Revenues Tell The Story For GMO internet, Inc. (TSE:4784) As Its Stock Soars 44%

Despite an already strong run, GMO internet, Inc. (TSE:4784) shares have been powering on, with a gain of 44% in the last thirty days. The last 30 days were the cherry on top of the stock's 404% gain in the last year, which is nothing short of spectacular.

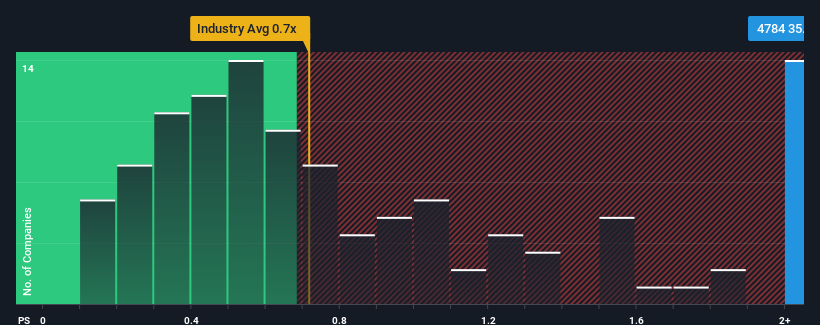

Since its price has surged higher, given around half the companies in Japan's Media industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider GMO internet as a stock to avoid entirely with its 35.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for GMO internet

What Does GMO internet's P/S Mean For Shareholders?

GMO internet hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on GMO internet will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For GMO internet?

The only time you'd be truly comfortable seeing a P/S as steep as GMO internet's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. This means it has also seen a slide in revenue over the longer-term as revenue is down 62% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 496% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 35%, which is noticeably less attractive.

With this information, we can see why GMO internet is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From GMO internet's P/S?

GMO internet's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of GMO internet's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for GMO internet that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal