Trump disrupts the game, and Wall Street is in turmoil again: banking giants are making money but are afraid to be optimistic

The Zhitong Finance App learned that it was difficult for investors to predict Trump's capricious policies, which made Wall Street banks set a trading record in the first quarter of 2025, but when industry leaders looked forward to the future, they had neither clear answers, nor were they optimistic about the upcoming situation.

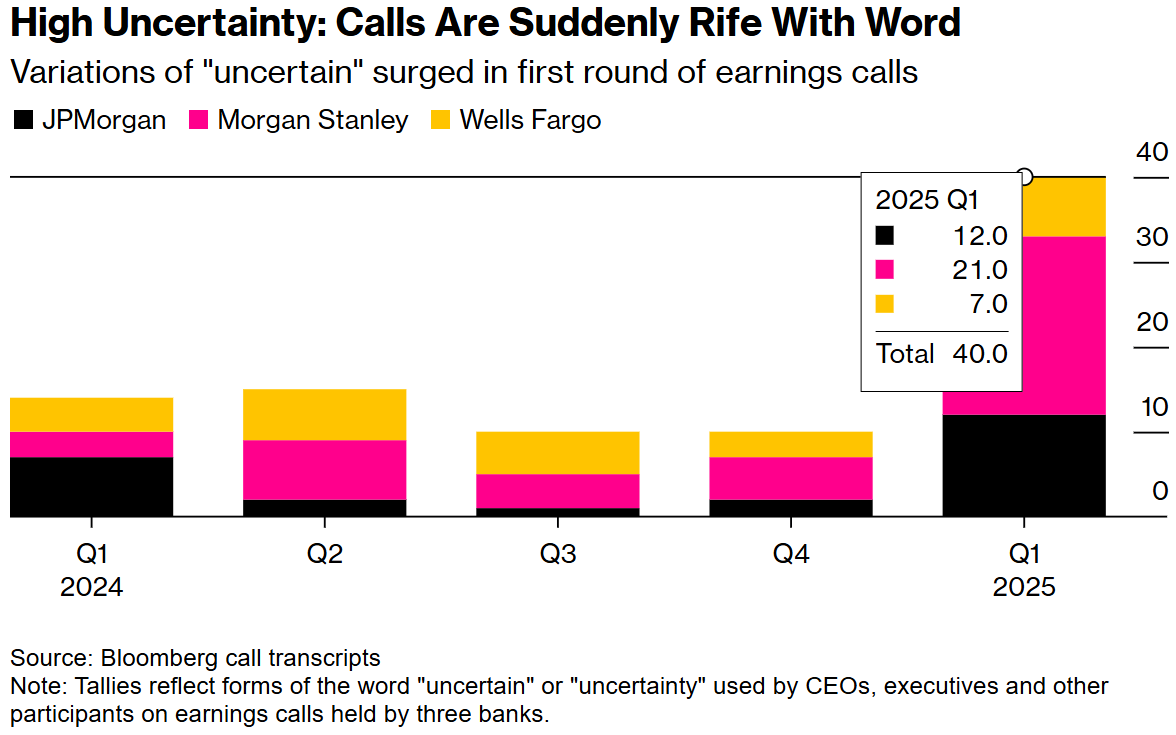

On Friday, as the three major US banks kicked off the industry earnings season, terms such as “uncertainty,” “unknown factors,” and “turbulence” appeared repeatedly. J.P. Morgan CEO Jamie Dimon said in a conference call that not only is the economic situation obscure and difficult to predict, but the more critical question is whether Western economic and military alliances can maintain unity.

The largest bank in the US surprised analysts with a bad debt provision of $973 million — more than 40% of analysts' estimates. Dimon said that the bank's capital holdings have exceeded regulatory requirements and has sufficient liquidity “to handle any turbulent waves.” Maybe when the earnings conference call is held next quarter, we won't have to guess anymore.” he added.

Earnings conference calls are full of “uncertainties”

Three banks, J.P. Morgan Chase (JPM.US), Wells Fargo (WFC.US), and Morgan Stanley (MS.US), all surpassed profit expectations, but then all described anxiety in the consumer and business community. All three stocks jumped in early trading, but as the market opened, the gains gradually subsided or even declined.

Trump's chaotic tariff policies and efforts to reduce the size of government institutions — aimed at unlocking America's growth potential — have raised concerns about trade, inflation, unemployment, and a potential recession. Bank executives said the company is suspending expansion plans, including lucrative mergers and acquisitions handled by Wall Street deal makers.

“Judging from the situation, many companies suspended their actions because of this and chose to wait and see.” Dimon pointed out, “This involves not only merger and acquisition transactions, but also mergers and acquisitions activities of medium-sized enterprises, and even affects corporate recruitment plans.”

When analyst Mike Mayo asked if multinational US companies such as J.P. Morgan should be concerned about getting involved in a trade war, Dimon confessed, “We will be targeted. That's what's about to happen, but that's OK.”

Wells Fargo CEO Charlie Schaff said the bank supports the government's efforts to break free trade barriers, but notes that this has increased corporate risk.” Resolving issues in a timely manner is beneficial to America, and will also benefit businesses, consumers, and markets.” Schaaf said his company was “prepared for an economic slowdown in 2025”.

Executives said that at present, consumers are still maintaining their old habits, although some are speeding up some purchases just before the expected tariffs come into effect.” If the labor market remains strong, consumer credit may not be a problem.” J.P. Morgan's chief financial officer Jeremy Barnum said, “Otherwise, we will see history repeat itself.”

Analysts questioned some executives about recent fluctuations in the bond market — such fluctuations prompted Trump's decision to set a 90-day negotiation grace period for various tariffs. Barnum said that J.P. Morgan is of course closely watching the matter, and Dimon responded, “I'm watching every minute.”

Morgan Stanley CEO Ted Pike told analysts that the stock, bond and foreign exchange markets showed investors were adjusting their predictions about the economic outlook around the clock.

“We've been talking about the 'final conclusion of history' for the past three years, that is, the era of long-term political and economic patterns trending towards globalization is over.” He said, “Now history has restarted. The ensuing period of adjustment is bound to make the outlook more difficult to predict.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal