart 2). Optional consumption/e-commerce is the industry with the highest share (Chart 5).

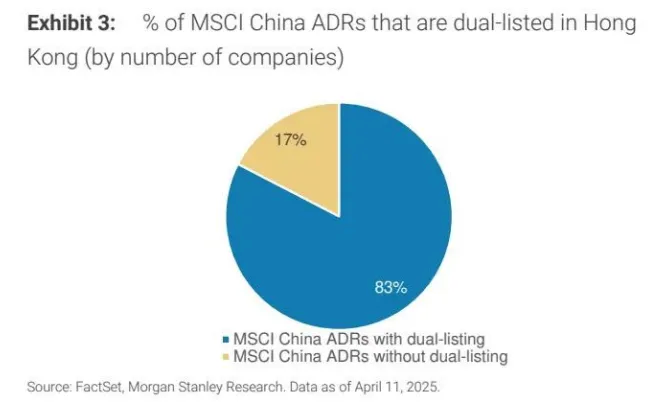

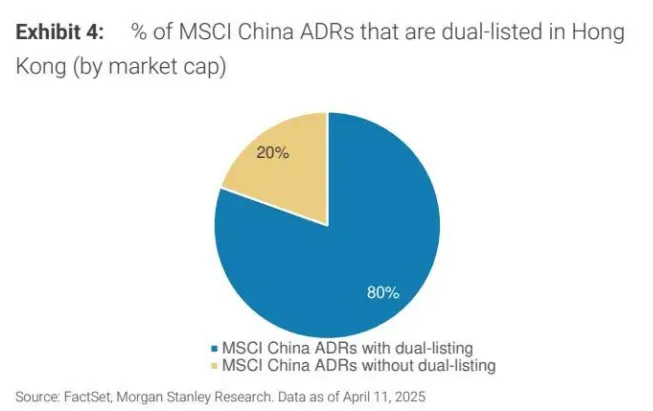

Most ADR constituents of the MSCI China Index (80% by market capitalization and 83% by number of companies) are double listed in Hong Kong and are actively traded daily in the Hong Kong market and the US market (Chart 3, Chart 4).

Dual listing ensures continued trading when ADR is delisted

Damo believes that dual listing usually ensures that ADR companies can still trade in Hong Kong even if they are delisted from the US market. ADR shareholders can choose to convert their ADR holdings into shares registered in Hong Kong, and these shares can usually be obtained through the company's previous registration conversion.

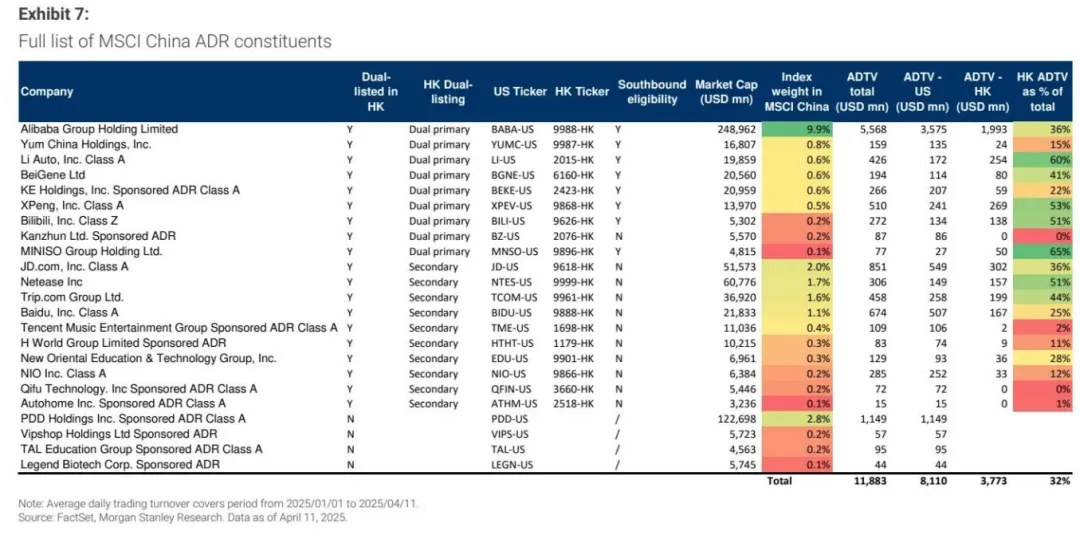

Damo lists all Chinese ADR companies in the MSCI China Index in Chart 7. Currently, there are only four companies that have yet to be dual listed in Hong Kong. The three largest companies are Pinduoduo, Vipshop, and Good Future. Whether the US Treasury Secretary's latest remarks will prompt these companies to immediately seek dual listing in Hong Kong remains to be seen.

The impact of the delisting incident on the Chinese stock market — negative in the short term, there is a risk of declining valuations, but it is more controllable in the long run

Currently, the total daily turnover of all ADR companies in the MSCI China Index in the US market is US$8.1 billion, accounting for 68% of the total daily turnover of these companies (Hong Kong, China + US) (Chart 6), which is roughly equivalent to 25% of the total daily turnover of the Hong Kong market. In the delisting incident, especially if all ADR companies are delisted at the same time, Damo believes this will mark an escalation in the geopolitical situation, and the stock market will face a downside risk in valuation because its equity risk premium will rise as a result. ADR companies that are not dual-listed in Hong Kong face far greater downside risks than dual-listed companies.

Key points to pay attention to in the future

Whether members of the Trump administration will continue to mention the ADR delisting issue, and whether the US Securities and Exchange Commission (SEC) will initiate a formal delisting process and clarify the delisting conditions and schedule;

whether Chinese ADR companies that are not currently dual listed will soon apply for listing in Hong Kong;

whether capital market regulators in Hong Kong, China and mainland China will promote faster dual listings and include southbound capital investments to provide short-term transaction support;

Are there any signs of further tightening capital market measures, such as restrictions or bans on US investors investing in Chinese companies.

Key charts

Figure 1: The share of ADR in the MSCI China Index by number of companies

Figure 2: The share of ADR in the MSCI China Index by index weight

Chart 3: Share of MSCI China ADR with dual listings in Hong Kong (by number of companies)

Chart 4: Share of MSCI China's ADR with dual listings in Hong Kong (by market capitalization)

Chart 5: ADR's weight in the MSCI China Index by Global Industry Classification Standard (GICS) industry

Chart 6: Average daily turnover of MSCI China ADR in the US and Hong Kong markets

Exhibit 7: Complete list of MSCI China ADR constituents

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal