Insider Trading: 3 CEOs Recently Buying Shares

Investors closely monitor insider buys, as they can give hints surrounding the long-term picture.

But it’s critical to note that insiders have a longer holding period than most, and many strict rules apply to their transactions.

Recently, CEOs of several companies – GameStop GME, MicroStrategy MSTR, and Applied Materials AMAT – have made splashes, acquiring shares. Let’s take a closer look at the transactions for those interested in trading like the insiders.

Meme Stocks Return?

Most investors are familiar with GameStop thanks to the ‘meme stock’ mania a few years back, with the company reflecting the poster child of the bunch overall. Though shares are down nearly 20% year-to-date, CEO Ryan Cohen recently stepped in and purchased 500k shares at a total transaction value of roughly $10.7 million.

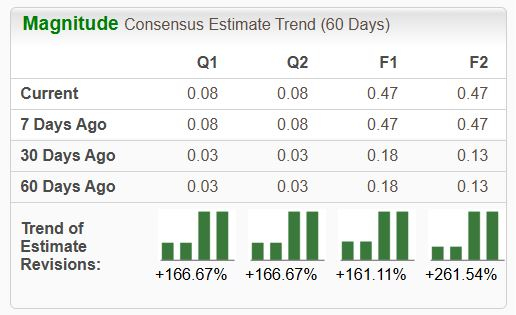

GameStop currently sports a bullish Zacks Rank #1 (Strong Buy), with its earnings outlook shifting notably bright over recent months.

Image Source: Zacks Investment Research

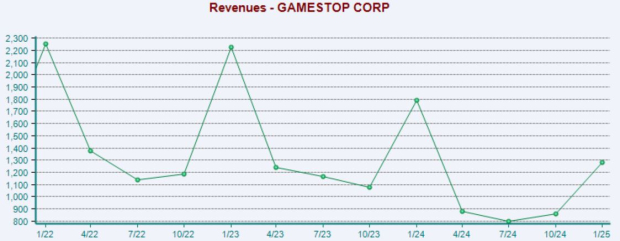

Though the EPS outlook remains bullish, the company’s top line has struggled to show any growth over recent years, as shown below.

Image Source: Zacks Investment Research

MSTR Shares Soar Alongside BTC

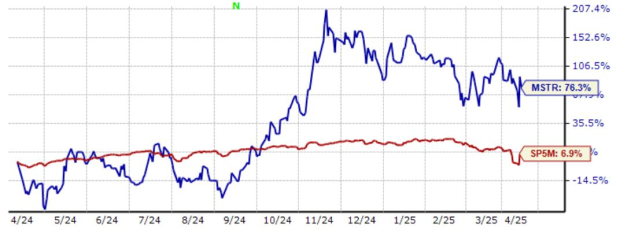

MicroStrategy shares have become notably popular amid the surge in bitcoin over the past year, up nearly 80% and widely outperforming relative to the S&P 500. CEO Phong Le recently swooped in and acquired 6k MSTR shares at a total transaction value of roughly $510k.

Image Source: Zacks Investment Research

Investors should be aware of the high-volatility nature of MSTR shares, which are largely dictated by price swings within BTC.

AMAT CEO Dives In

Applied Materials provides manufacturing equipment, services, and software to the semiconductor, display, and related industries. CEO Gary Dickerson recently purchased 50k AMAT shares at a total transaction value of just under $7 million.

AMAT shares have faced a tough environment in 2025 amid the cooldown in semiconductors, down nearly 15% and underperforming relative to the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, looking to receive insights into the longer-term picture. The transactions shouldn’t be relied on for near-term performance, as insiders’ holding periods are longer than most, and many strict rules apply.

Rather, investors can see insider buys as an overall net positive concerning the longer-term outlook.

All large-cap stocks above – GameStop GME, MicroStrategy MSTR, and Applied Materials AMAT – have seen recent insider activity.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

GameStop Corp. (GME): Free Stock Analysis Report

MicroStrategy Incorporated (MSTR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal