Deutsche Bank (DB.US) welcomes a critical year: CEO renews for five years, and the executive team changes blood

The Zhitong Finance App learned that Deutsche Bank (DB.US) announced major management adjustments on Thursday evening: CEO Christian Sewing has been re-elected, while the vice president and another executive are leaving office soon. The move marks the completion of the leadership structure of Germany's largest bank in a critical phase of transformation.

In a critical year for the bank to achieve a series of ambitious goals, this personnel change will affect its global strategic layout and is expected to put an end to recent legal setbacks.

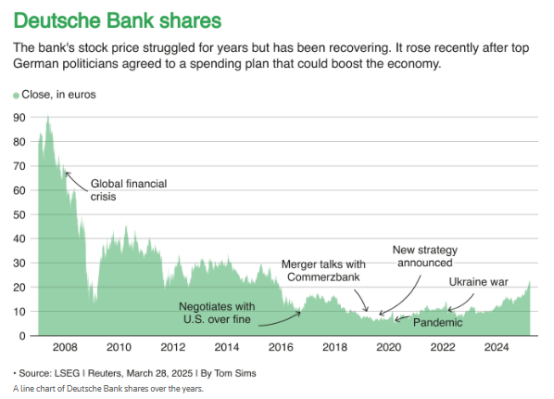

Sewing joined Deutsche Bank in the 1980s when he was a teenager, and in 2018, he was ordered to take charge of this financial institution after years of turmoil and huge losses. During his tenure, he led failed merger and acquisition negotiations with Commerzbank, driving strategic transformation, and ultimately led the bank to achieve continuous profits despite the twists and turns — despite the weak growth trend.

“The opportunities ahead of us are limitless,” Sewing wrote on LinkedIn. “The core of this new phase of development is to seize these opportunities.”

Sewing's new term as CEO will be his third term, which will last until April 2029. According to reports, Sewing has begun to adjust its strategic direction after 2026, which may include closing some of its businesses. “Anything is possible,” he emphasized.

The Frankfurt-based bank also announced that Deputy Governor James von Moltke, who has been the chief financial officer since 2017, will leave office after his term expires next year. The position will be taken over by Morgan Stanley Deputy Chief Financial Officer Raja Akram.

Stefan Simon, board member and head of the legal department for the Americas, resigned due to personal reasons. According to the bank's annual report, last year, its short-term incentive target achievement rate was only 60%, significantly lower than Sewing's 103% and von Moltke's 98%.

Last year, a sudden legal dispute with Postbank, a subsidiary of Deutsche Bank, caused quarterly losses, breaking the continuous profit record. Deutsche Bank said Sewing thanked Simon for his contributions, and the latter mentioned on LinkedIn that he was proud of the bank's momentum, but he did not respond to a request for comment on his departure. Investment bank head Fabrizio Campelli will succeed Simon in managing the American business from May.

Since Sewing took office, Deutsche Bank's stock price has doubled cumulatively, outperforming the European Stoxx 600 Bank Index, which rose 50% during the same period.

But as Sewing strives to meet its ambitious profit and cost targets, some analysts remain skeptical about the bank's ability to meet all of its goals.

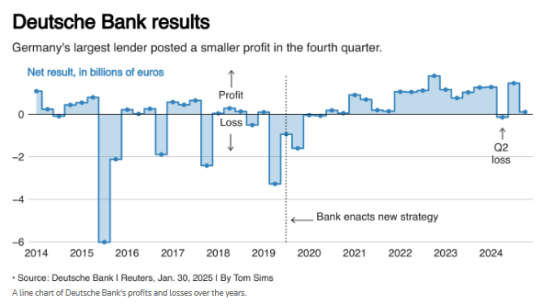

In January, Deutsche Bank reported that its fourth-quarter and full-year profit declined more than expected, and a key cost target was also abandoned as legal provisions and restructuring costs eroded investment banking business profits.

Despite this, Royal Bank of Canada analysts said in a report to clients on March 24 that the German government's move to ease spending restrictions is beneficial to Deutsche Bank and the country's economy.

Board changes were overseen by bank chairman Alexander Wynaendts at a virtual board meeting on Thursday. According to a person with direct knowledge of the situation, there will also be personnel changes in the Bank Supervisory Board, and Theodor Weimer and Dagmar Valcarcel will not seek re-election.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal