3 UK Dividend Stocks Offering Yields Up To 7.2%

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower as weak trade data from China highlights ongoing struggles in the global economy. Amidst these market fluctuations, dividend stocks can offer a measure of stability and income for investors, making them an attractive option in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.71% | ★★★★★★ |

| Man Group (LSE:EMG) | 8.21% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 4.01% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.94% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.55% | ★★★★★☆ |

| DCC (LSE:DCC) | 4.35% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 5.27% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.59% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.78% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.70% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

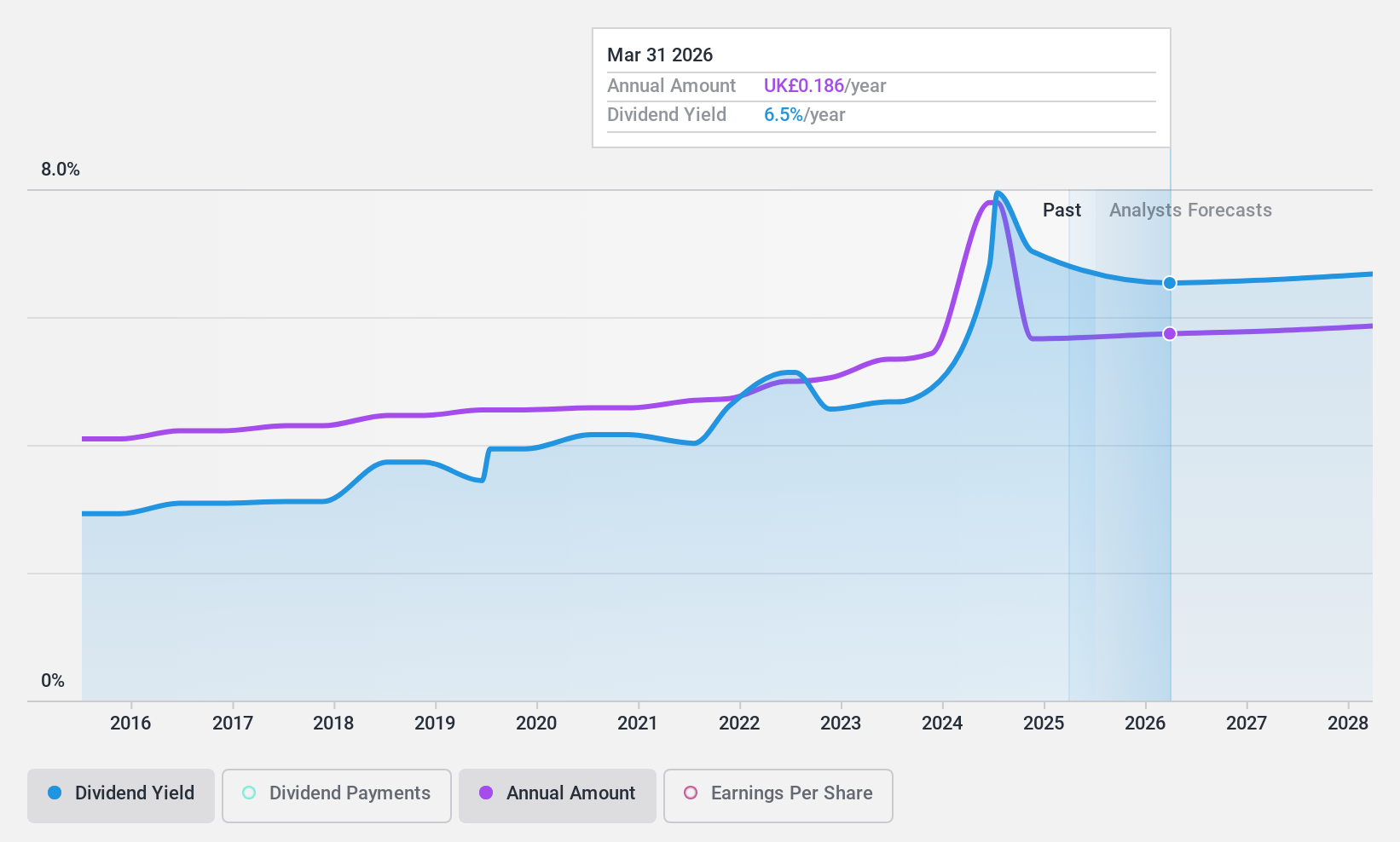

Bioventix (AIM:BVXP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bioventix PLC is a company that specializes in the creation, manufacture, and supply of sheep monoclonal antibodies for diagnostic applications globally, with a market cap of £125.27 million.

Operations: Bioventix PLC generates revenue primarily from its biotechnology segment, amounting to £13.66 million.

Dividend Yield: 6.5%

Bioventix recently announced a 3% increase in its interim dividend to 70 pence per share, reflecting its commitment to rewarding shareholders despite earnings challenges. However, the dividend's sustainability is questionable due to a high payout ratio of 104.5% and cash payout ratio of 107.7%, indicating it's not well covered by earnings or free cash flows. While dividends have grown steadily over the past decade, their coverage remains concerning for long-term reliability.

- Click here to discover the nuances of Bioventix with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Bioventix is priced lower than what may be justified by its financials.

Capital (LSE:CAPD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Capital Limited, along with its subsidiaries, offers a range of drilling solutions to the minerals industry and has a market cap of £120.50 million.

Operations: Capital Limited generates revenue primarily from its Business Services segment, which amounts to $348 million.

Dividend Yield: 3.3%

Capital Limited's recent mining services contract with Reko Diq Mining Pakistan Limited is a significant development, potentially boosting long-term revenue. However, for dividend investors, the picture is mixed. The proposed final dividend for 2024 has halved compared to the previous year, reflecting volatility in dividend payments over the past decade. Despite this, dividends are well covered by earnings and cash flows due to low payout ratios. The company's share price has been highly volatile recently.

- Navigate through the intricacies of Capital with our comprehensive dividend report here.

- Our valuation report unveils the possibility Capital's shares may be trading at a premium.

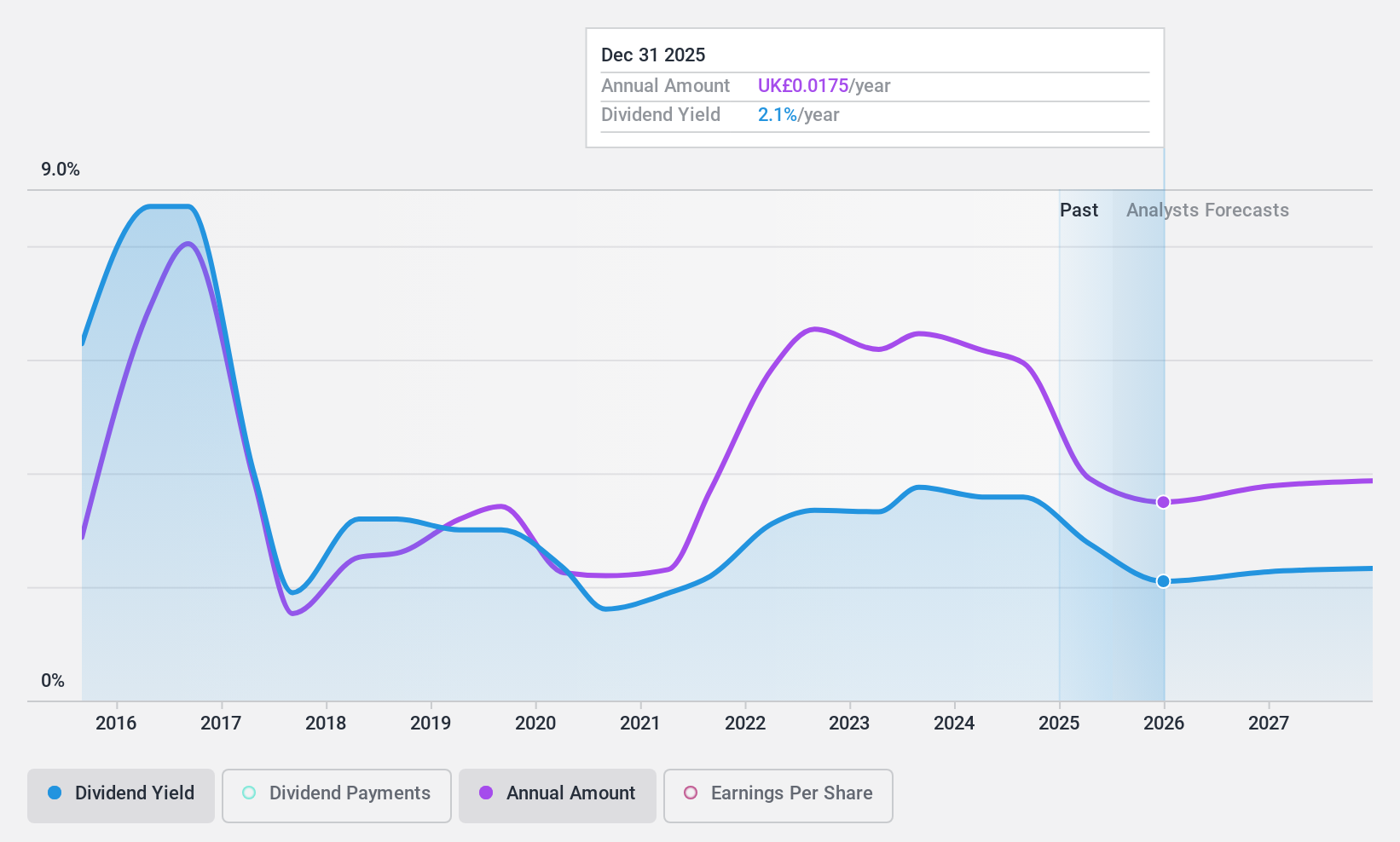

Castings (LSE:CGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castings P.L.C. is involved in iron casting and machining operations across various regions including the United Kingdom, Europe, and the Americas, with a market cap of £110.82 million.

Operations: Castings P.L.C. generates revenue through its Foundry Operations (£225.67 million) and Machining Operations (£35.57 million).

Dividend Yield: 7.2%

Castings offers a high dividend yield of 7.22%, placing it in the top 25% of UK dividend payers, yet its sustainability is questionable due to lack of free cash flows. Although dividends are covered by earnings with a payout ratio of 66.1%, they have been volatile and unreliable over the past decade. The stock trades at a significant discount to fair value, but future earnings are expected to decline slightly, affecting potential long-term stability for income-focused investors.

- Unlock comprehensive insights into our analysis of Castings stock in this dividend report.

- The valuation report we've compiled suggests that Castings' current price could be quite moderate.

Make It Happen

- Click here to access our complete index of 67 Top UK Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal