BlackRock is betting on outcome-oriented ETFs and expects assets to reach $650 billion in 2030

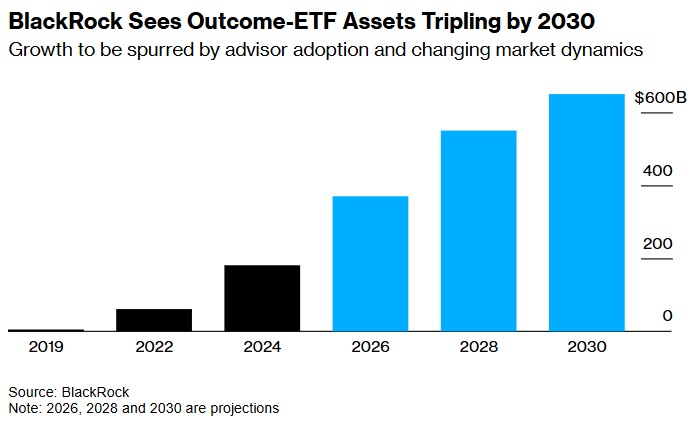

The Zhitong Finance App learned that BlackRock, the world's largest asset management company, is betting on a quiet revolution — derivative-driven “Outcome ETFs (Outcome ETFs)” are encroaching on traditional portfolio management territory at an alarming rate. According to the latest white paper, the asset size of this type of ETF, which achieves its intended investment goals through complex financial instruments, will triple to reach 650 billion US dollars by 2030. The core driving force comes from the popularization of financial advisors and changes in population structure.

So-called outcome-oriented ETFs essentially encapsulate derivatives strategies into standardized products, which can not only limit market losses (buffer strategies), but also generate profits (revenue strategies) in volatile markets, and even double profits (acceleration strategies). This innovative tool just helped the overall scale of actively managed ETFs break through the $1 trillion mark this week, marking Wall Street's official entry into the era of “regular investment” democratization.

In response, after in-depth analysis of more than 20,000 advisory models, BlackRock found that currently only 10% of practitioners include such ETFs in their asset allocation toolbox. However, as market recognition increases and similar strategic funds continue to expand, this ratio is expected to usher in a significant breakthrough.

Notably, BlackRock has pioneered the deep-implantation of its two revenue strategy ETFs — iShares Advantage Large Cap Income ETF (BALI.US) (enhanced earnings for large cap stocks) and iShares High Yield Corporate Bond Buywrite Strategy ETF (HYGW.US) (corporate bond buy-write strategy) — into its revenue-oriented model portfolio, showing a forward-looking strategy in this field. According to reports, the “buy-write strategy” is an innovative strategy that combines bond investment with options trading.

Bob Hum, head of the US Factors and Results ETF, said bluntly: “The real breakthrough is that ETFs make complex strategies within reach.” This ratio is expected to rise rapidly as more similar products pour into model portfolios.

According to information, since the US eased restrictions on the issuance of derivatives funds in 2019, the sector has shown a blowout trend. According to the data, 54% of the ETFs newly listed in February this year included derivatives strategies. According to an ETF survey by Brown Brothers Harriman, buffer products are particularly favored by installers, and about 30% of respondents plan to increase their holdings next year.

BlackRock already has 12 similar products with assets under management of about $2.5 billion, but the growth rate is even more astonishing — the sector's growth rate reached 58% in 2024, ranking first among all segments.

However, as derivatives ETFs became popular, there were more and more questions. Quantification giant AQR's research directly points to the pain points of buffer strategies: compared to simply holding the underlying asset, this type of strategy showed distorted characteristics of “low risk, low return, high risk and high return” in backtesting.

In response, Hum emphasized the need for the industry to establish more clear product application standards: “We must clearly tell customers what scenarios to use and when to avoid them.”

This derivative-driven ETF revolution is reshaping the underlying logic of investment management. The “art” and “science” dispute on Wall Street may usher in a new turning point when complex strategies break out of institutions and become standardized products that can be traded by the public.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal