Tamawood (ASX:TWD) Will Pay A Dividend Of A$0.11

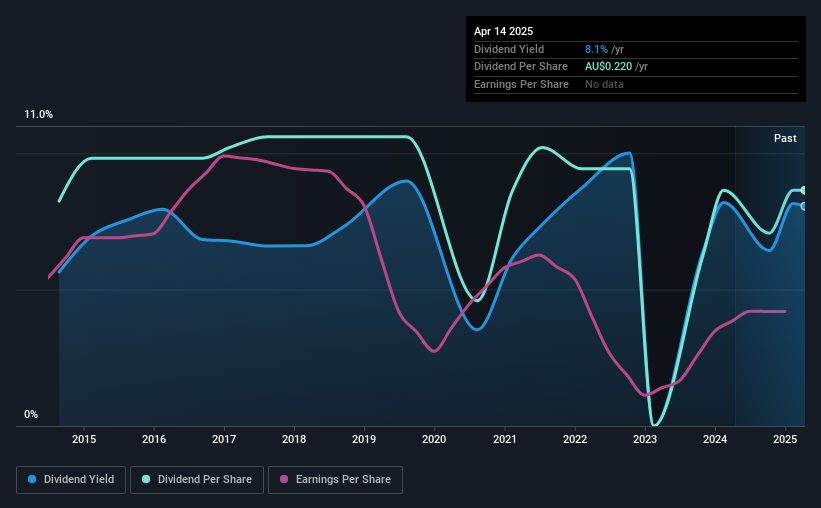

The board of Tamawood Limited (ASX:TWD) has announced that it will pay a dividend on the 6th of June, with investors receiving A$0.11 per share. Based on this payment, the dividend yield on the company's stock will be 8.1%, which is an attractive boost to shareholder returns.

Tamawood's Future Dividends May Potentially Be At Risk

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, the company was paying out 131% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Earnings per share could rise by 8.6% over the next year if things go the same way as they have for the last few years. If the dividend continues on its recent course, the payout ratio in 12 months could be 120%, which is a bit high and could start applying pressure to the balance sheet.

See our latest analysis for Tamawood

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The dividend has gone from an annual total of A$0.21 in 2015 to the most recent total annual payment of A$0.22. Its dividends have grown at less than 1% per annum over this time frame. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

There Isn't Much Room To Grow The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Tamawood has seen EPS rising for the last five years, at 8.6% per annum. However, the company isn't reinvesting a lot back into the business, so we would expect the growth rate to slow down somewhat in the future.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 3 warning signs for Tamawood (2 make us uncomfortable!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal