NIKE (NYSE:NKE) Unveils Vibrant Kool-Aid Sneaker Collaboration With Ja Morant

Nike (NYSE:NKE) recently announced an innovative collaboration with Kool-Aid, unveiling the vibrant Nike x Kool-Aid Ja 2 sneaker, which incorporates playful design elements inspired by NBA star Ja Morant's favorite flavors. Despite this launch, Nike's share price dipped 2.2% over the past week, a movement contrasting with the broader market’s 5.8% gain. This slight decline in Nike's price might not align with the broader market trend influenced by external factors, such as overall market optimism from major tech stocks rallying on tariff exemption news, which appeared to influence broader market sentiment more positively.

Buy, Hold or Sell NIKE? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

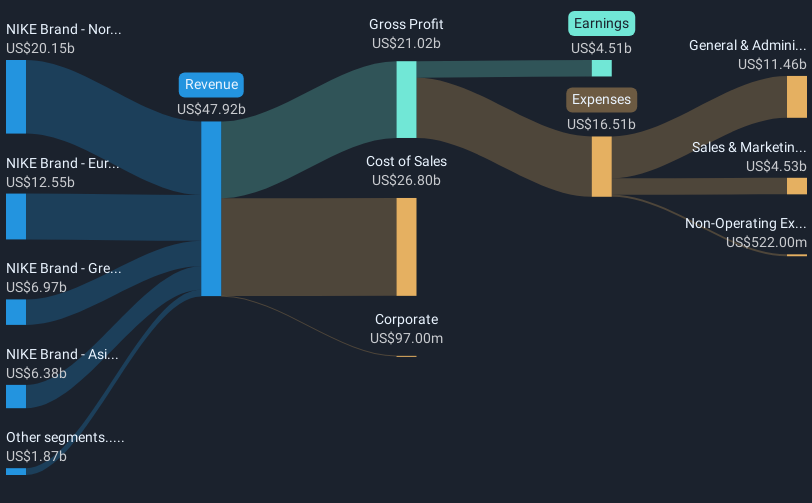

The recent collaboration between Nike and Kool-Aid, featuring the vibrant Nike x Kool-Aid Ja 2 sneaker, may add fresh appeal to Nike's product lineup. This partnership aligns with Nike's strategy to enhance brand storytelling and leverage sports performance dimensions as growth drivers. Although the share price fell 2.2% recently, this may be a short-term fluctuation possibly reflecting external market conditions rather than an immediate impact of the collaboration. Over a longer period of five years, Nike's total shareholder return, which includes share price and dividends, was a decline of 34.31%, underscoring challenges the company has faced in maintaining upward momentum.

Compared to the past year, Nike's performance has lagged behind both the US Market and the broader Luxury industry, which are indicators of the competitive and economic pressures it encounters. Analysts predict a modest revenue growth of around 1.9% annually, alongside a slight increase in profit margins to 9.9% within three years. However, for Nike to meet the consensus price target of US$78.49, the stock would need to see a significant increase from its current trading price of US$53.27, indicating a trading discount of about 33.4% against the target. The Kool-Aid collaboration may help boost revenue and support these forecasts by enhancing brand engagement and driving full-price sales, aiding in net margin improvements and inventory turnover.

Evaluate NIKE's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal