3 Promising Asian Penny Stocks With Market Caps Up To US$400M

As global markets navigate a landscape of economic uncertainties, the Asian market continues to capture investor interest with its diverse opportunities. Penny stocks, a term that may seem outdated but still relevant, represent smaller or newer companies that can offer significant growth potential at lower price points. By focusing on those with strong financials and solid fundamentals, investors can uncover promising opportunities in this underappreciated segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.44 | THB2B | ✅ 4 ⚠️ 5 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.80 | THB1.77B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ✅ 4 ⚠️ 3 View Analysis > |

| Hong Leong Asia (SGX:H22) | SGD1.08 | SGD807.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.40 | SGD9.48B | ✅ 5 ⚠️ 0 View Analysis > |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.03 | HK$4.23B | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.93 | HK$45.04B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.28 | HK$807.62M | ✅ 3 ⚠️ 1 View Analysis > |

| China Zheshang Bank (SEHK:2016) | HK$2.58 | HK$83.42B | ✅ 4 ⚠️ 1 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.04 | CN¥3.52B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,168 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lung Kee Group Holdings (SEHK:255)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lung Kee Group Holdings Limited is an investment holding company that manufactures and markets mold bases and related products in China and internationally, with a market cap of HK$934.88 million.

Operations: The company generates revenue of HK$1.55 billion from its Metal Processors and Fabrication segment.

Market Cap: HK$934.88M

Lung Kee Group Holdings Limited, with a market cap of HK$934.88 million, reported revenue of HK$1.55 billion for 2024 but remains unprofitable with a net loss of HK$13.67 million, though this is an improvement from the previous year's loss. The company is debt-free and has stable short-term assets exceeding liabilities by a significant margin. Recent announcements include increased dividends and a special dividend, reflecting shareholder returns despite ongoing losses. Board changes have occurred with Ms. He Lamei taking over as chairman of the Nomination Committee following Mr. Lee Joo Hai's resignation after two decades on the board.

- Get an in-depth perspective on Lung Kee Group Holdings' performance by reading our balance sheet health report here.

- Gain insights into Lung Kee Group Holdings' past trends and performance with our report on the company's historical track record.

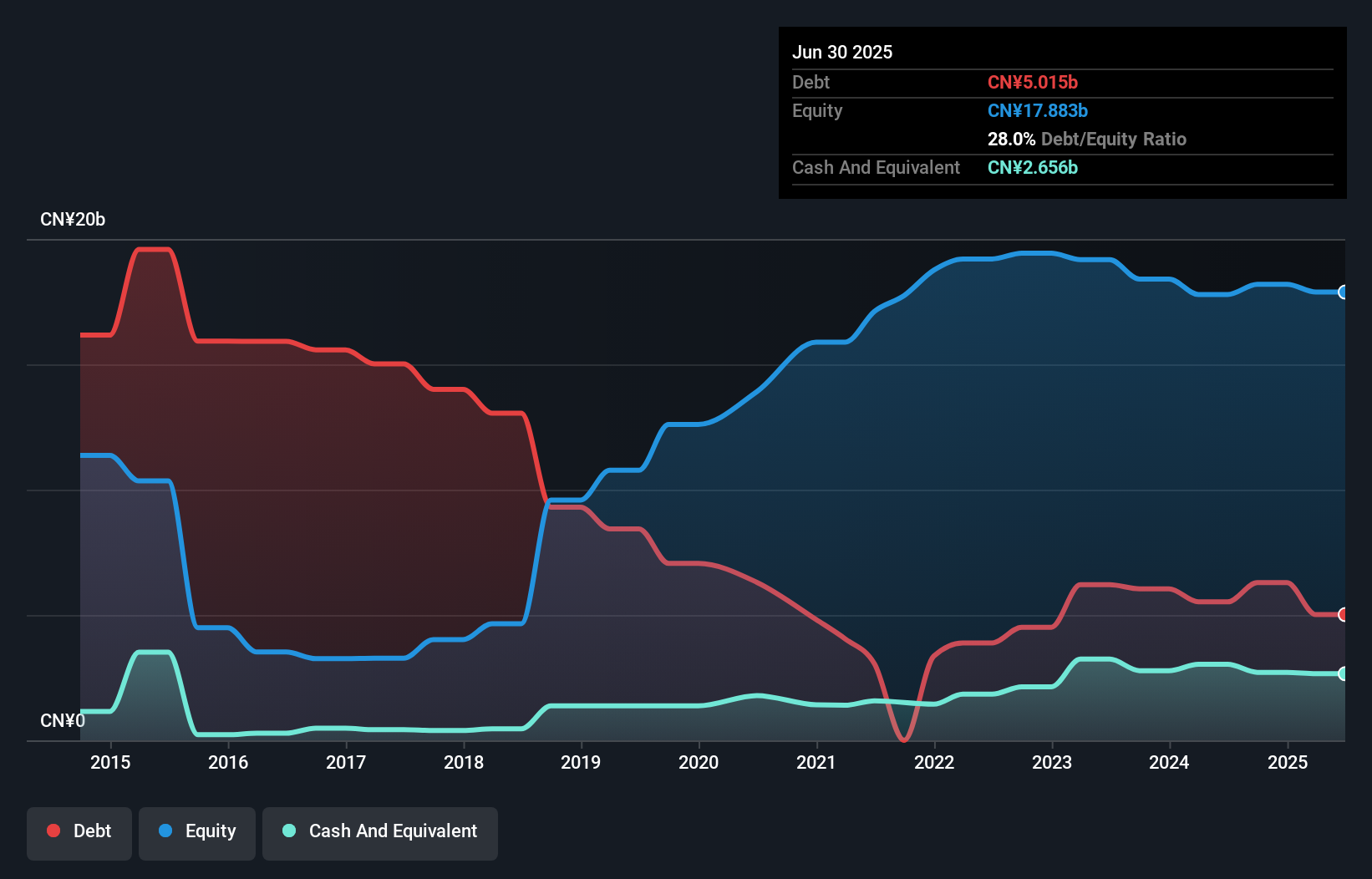

China Shanshui Cement Group (SEHK:691)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Shanshui Cement Group Limited is an investment holding company involved in the manufacture and sale of cement, clinker, concrete, and related products and services in China, with a market cap of HK$2.31 billion.

Operations: The company's revenue is primarily derived from the manufacturing and trading of cement, clinker, and concrete, totaling CN¥14.51 billion.

Market Cap: HK$2.31B

China Shanshui Cement Group Limited, with a market cap of HK$2.31 billion, reported revenue of CN¥14.51 billion for 2024 but remains unprofitable with a net loss of CN¥140.61 million, an improvement from the previous year's larger loss. The company maintains a satisfactory net debt to equity ratio at 14.7% and has well-covered interest payments by EBIT at 7.9 times coverage; however, short-term liabilities exceed short-term assets by CN¥1.2 billion, indicating liquidity concerns. Recent proposals to amend the company's articles aim to establish an employee bonus policy and implement housekeeping changes pending shareholder approval in May 2025.

- Unlock comprehensive insights into our analysis of China Shanshui Cement Group stock in this financial health report.

- Understand China Shanshui Cement Group's track record by examining our performance history report.

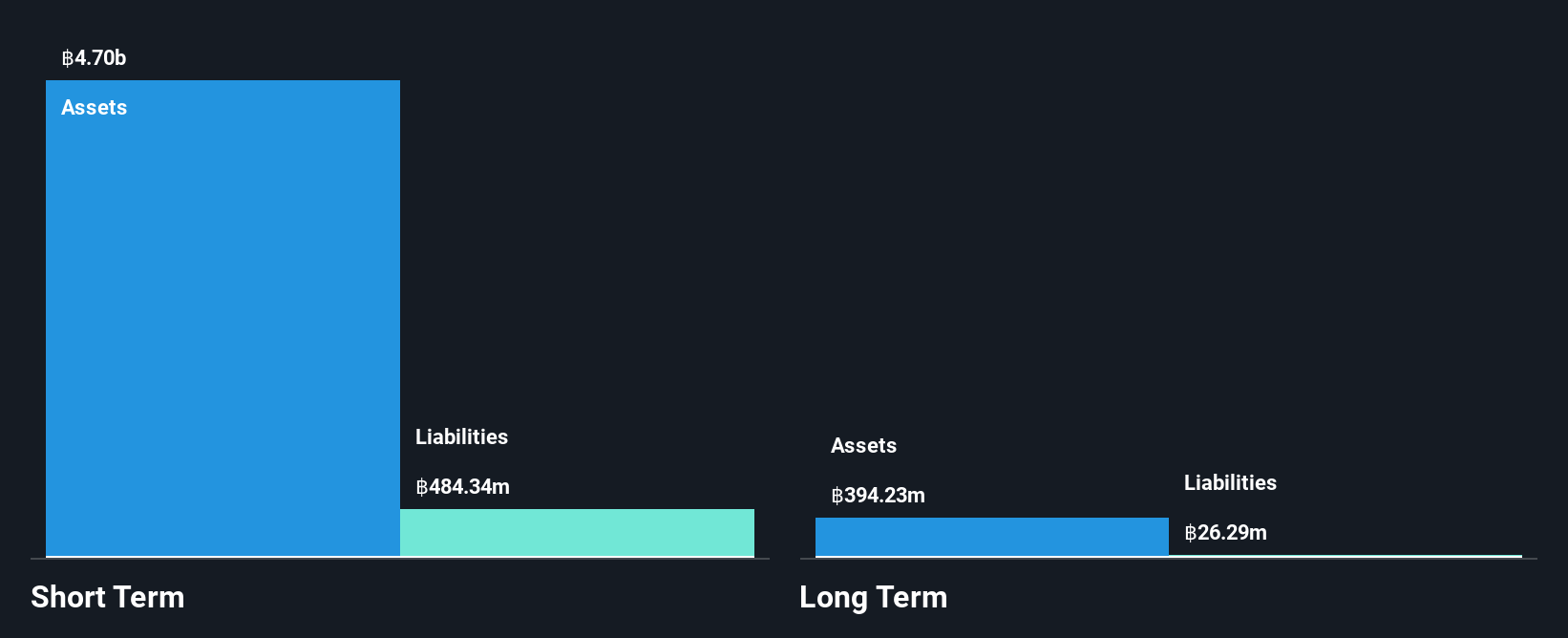

PSG Corporation (SET:PSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PSG Corporation Public Company Limited, along with its subsidiary, operates in turnkey engineering, procurement, and construction (EPC) and large-scale construction projects in Thailand and the Lao People’s Democratic Republic, with a market cap of THB11.70 billion.

Operations: The company's revenue is primarily derived from its plant and building construction segment, totaling THB3.56 billion.

Market Cap: THB11.7B

PSG Corporation, with a market cap of THB11.70 billion, operates debt-free and has shown consistent earnings growth over the past five years at 72.4% annually. Despite recent volatility in its share price, the company maintains a high Return on Equity of 32% and covers both short-term and long-term liabilities comfortably with assets totaling THB4.5 billion against minimal liabilities. The Price-To-Earnings ratio stands attractively lower than the Thai market average at 8.1x compared to 12.2x, suggesting potential value for investors seeking opportunities in penny stocks within Asia's construction sector amidst ongoing strategic financial adjustments like reverse stock splits.

- Navigate through the intricacies of PSG Corporation with our comprehensive balance sheet health report here.

- Evaluate PSG Corporation's historical performance by accessing our past performance report.

Next Steps

- Access the full spectrum of 1,168 Asian Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal