3 UK Penny Stocks With Market Caps Under £200M To Consider

The UK market has recently felt the impact of weak trade data from China, with the FTSE 100 and FTSE 250 indices both closing lower amid concerns over global economic recovery. Amidst these broader market challenges, investors often look beyond established giants to explore opportunities in smaller or newer companies. Penny stocks, though a somewhat outdated term, remain relevant for those seeking potential growth; when backed by strong financial health, they can offer intriguing investment prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.644 | £54.45M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.58 | £266.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.335 | £232.23M | ✅ 4 ⚠️ 5 View Analysis > |

| Central Asia Metals (AIM:CAML) | £1.478 | £257.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.19 | £257.71M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.09 | £350.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.50 | £337.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.75M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.616 | £2B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.325 | £35.17M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Catalyst Media Group (AIM:CMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Catalyst Media Group plc provides business administrative services globally and has a market cap of £9.46 million.

Operations: The company generates revenue of £0.03 million from its business administrative services segment.

Market Cap: £9.46M

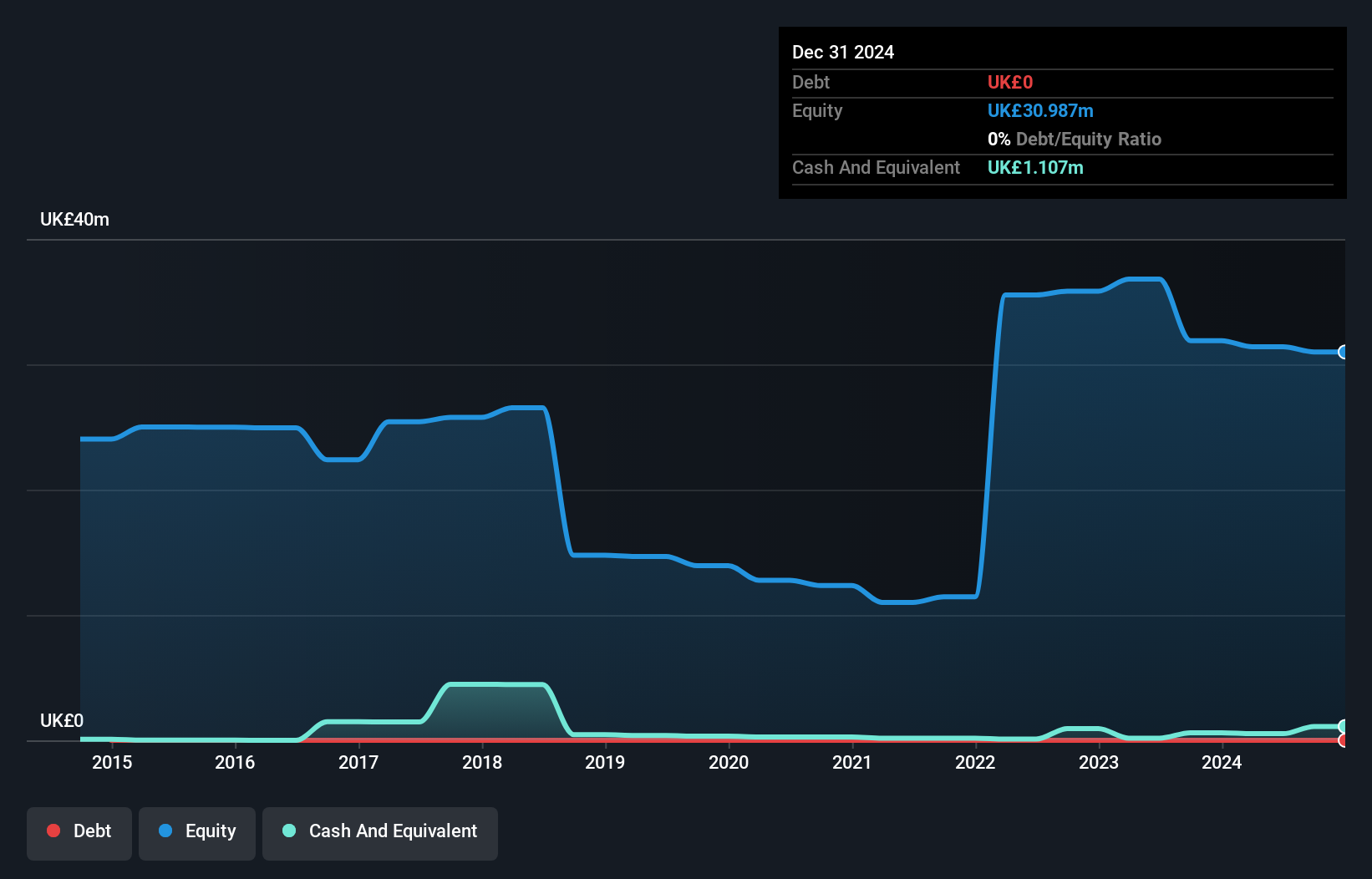

Catalyst Media Group plc, with a market cap of £9.46 million, is pre-revenue and unprofitable, reporting a net loss of £0.41 million for the half year ended December 31, 2024. Despite its current financial challenges, the company has no debt and its short-term assets significantly exceed its short-term liabilities. The stock trades at a substantial discount to estimated fair value and has not experienced meaningful shareholder dilution recently. However, it faces high share price volatility and an unsustainable dividend yield of 8.89%. The seasoned board offers stability amid these uncertainties.

- Click to explore a detailed breakdown of our findings in Catalyst Media Group's financial health report.

- Understand Catalyst Media Group's track record by examining our performance history report.

Provexis (AIM:PXS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Provexis plc, with a market cap of £11.73 million, develops, licenses, and sells functional foods, medical foods, and dietary supplements globally.

Operations: The company's revenue is derived from its Vitamins & Nutrition Products segment, which generated £1.20 million.

Market Cap: £11.73M

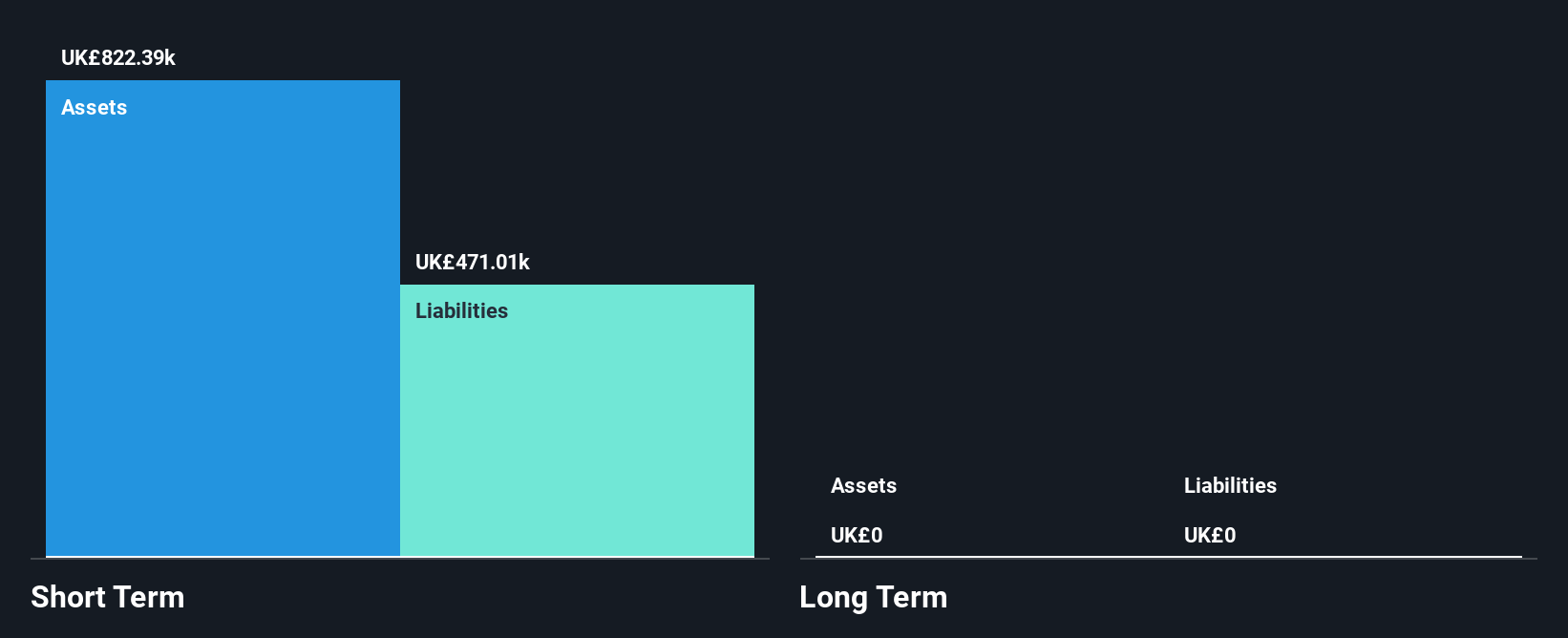

Provexis plc, with a market cap of £11.73 million, is pre-revenue and unprofitable, generating only £1 million in revenue from its Vitamins & Nutrition Products segment. The company benefits from being debt-free and having no long-term liabilities. Its seasoned board offers stability with an average tenure of 14 years. Despite having sufficient cash runway for over three years based on current free cash flow trends, Provexis faces challenges such as high share price volatility and a negative return on equity of -136.65%. Additionally, earnings have declined by 5.5% annually over the past five years.

- Get an in-depth perspective on Provexis' performance by reading our balance sheet health report here.

- Assess Provexis' previous results with our detailed historical performance reports.

Castings (LSE:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castings P.L.C. is involved in iron casting and machining operations across various regions including the UK, Europe, and the Americas, with a market cap of £110.82 million.

Operations: The company's revenue is derived from £225.67 million in foundry operations and £35.57 million in machining operations.

Market Cap: £110.82M

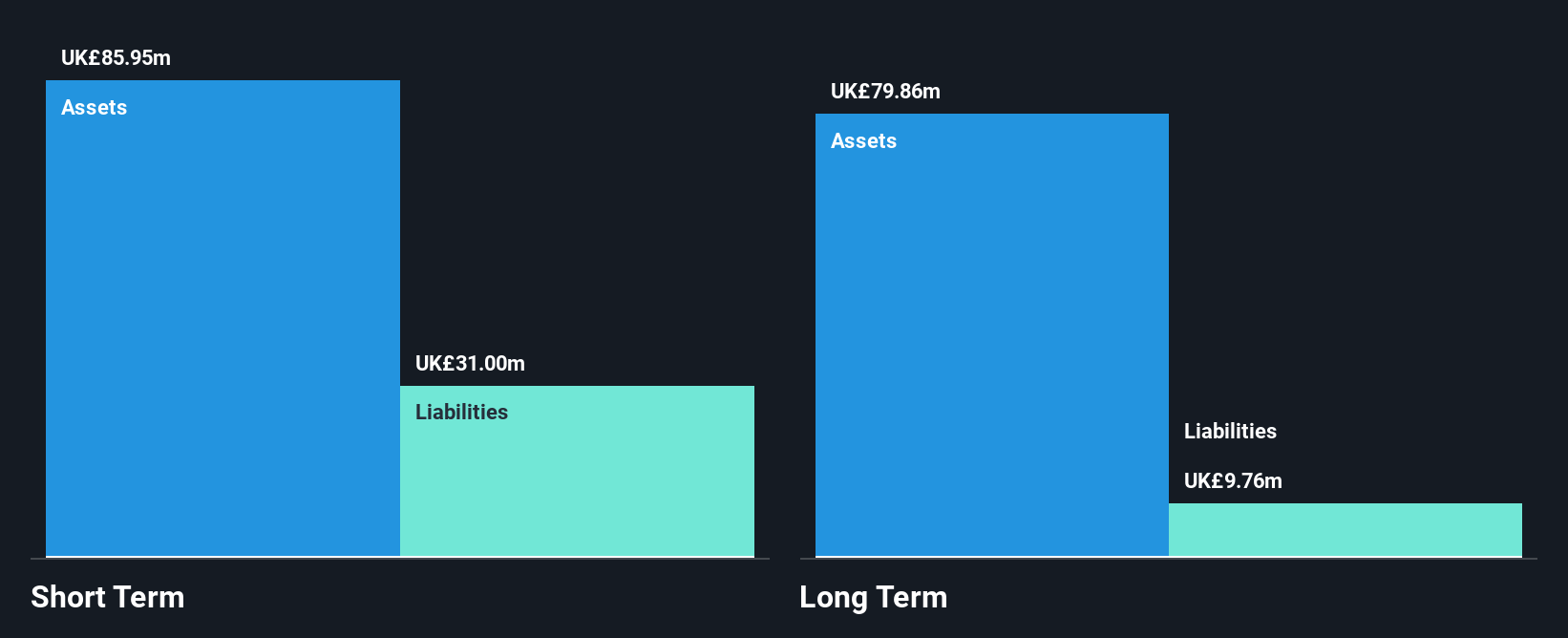

Castings P.L.C., with a market cap of £110.82 million, is financially stable, having no debt and sufficient short-term assets (£98.3M) to cover both short-term (£27.8M) and long-term liabilities (£7.9M). The company generates substantial revenue from its foundry (£225.67 million) and machining operations (£35.57 million), although recent earnings growth has been negative (-21.6%). Despite trading at 44.2% below estimated fair value, challenges include a low return on equity (9.5%) and declining earnings forecasts over the next three years by an average of 0.4% annually, alongside an unsustainable dividend yield of 7.22%.

- Take a closer look at Castings' potential here in our financial health report.

- Examine Castings' earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Unlock our comprehensive list of 391 UK Penny Stocks by clicking here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal