IDC: The compound annual growth rate of China's liquid-cooled server market is expected to reach 46.8% in 2024-2029, and the market size will reach US$16.2 billion in 2029

The Zhitong Finance App learned that recently, the International Data Corporation (IDC) released the latest “China Semi-Annual Liquid-Cooled Server Market (Second Half of 2024) Tracking” report. According to IDC data, China's liquid-cooled server market continued to grow rapidly in 2024, with a market size of 2.37 billion US dollars, an increase of 67.0% compared with 2023. Among them, the market share of cold plate solutions has further increased. IDC predicts that in 2024-2029, the compound annual growth rate of China's liquid-cooled server market will reach 46.8%, and the market size will reach 16.2 billion US dollars in 2029.

According to IDC data, in 2024, China's liquid-cooled server market continued the growth trend of the previous year, with annual shipments exceeding 230,000 units. Although current liquid cooling application scenarios are still relatively concentrated, both ecological chain suppliers and users are fully aware that liquid cooling technology has a positive effect in saving energy and reducing emissions and improving the energy utilization rate of data centers. At the same time, thanks to the accelerated expansion of the server market as a whole, liquid cooling servers are also more widely used. Among them, the cold plate liquid cooling solution is becoming the standard choice for intelligent computing centers because it has better heat dissipation density and PUE control capabilities.

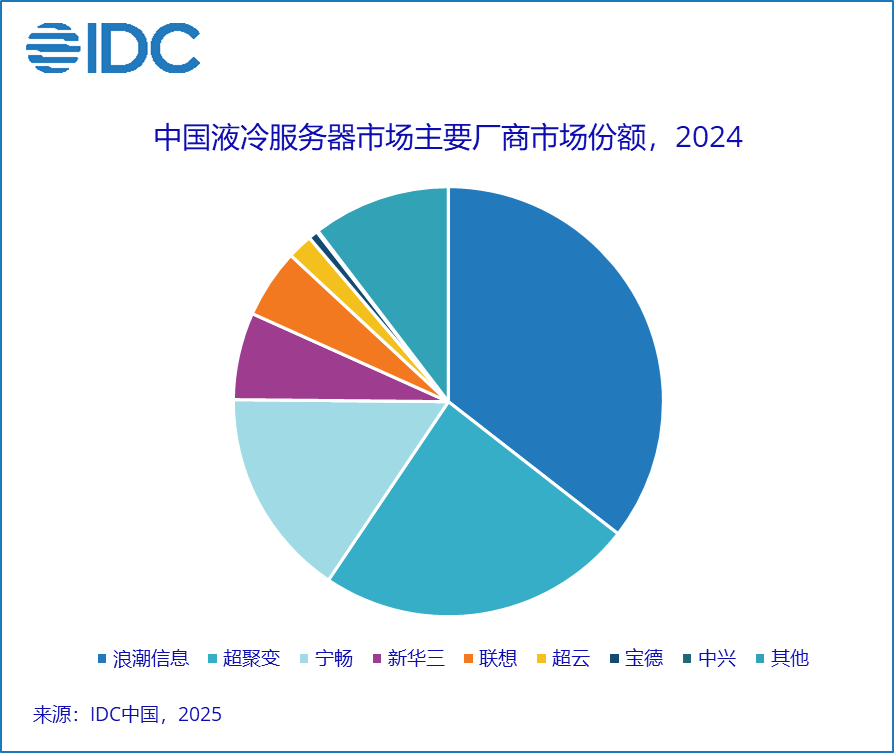

From the perspective of manufacturer sales, the top three vendors in the liquid cooling server market in 2024 are Inspur Information, Superfusion, and Ningchang, which account for about 70% of the market share. The core reason why traditional server vendors maintain a high market share in the field of liquid cooling is their comprehensive advantages of technology accumulation, full-stack service capabilities, and industrial ecological collaboration. Relying on hardware design experience, it quickly adapts to the collaborative optimization of cold plate liquid cooling and AI servers to lower the deployment threshold; the full chain solution (component - cabinet - data center) meets strict PUE requirements and optimizes dilution costs through modularity and supply chain.

From an industry perspective, applications of liquid cooling servers are still relatively concentrated. The Internet, telecom operators, and government industries are the top three in terms of industry procurement volume. As a pioneer in technology applications, the Internet industry has taken the lead in large-scale deployment of liquid cooling technology based on the rigid requirements of TCO optimization and PUE index control; in intelligent computing infrastructure construction, telecom operators use liquid cooling solutions as a key technical path to achieve the strategic goal of “dual carbon”, effectively balance the contradiction between increased computing power and energy consumption growth through thermal management technology innovation; on the government side, using national supercomputing The center is a representative high-performance computing cluster. Based on the cooling challenges brought about by the continuous rise in computing power density, it has formed a remarkable demonstration effect. The above three industries account for about 90% of the overall market procurement volume, while industries such as finance, services, manufacturing, and utilities are also actively exploring liquid cooling solutions suitable for themselves.

Xin Yi, IDC's China server market research manager, believes that in the context of intelligent upgrading of global computing power infrastructure, the liquid-cooled server market is experiencing structural growth driven by multiple changes. With the explosive growth in demand for AI computing power such as large model training and AIGC inference, traditional air cooling systems have shown energy efficiency bottlenecks when dealing with high-density computing power clusters of 40 kW/cabinet or above. Meanwhile, in the context of limited domestic high-end chip supply, China's liquid cooling server market will show the development characteristics of “policy driving+scenario differentiation+technology integration” for some time to come.

He said that on the policy side, the Chinese government has put forward higher requirements for future high-quality data center construction and will be implemented as a long-term goal; application scenarios will accelerate penetration into customization and scenarios, spawning innovative forms of modular liquid cooling deployment; at the technical level, new technologies represented by phase change cold plate liquid cooling technology will be applied. Combined with large models to reduce the demand for user computing power through algorithm optimization, applications of different scales will more rationally choose cooling methods of cold plate, immersion, or wind liquid mixture to promote the evolution and flexibility of cooling technology in the direction of modular, intelligent, and scenario adaptability Efficient cooling solution system.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal