MacroGenics, Inc. (NASDAQ:MGNX) Looks Inexpensive After Falling 42% But Perhaps Not Attractive Enough

Unfortunately for some shareholders, the MacroGenics, Inc. (NASDAQ:MGNX) share price has dived 42% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 92% loss during that time.

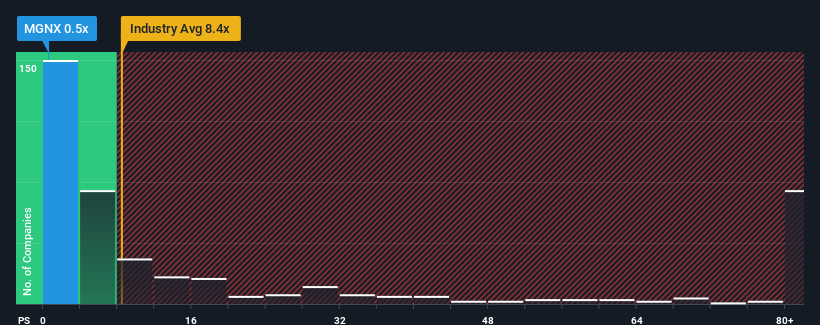

After such a large drop in price, MacroGenics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.5x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.4x and even P/S higher than 47x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for MacroGenics

What Does MacroGenics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, MacroGenics has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think MacroGenics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For MacroGenics?

The only time you'd be truly comfortable seeing a P/S as depressed as MacroGenics' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 155%. Pleasingly, revenue has also lifted 94% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 29% per annum during the coming three years according to the six analysts following the company. Meanwhile, the broader industry is forecast to expand by 173% each year, which paints a poor picture.

With this in consideration, we find it intriguing that MacroGenics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On MacroGenics' P/S

Having almost fallen off a cliff, MacroGenics' share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that MacroGenics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, MacroGenics' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for MacroGenics (1 is potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on MacroGenics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal