European Dividend Stocks: 3 Top Picks To Consider

As European markets navigate the challenges of escalating trade tensions and economic uncertainty, investors are increasingly looking towards dividend stocks for stability and income. In this environment, a good dividend stock is often characterized by a strong track record of consistent payouts and resilience in volatile market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.28% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.78% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.00% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.85% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.55% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.20% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.41% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.70% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

Click here to see the full list of 242 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

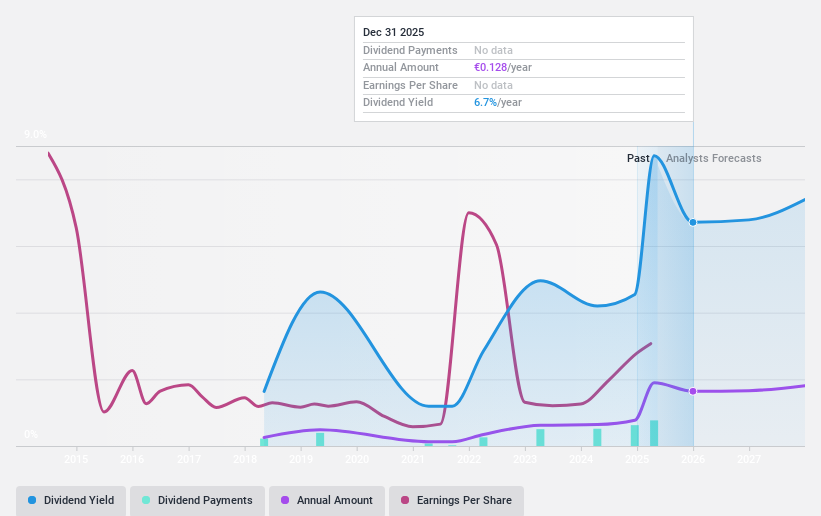

Unicaja Banco (BME:UNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unicaja Banco, S.A. operates in the retail banking sector in Spain with a market capitalization of €4.05 billion.

Operations: Unicaja Banco, S.A. generates its revenue primarily from retail banking activities within Spain.

Dividend Yield: 9.4%

Unicaja Banco offers a high dividend yield, ranking in the top 25% of Spanish dividend payers, but its dividends have been unreliable over the past seven years. While its payout ratio is currently sustainable at 61.7%, earnings are forecast to decline by an average of 3.9% annually over the next three years, potentially impacting future payouts. The bank's net income improved significantly in 2024, yet it faces challenges with a high level of bad loans and low allowance coverage.

- Unlock comprehensive insights into our analysis of Unicaja Banco stock in this dividend report.

- Our valuation report unveils the possibility Unicaja Banco's shares may be trading at a discount.

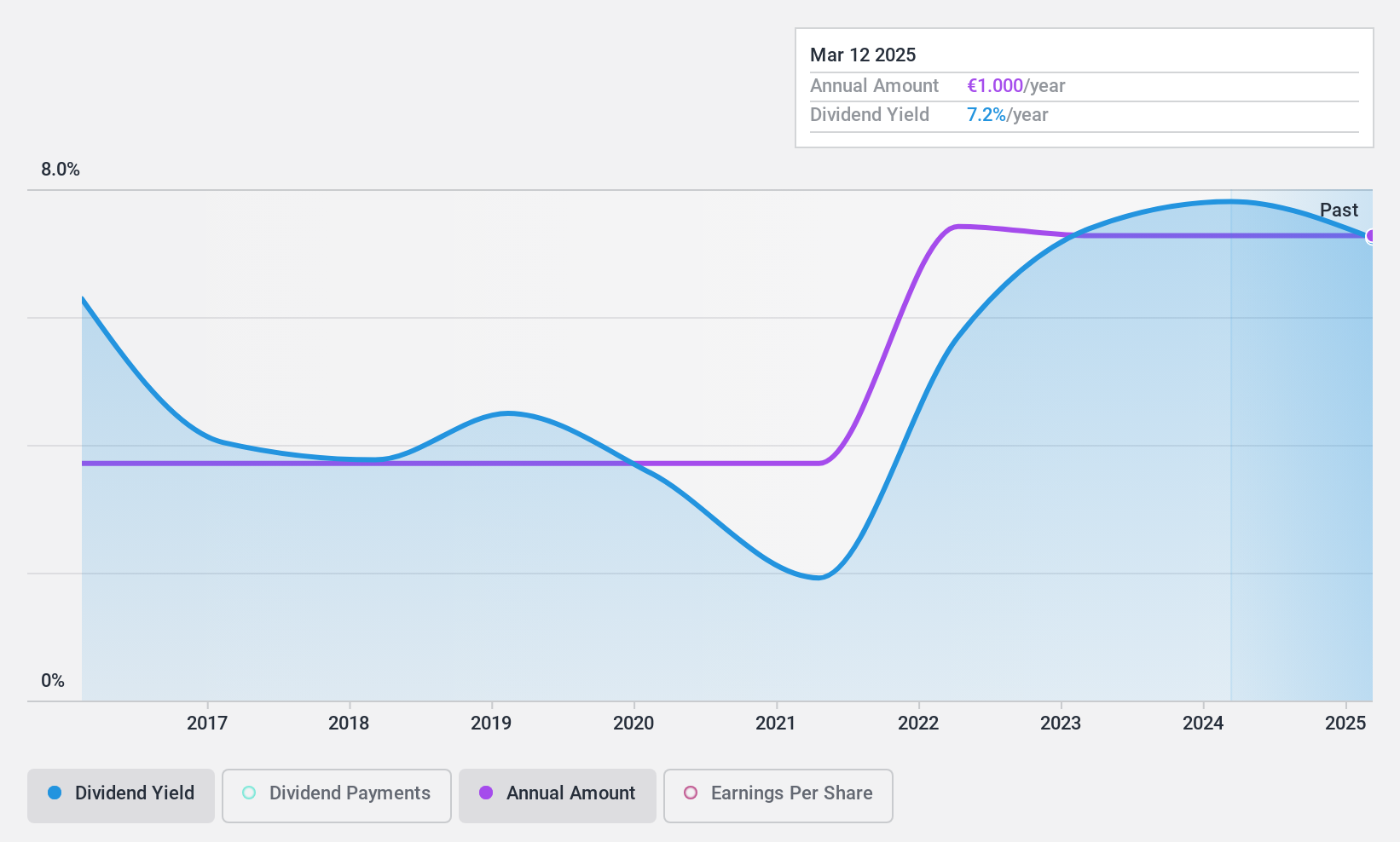

Piscines Desjoyaux (ENXTPA:ALPDX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Piscines Desjoyaux SA designs, manufactures, and markets swimming pools and related products in France and internationally, with a market cap of €115.78 million.

Operations: Piscines Desjoyaux SA generates revenue primarily from its Swimming Pools segment, which accounts for €115.56 million, while the Real Estate segment contributes €0.10 million.

Dividend Yield: 7.8%

Piscines Desjoyaux's dividend yield of 7.75% ranks in the top 25% of French payers, but its dividends are not covered by free cash flows. Despite this, the payout ratio is sustainable at 82%, supported by stable and growing dividends over the past decade. The company's Price-To-Earnings ratio (10.5x) is favorable compared to the broader French market (13.9x), although recent financials suggest caution due to insufficient earnings coverage for dividend payments.

- Click here to discover the nuances of Piscines Desjoyaux with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Piscines Desjoyaux is priced higher than what may be justified by its financials.

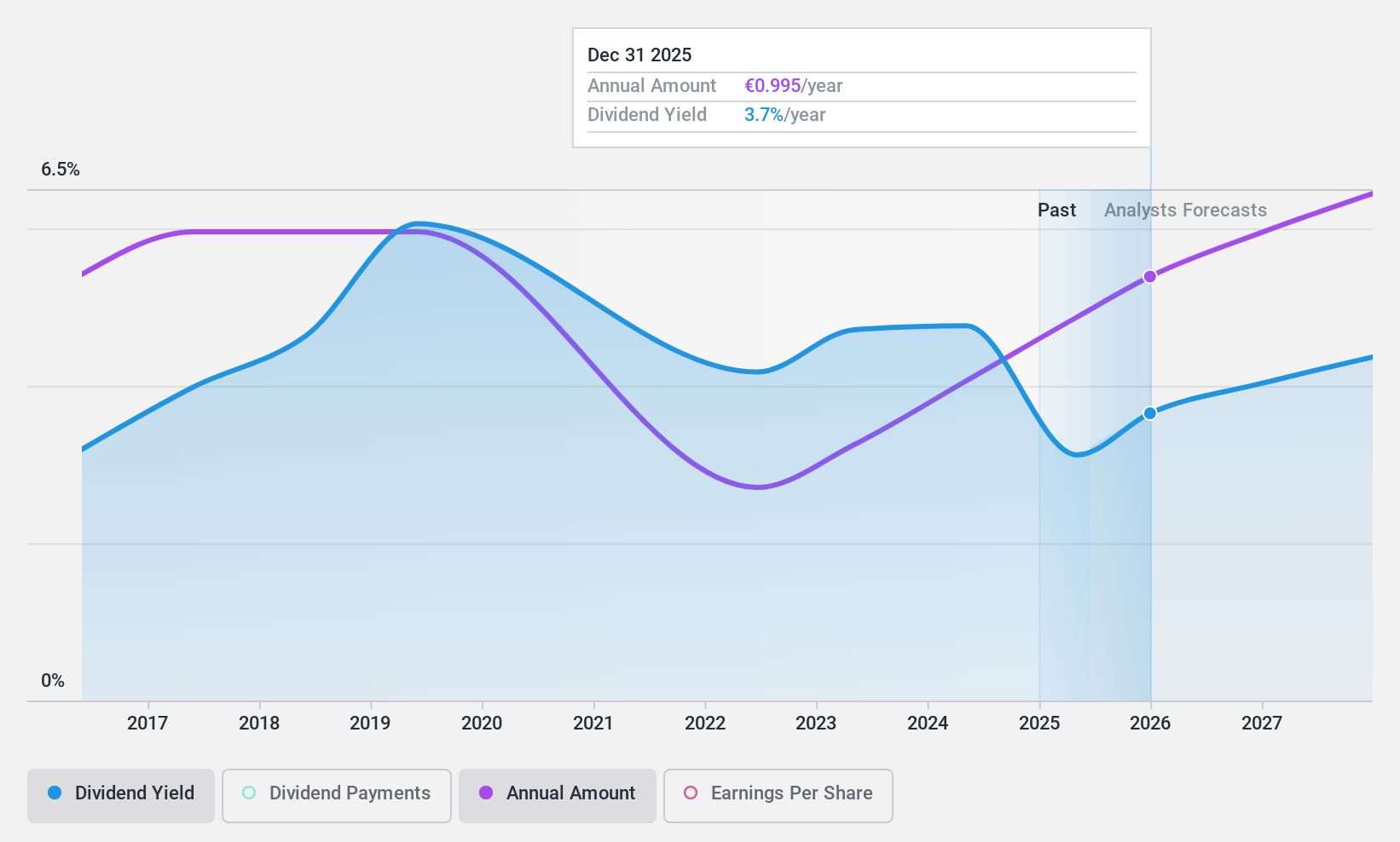

PORR (WBAG:POS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PORR AG is a construction company operating in Austria and various other European countries, with a market cap of €998.85 million.

Operations: PORR AG generates its revenue primarily from its operations in Austria and Switzerland (€3.07 billion), Germany (€977.96 million), Poland (€941.75 million), Central and Eastern Europe (€805.65 million), and Infrastructure International (€402.91 million).

Dividend Yield: 3.4%

PORR AG's dividend yield of 3.43% is below the top quartile of Austrian payers, yet dividends are well covered by earnings and cash flows with payout ratios at 38.8% and 25.6%, respectively. Despite volatile dividends over the past decade, recent financial results show modest growth in sales and net income for 2024, suggesting potential stability moving forward. The Price-To-Earnings ratio (11.2x) is slightly favorable compared to the Austrian market average (11.7x).

- Delve into the full analysis dividend report here for a deeper understanding of PORR.

- The analysis detailed in our PORR valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Access the full spectrum of 242 Top European Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal