Kerui Real Estate Research: The transaction area of second-hand housing in key cities across the country reached 82.04 million square meters in the first quarter, an increase of 17% year-on-year

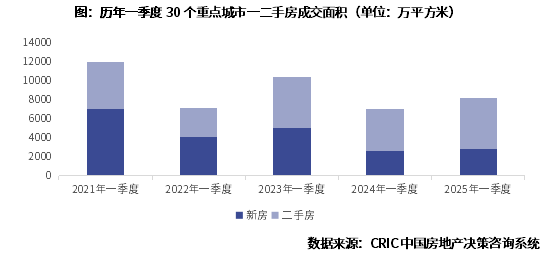

The Zhitong Finance App learned that data released by Kerui Real Estate Research shows that at the new housing level, thanks to the continuous fermentation of favorable policies at the core and frontline, the commercial housing transaction area in 115 key cities in the first quarter was 51.31 million square meters, the same as last year. Judging from monthly trends, since February 2024, the year-on-year decline in new housing transactions has continued to narrow. Until March 2025, the month-on-month trend of new housing transactions remained flat year-on-year last year, and signs of stopping the decline and stabilizing are beginning to show signs of stopping and stabilizing. In the first quarter of 2025, the transaction area of second-hand housing in 30 key cities reached 82.04 million square meters, an increase of 17% over the previous year.

In terms of energy levels, first-tier resilience is better than second-tier resilience. According to CRIC monitoring data, the first-tier first-tier cumulative year-on-year increase was 26% in the first quarter, significantly better than the second-tier 5%. The third- and fourth-tier “return home purchase” contracts were cancelled, compounded by weak residents' purchasing power. The cumulative year-on-year increase was 8%.

At the level of second-hand housing, the increase was higher than that of new housing, but from a month-on-month perspective, there is also a slowing trend: according to CRIC monitoring data, the cumulative transaction area of second-hand housing in the 30 key monitored cities is expected to be 53.53 million square meters in the first quarter of 2025, with a cumulative year-on-year increase of 22%. Looking at monthly trends, the year-on-year increase in March was 22%, which is a sharp drop from the year-on-year increase in February.

The Beijing-Shanghai-Hangzhou-Rong project had the highest elimination rate. Guangjin Han visited and subscribed to a “point of recovery”

We have selected some typical cities, which can be broadly divided into the following three categories: the first category is the most popular cities in the short term, represented by Beijing, Shanghai, Hangzhou, and Chengdu. The second-hand recovery market is better than that of new homes. The second category is cities with weak recovery, such as Guangzhou, Tianjin, and Wuhan. They have experienced early and deep adjustments. Since March 2025, project visits and subscriptions have steadily rebounded, and have recovered to the same period last year. The third category is Hefei, Nanjing, etc., which showed slightly insufficient growth momentum. Specifically,

1. Hot cities such as Beijing, Shanghai, Hangzhou, and Rong improve the market, concentrate their entry into the market to support the high level of market enthusiasm

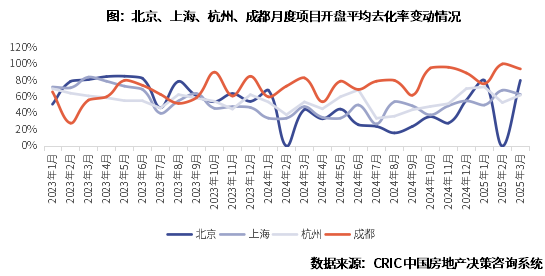

The popularity of the new housing market continues to fluctuate at a high level in the short-term, mainly in core Tier 1 and 2 cities such as Beijing, Shanghai, Hangzhou, and Chengdu. On the one hand, since March, all four cities have accelerated the pace of promotion and improved the quality of marketable real estate, which has increased residents' enthusiasm to buy homes to a certain extent; on the other hand, Beijing and Shanghai's favorable New Policy superposition project promotion at the end of the third quarter of last year also caused a steady rise in market popularity since the beginning of the year.

According to CRIC monitoring data, since the second half of last year, the opening and elimination rate of the four-city project began to fluctuate upward. By the end of March 2025, the opening and elimination rates were above 60%, which is significantly better than the same period in 2024. It is worth noting that the opening and elimination rate in Beijing has reached a phased high since 2024.

2. The conversion rate of Guangzhou, Tianjin, Wuhan and other projects was restored to the same period last year

Markets in cities such as Guangzhou, Tianjin, and Wuhan have been steadily recovering after the Spring Festival. These cities have basically experienced deep adjustments in the past two years. With the gradual restoration of purchasing power, the market has begun to show signs of stopping falling and recovering.

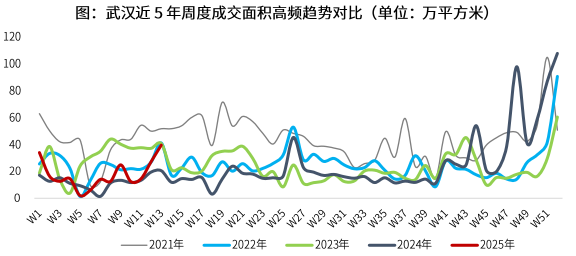

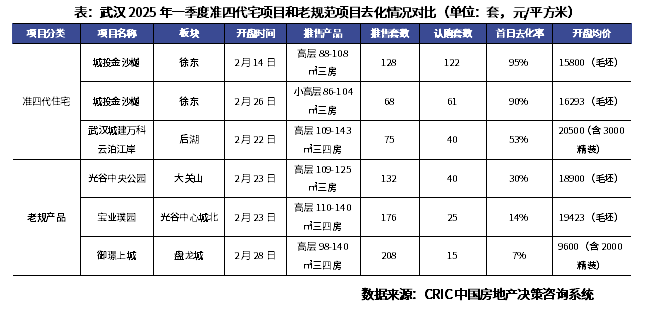

Taking Wuhan as an example, there are significant signs that new housing transactions have stopped falling and stabilized, showing “less than the above”: according to CRIC monitoring data, the cumulative number of online signings for the 13th week of 2025 (March 30) fell by -43% compared to the same period in 23 years, and increased by 42% compared to the same period in 24 years.

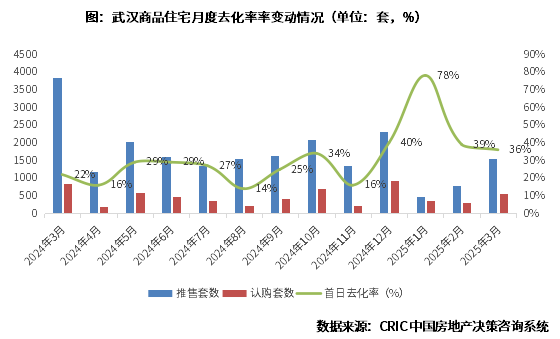

Judging from the opening of the project, it is still at a relatively high level of 3-4 percent. According to CRIC monitoring data, the elimination rate in Wuhan remained stable at a low level of less than 30% in 2024. Since entering 2025, the removal rate once soared to 78% in January due to increased quality and reduction. Although there was a slight correction in February-March, it was still relatively high at 3-4 percent.

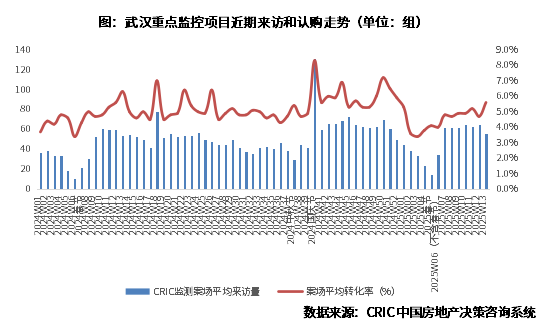

Judging from front-end index project visits and subscriptions, the current customer conversion rate continued to increase: According to CRIC monitoring key projects, post-holiday visits and subscriptions have been rising steadily. In particular, since entering March, the average number of weekly single market visits has remained stable at 60 groups, and the number of subscriptions has also been above 3 groups. The customer desire to see the house has rebounded, and the customer conversion rate has risen to 5.6%.

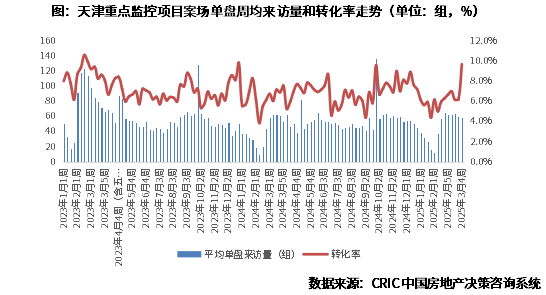

Another example is Tianjin. The new housing market was gradually repaired after the holiday season. Due to increased discounts from housing companies, the launch of bargain housing, etc., attracted popularity. The number of project visits and subscriptions increased steadily to a high level during the year. It was basically the same as the same period last year, and the customer conversion rate soared to 9.7% at the end of the month. Take Tianjin as an example. According to CRIC's key monitoring projects, visits rose steadily after the holiday season. In particular, since the beginning of March, the average number of visitors per week remained stable at 60 groups. On the other hand, the customer conversion rate remained stable at 6%-7% for the first 3 weeks of March, and surged to 9.7% at the end of the month.

3. Weekly visits to Hefei, Nanjing, etc., increased and then declined before and after subscription, and growth momentum was insufficient

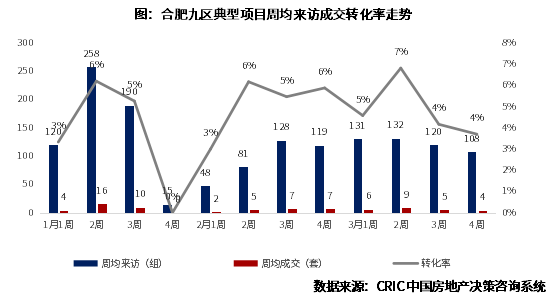

There are also some cities, such as Hefei and Nanjing. Weekly visits are high and low before and after subscription. As a result, customer conversion rates have declined, and the wait-and-see sentiment is still strong. In the short term, growth momentum is slightly insufficient. Take Hefei as an example. In the first 2 weeks of March, the average number of visits to real estate listings focused on monitoring jumped to more than 130 groups. The average number of units subscribed to remained around 8 units, then began to decline steadily in the next 2 weeks, causing the customer conversion rate to drop below 5%.

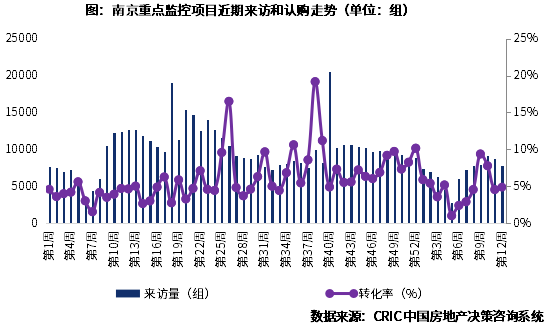

As is the case in Nanjing, the number of visitors has risen and declined in the short term, the customer conversion rate has been declining steadily, and the momentum for market growth is slightly insufficient. According to CRIC monitoring data, the average number of weekly visits declined steadily for the first two weeks after March. The number of visitors in the 12th week was less than 8,000, down 15% from the high week in March. As a result, the customer conversion rate continued to decline. As a result, the customer conversion rate continued to decline. At the end of March, it was less than 5%, and the overall level was still below the average for the fourth quarter of last year.

Improved products such as strong products boost market popularity, and immediate demand accelerates “price for volume”

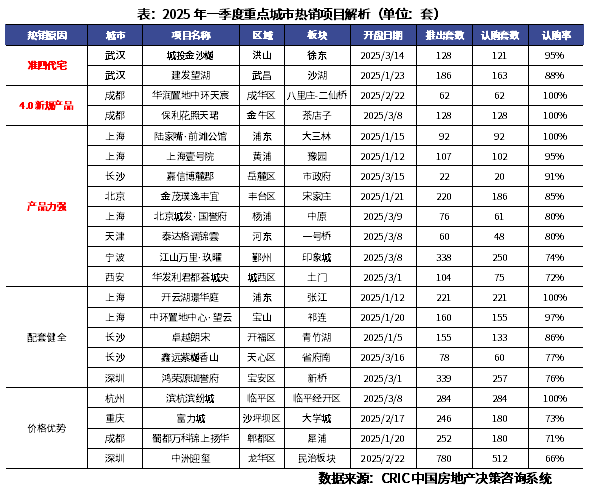

Judging from the best-selling project data for the first quarter of 2025 in key cities, the typical characteristics are nothing more than the following:

First, strong products. In particular, the entry into the market of new products with high housing rates, such as the fourth generation house, has led to a steady increase in market popularity;

Second, the supporting facilities are excellent. Generally, the supply is scarce in the regional sector where the project is located. In addition, such real estate often also has core supporting resources such as school districts, business districts, medical care, etc., which makes them very popular in the short term;

Third, cost-effective real estate with significant price advantages. Housing enterprises often adopt strategies such as direct price reduction or strong channel marketing to speed up project elimination. It is worth noting that there is no single reason for the popularity of popular real estate properties; they often have one or more of the above characteristics. In the analysis below, we will focus on the single characteristics of some projects.

1. Strong product strength. High-yield products such as the fourth generation house are the “finishing touch” for popular projects

Due to the city's policies to reduce restrictive measures, establish a new model for real estate development, and promote the construction of safe, comfortable, green, and smart “good houses”, etc., the product logic of the property market has also changed. Newly regulated housing, represented by fourth-generation homes, not only has the highest sales volume, but can also achieve high premiums, and has become the darling of current improvement products.

Take Shanghai as an example. After the double limit of local auctions was opened, the 10% premium limit was broken through. Urban projects generally had a premium rate of over 15%, land prices rose 10-50%, housing prices partially rose, and the inversion logic gradually disappeared. High-end “price limit” projects in the core area also recently showed an upward trend in prices, which also provided more room for product innovation.

However, judging from the best-selling projects in the first quarter, newly regulated products such as the fourth generation house have gradually been implemented in several core second-tier cities, and have basically become the king of regional sales.

For example, in Wuhan, the pace of home promotion for quasi-fourth-generation homes is generally speeding up, and it is often very popular. We compare the four-generation housing project that opened in the first quarter of 2025 in Wuhan with the traditional old standard project. It can be seen that the four-generation housing removal rate is clearly superior to that of traditional housing projects. Among them, projects such as Jianfa Wanghu and Songyue mainly achieved initial popularity due to scarce resources, high cost performance, and high-quality product capabilities. CITIC Jinshayue focuses on low-total price quasi-four-generation homes within Wuchang's Second Ring Road. The apartment design is novel and the product is outstanding. The 99-square-meter south-facing four-bedroom apartment enjoys a single elevator. The average housing acquisition rate is over 90%. Since the first opening, the market was replenished three times, and the market was replenished twice during the month. The market popularity was high, and the removal continued to be excellent; Wuhan Chengjian Vanke Yunbo Jiang'an first launched a second-phase quasi-fourth-generation house. Since the plot conditions were not as good as the first phase, the room rate was increased to 85-90%. The price was lowered compared to the previous period, and the initial removal was acceptable.

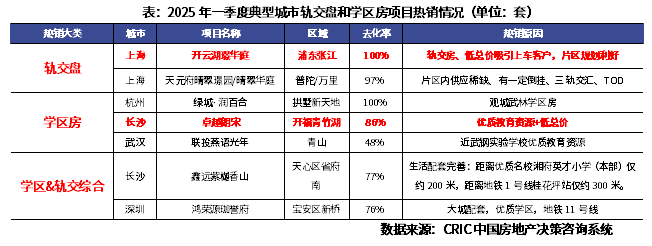

2. The core area is well equipped, and rail sales, school district housing, etc. have become popular sales tools

In addition to product strength, improving supporting facilities is also an important factor in attracting buyers. In particular, rail delivery with convenient transportation and school district housing with strong educational resources have also become the only way to leverage current sales. In the table below, we have listed some of the most popular rail sales and school district housing projects, mainly achieving excellent sales results through high-quality transportation facilities or educational resources.

Rail trading has been favored by customers who have just needed it and have just changed. The Shanghai Kaiyun Lake Jinghuating project uses rail transit as its core selling point, attracting customers who just need to get on the bus at a low total price. School district housing mainly relies on educational resources to leverage customer needs. Take the excellent Langsong project in Kaifu District. The project is located in the Qingzhu Lake section of Kaifu District. It first launched 1 and 6 #小高层,折后成交均价11000元 /㎡ (blank), and was inverted with the surrounding second-hand housing. The removal rate was as high as 86%, mainly due to the project supporting the expansion of the headquarters of the Xiangyi Foreign Language School. It is the top educational resource in Changsha. At the same time, the apartment area has been reduced to 88 square meters, and the total price is low, suitable for customers who pay for the school.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal