Italgas (BIT:IG) Is Increasing Its Dividend To €0.406

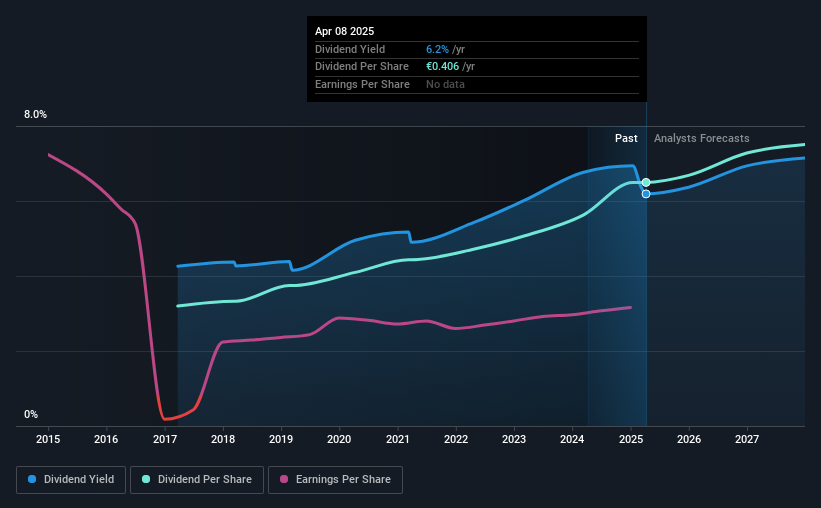

The board of Italgas S.p.A. (BIT:IG) has announced that it will be paying its dividend of €0.406 on the 21st of May, an increased payment from last year's comparable dividend. This will take the dividend yield to an attractive 6.2%, providing a nice boost to shareholder returns.

Italgas' Future Dividend Projections Appear Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, Italgas' dividend was only 69% of earnings, however it was paying out 153% of free cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Looking forward, earnings per share is forecast to rise by 21.9% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 54% by next year, which is in a pretty sustainable range.

See our latest analysis for Italgas

Italgas Doesn't Have A Long Payment History

It is great to see that Italgas has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2017, the annual payment back then was €0.20, compared to the most recent full-year payment of €0.406. This means that it has been growing its distributions at 9.3% per annum over that time. The dividend has been growing as a reasonable rate, which we like. However, investors will probably want to see a longer track record before they consider Italgas to be a consistent dividend paying stock.

Italgas May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Earnings has been rising at 2.6% per annum over the last five years, which admittedly is a bit slow. Italgas is struggling to find viable investments, so it is returning more to shareholders. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

Our Thoughts On Italgas' Dividend

Overall, we always like to see the dividend being raised, but we don't think Italgas will make a great income stock. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for Italgas (of which 1 shouldn't be ignored!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal