“Doctor Doom” Roubini: The US economy will avoid recession, the Federal Reserve will not bail out the market

The Zhitong Finance App learned that “Doctor Doom” Nouriel Roubini (Nouriel Roubini) issued a new warning to Wall Street: traders should reduce their bets that the Federal Reserve will step up interest rate cuts to mitigate the impact of Trump's tariff policy. This time, the economist, famous for correctly predicting the 2008 financial crisis, predicts that after the tariff-related policy struggle is gradually downgraded, the Federal Reserve will keep interest rates stable for the rest of the year, and the US economy will avoid recession.

Fearing that punitive tariffs will exacerbate the global recession, the US stock market has been sold for three consecutive days at $5 trillion. Roubini expects that Trump will be the first to succumb to market pressure, even though Trump recently supported tariffs as a good medicine, while the Federal Reserve insisted on its mission to fight inflation. Roubini believes that, in addition to the fact that the credit market has shown relative elasticity in the recent global turmoil, there is reason for the Federal Reserve to be cautious in terms of policy.

In a telephone interview, Roubini said, “Of course, there is a cowardly game between Trump's position and that of Federal Reserve Chairman Powell. But I want to say that the execution price of Powell's put option will be lower than the execution price of Trump's put option, which means Powell will wait until Trump succumbs. ”

Powell said last week that the impact of the new tariffs on the economy may be far greater than expected, leading to a slowdown in economic growth and a rise in inflation. This week, traders expect the Fed to cut interest rates by 25 basis points 3 to 5 times this year — some people on Wall Street are even considering the Fed's emergency rate cut before the next meeting.

Despite this, Powell hinted on Friday that now is not the time to implement the “Federal Reserve Put Options,” and that even if the wealth of American households evaporates, economic activity faces real risks.

“Fed put options” is Wall Street's statement about the actions of the Federal Reserve to support a plummeting stock market. After the famous “Black Monday” US stock market crash in October 1987, former Federal Reserve Chairman Greenspan cut interest rates and injected liquidity. This statement first appeared in the form of a “Greenspan Put” (Greenspan Put). Successive Federal Reserve leaders have taken other major steps to deal with the ensuing crisis, which helped contain market losses and even helped reverse the market.

No Federal Reserve official would acknowledge that “Fed put options” are part of their policy toolbox, yet Wall Street has had natural confidence in their existence for nearly 40 years. Currently, unless the US economy falls into recession, it will be difficult for the Federal Reserve to cut interest rates drastically to bail out the market.

Trade negotiations are expected to be reached on Tuesday after tariff increases exceeded expectations, and trade shocks continue. US Treasury bonds fell after experiencing the craziest day for bond traders since the worst of the pandemic in March 2020, while the US stock market soared at its fastest pace since 2022 before falling back. The VIX Index — Wall Street's so-called panic indicator — is currently around 60 after soaring above 55. Investors have always feared that in the midst of all the fluctuations, part of the market might collapse.

Roubini's optimistic economic outlook is in stark contrast to other market watchers. Former US Treasury Secretary Summers predicted that the recession might cause 2 million Americans to lose their jobs, and some Wall Street economists agree with his pessimistic stance. S&P Global raised the probability of a US recession from 25% in March to the current 30% to 35%. HSBC increased the probability of a recession in the US stock market to 40%.

J.P. Morgan Chase also joined the camp of predicting the US recession last Friday. The bank's economists expect the US annual real GDP to fall by 0.3%, lower than the 1.3% increase previously predicted, and the unemployment rate will rise to 5.3% from the current 4.2%. After introducing these tariffs, J.P. Morgan also raised the probability of a recession in the US and the global economy to 60%, an increase of 20 percentage points over the previous one.

Meanwhile, on April 6, the Goldman Sachs research team drastically raised the probability of the US recession in the next 12 months to 45%, a sharp increase of 10 percentage points from the previous forecast. The report also lowered the GDP growth forecast for the fourth quarter of 2025 to 0.5%, which is directly lower than the original forecast. Goldman Sachs only raised the probability of the US recession in the next 12 months from 20% to 35% last Monday.

Although trade talks have raised hopes that the US will ease its protectionist stance, they warn that a new world with higher tariffs is waving at them. According to Roubini, this indicates that inflation will become difficult, hurting investors in long-term bonds. This is a constructive background for the ETF he manages, which invests in inflation-protected US Treasury bonds, municipal securities, and gold trusts.

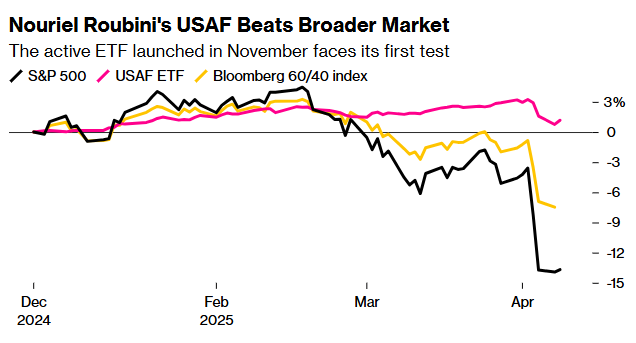

Since its inception, Roubini's actively managed Atlas America Fund (USAF) has accumulated only $16 million in assets. Since the beginning of the year, the ETF has risen nearly 1%, outperforming the S&P 500 index, which hovered on the edge of a bear market for the first time since 2022, and the Bloomberg 60/40 index.

Last week, the US 2-year inflation forecast soared to a new high since 2022. The Federal Reserve is closely watching these indicators to help guide its monetary policy decisions, as they say they can drive changes in actual inflation. Powell even called inflation expectations “the most important driver of actual inflation” in 2019.

Generally, emphasis is placed on long-term inflation expectations because they are seen as excluding short-term disruptions. One of the long-term inflation expectations market indicators favored by the Federal Reserve — the 5-year forward inflation rate is currently around 2.3%, while the peak in January of this year was 2.47%.

He said, “ETFs should basically perform well when there are various tail risks. In the medium term, long-term bond yields are likely to rise if inflation increases. And it makes you want to invest in short-term bond yields.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal