IPO outlook | The annual income of 1.5 billion dollars mainly depends on exports of small household appliances. What is the future growth potential of Xiangjiang Electric?

Oki A has been fruitless for many years, and in the end, Heungjiang Electric has set its sights on “Hong Kong.”

Recently, Hubei Xiangjiang Electric Co., Ltd. (hereinafter referred to as “Xiangjiang Electric”) submitted another listing to the Hong Kong Stock Exchange. As early as 2017, this company, whose main business is exporting small kitchen appliances, hired a consulting agency to provide guidance in seeking an A-share listing. However, after many years, Xiangjiang Electric has not been able to go any further. Since then, Xiangjiang Electric first submitted its listing on the main board of the Hong Kong Stock Exchange in September last year, and quickly submitted it again this month after the Hong Kong stock IPO prospectus expired.

As a household goods manufacturer, Xiangjiang Electric mainly operates under the ODM/OEM model, and has established a customer base composed of world-renowned brands such as Walmart and Philips. According to Frost & Sullivan's report, based on the 2023 export value, Heungjiang Electric is the tenth largest enterprise in the small kitchen appliance industry in China, with a market share of about 0.6%. Also, based on exports from China to the US and Canada in 2023, Heungjiang Electric's electric kettles account for about 21.4% and 32.3% of the market share in the relevant categories defined by the China General Administration of Customs, respectively; based on exports from China to the US in that year, the company's electric products such as egg beaters account for about 6.7% of the market share in the relevant categories defined by the China General Administration of Customs.

Over the past few years, the core financial data of Heungjiang Electric has continued to rise. However, in recent times, the original international economic and trade order has been facing major challenges. Under the shadow of tariffs, most of the revenue comes from whether the exported Xiangjiang Electric Appliance can “stay on a fishing boat”. This may require a question mark.

What is the gold content behind the double-digit growth?

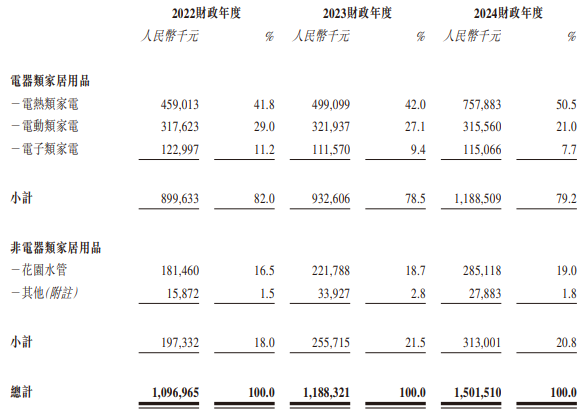

Dismantling the business structure, the business scope of Xiangjiang Electric includes R&D, design, production and sales of electrical household items and non-electrical household goods. Among them, electrical household items are mainly electric heating appliances, electric household appliances, and electronic household appliances, while non-electrical household items are garden pipes and pots.

From 2022 to 2024, the revenue of Heungjiang Electric continued to grow, reaching 1,097 billion yuan (RMB, same below), 1,188 billion yuan, and 1,502 billion yuan respectively, with revenue growth of 26.4% in 2024. Looking at the structure, household appliances have always been the company's main source of revenue. During the reporting period, this business type contributed 82%, 78.5%, and 79.2% of revenue, respectively, and remained high. Among them, in 2024, the proportion of electric heating appliances and electric household appliances was 50.5% and 21%, respectively.

During the period, revenue from non-electrical household items accounted for 18%, 21.5%, and 20.8%, respectively. In this business type, garden water pipes account for the absolute majority, accounting for 16.5%, 18.7%, and 19%, respectively.

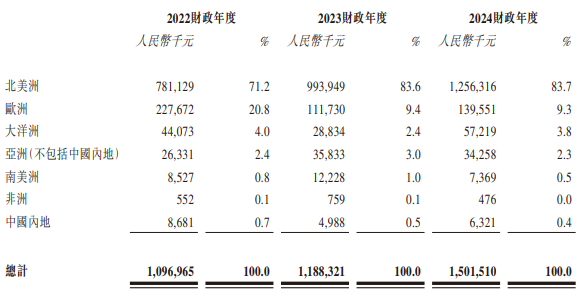

The products of Xiangjiang Electric are mainly manufactured in China, and most of the company's revenue comes from product sales to the US. In 2022 to 2024, sales of the company's products with the US as the shipping destination accounted for 68.8%, 80.6%, and 76.5% of total revenue, respectively. In addition to this, Xiangjiang Electric also derives much of its revenue from Canada in North America, as well as Europe, Oceania, South America, Africa, and other regions in Asia excluding mainland China. During the period, the company's products shipped to mainland China accounted for less than 1% of sales.

Thanks to a significant increase in electric appliances and garden water pipes in 2024, the total revenue of Xiangjiang Electric achieved double-digit growth this year. At the same time, the company's profit indicators were also structurally optimized during the year. According to the data, in 2022 to 2024, the gross profit of Xiangjiang Electric was 224 million yuan, 286 million yuan, and 329 million yuan respectively, corresponding to gross profit margins of 20.4%, 24.1%, and 21.9%; net profit was 80,261,000 yuan, 121 million yuan, and 140 million yuan. Among them, the company's net profit also increased 15.6% in '24.

Building overseas factories to enhance global competitiveness?

From a macro perspective, over the past few decades, China's small household appliance industry has become the world's leading production base. However, due to rising uncertainty in the external environment, some international brands are also seeking to expand their supply chains to mitigate the impact of the single market. Perhaps it is also due to considerations in line with customer needs that Xiangjiang Electric is starting to build overseas factories to further enhance its global competitiveness.

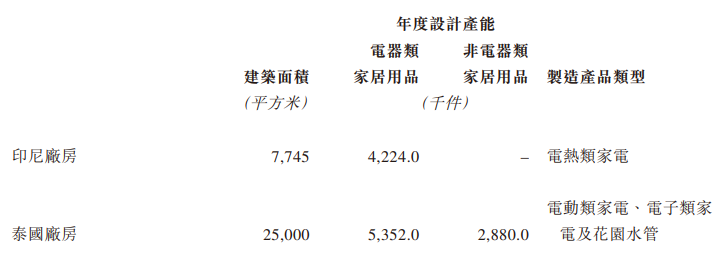

According to reports, Heungjiang Electric is currently planning to set up a production base in Thailand. According to the prospectus, the new production facility to be built by Xiangjiang Electric covers an area of about 25,000 square meters. The company will configure a new automated assembly line that mainly produces electric products and garden water pipes at the base. According to estimates from Xiangjiang Electric, the new production workshop will be put into operation in the second half of this year, and it is expected that acceptance tests will be carried out in September next year.

Also, it is worth mentioning that HeungKong Electric also has production facilities in Indonesia. As part of Heungjiang Electric's response measures to reduce external risks, the company's plant in Indonesia has now applied for the necessary regulatory approvals and certificates to start production. Xiangjiang Electric expects the plant to be put into operation in the second quarter of this year. Subsequently, the plant will mainly be used to manufacture electric appliances such as air fryers.

From the ambitious expansion plan, it is easy to see that Xiangjiang Electric has long anticipated the deeply intertwined external situation of complexity and uncertainty, and has indeed taken a series of countermeasures. But what cannot be ignored is that considering that the US tariff policy is difficult to predict in the future, and that Thailand is the target of additional tariffs imposed by the US, it is still difficult to quantitatively analyze subsequent effects based on existing information, so I'm afraid there are still major variables in the growth prospects of Heungjiang Electric.

Based on this, although Xiangjiang Electric achieved good performance in 2022 to 2024, it may not be easy for Xiang Jiang Electric to impress investors with fundamentals in a capital market that places more importance on growth expectations and certainty. Zhitong Finance will continue to pay attention to whether it can successfully land on the Hong Kong Stock Exchange this time after being turned away by A-shares.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal