The bond market “gets on the roller coaster”! Trump's suspension of tariffs triggered sharp fluctuations in US bond yields

The Zhitong Finance App learned that although US President Trump called the bond market “amazingly beautiful” on Wednesday, the day was completely chaotic for US treasury bond traders. At the opening of the market on Wednesday, market concerns about the stability of the world's largest bond market grew as the stock market and US bonds were sold off for many days in a row. But in the afternoon, the situation changed abruptly. Trump announced the suspension of “equal tariffs” on most countries, instantly turning market sentiment from risk aversion to adventure.

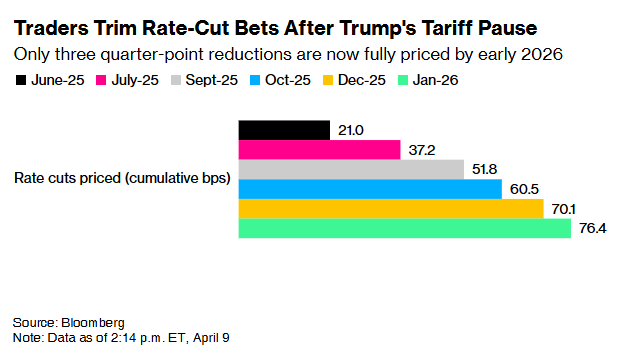

The “sharp braking” of the policy has caused sharp fluctuations in the bond market. The policy-sensitive 2-year US Treasury yield surged 30 basis points during the intraday period, the biggest intraday increase since 2009, as traders reduced their bets on the Fed's interest rate cut. The market currently expects the Federal Reserve to cut interest rates three times before the end of the year; earlier, it was thought that it would be four times.

Meanwhile, the 30-year US Treasury yield erased previous gains, partly because market concerns about inflation caused by tariff escalation have eased. After reaching the highest level since 2023 of 5.02%, the yield once fell to a low of 4.7%.

This shock quickly spread to the Asian market. Australian short-term treasury yields recorded the biggest increase in the past three years, while the New Zealand treasury yield curve flattened sharply.

The bond market, as well as the sharp rise in US and emerging market stocks, together suggest that the economic outlook may be brighter. But for US debt, this means that the pressure is simply shifting from one term to another. Zachary Griffiths, Head of Investment Level and Macro Strategy at CreditSights, said, “This is an inexplicable market for US bonds. Either traditional 'risk appetition' drives up yields, or 'risk auster' caused by trade wars causes foreign sell-offs or the collapse of base difference trading, which also boosts returns.”

Before the market reversal, the bond market sentiment was extremely pessimistic, and people speculated that investors were canceling their leveraged bond positions. Trump also seemed to be aware of this during his speech on Wednesday afternoon. He said, “I saw that everyone was a little nervous last night. I'm watching it, but now if you look at it again, it's so beautiful.”

At the beginning of this week, the sharp rise in US bond yields was in stark contrast to the rise in bonds triggered by Trump after announcing widespread equal tariffs on April 2. This round of yield changes mainly focuses on long-term US debt, which partly reflects the market's expectation that tariffs will trigger an inflationary global trade war. At the same time, however, the turmoil in the bond market also showed a self-reinforcing trend — sharp losses caused investors to flee popular trades.

In particular, many traders previously bet that US bonds will outperform the interest rate swap market because it is expected that the Trump administration will provide more favorable regulatory treatment. When “inflation trading” dominated, these positions were forced to be abandoned, leading to a historic increase in the relative performance of the swap market.

Sean Simko, head of global fixed-income portfolio management at SEI Investments, said that Trump's current “softening” tariff stance — if only temporarily — “gave the Federal Reserve more time to observe inflation trends.” He said, “This is an optimistic interpretation. Time will tell if this is just a moratorium, or if it means progress in positive negotiations, reducing the cost of doing business globally.”

Furthermore, less than an hour before Trump's speech, the $39 billion 10-year US bond auction showed good demand — even though some in the market feared that Trump's policies might dampen the interest of overseas buyers. This auction performed better than Tuesday's 3-year US bond auction, and also brought more positive prospects to Thursday's 30-year US bond auction. Subadra Rajappa, fixed income strategist at Société Générale, said: “This has indeed allayed some market concerns.”

After the US bond auction and Trump's latest tariff measures, the US dollar continued to weaken on the same day. The Australian dollar, Brazilian real, and Mexican peso all increased by at least 3% against the US dollar. The Pioneer FTSE Emerging Markets ETF (VWO) rose 6.5%, the biggest one-day gain since March 2022.

Brendan McKenna, foreign exchange strategist at Wells Fargo Bank, said, “Even if only temporarily, Trump's' blink 'and lower tariffs this time should greatly boost investor sentiment.” He anticipates that this will support emerging market assets.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal