Asian Penny Stocks: 3 Picks With Market Caps Under US$300M

As global markets navigate a landscape of economic uncertainty and mixed data, investor interest in smaller-cap opportunities continues to grow. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. These typically smaller or newer companies can offer significant growth potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.41 | THB1.96B | ✅ 4 ⚠️ 5 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.82 | THB1.78B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ✅ 4 ⚠️ 3 View Analysis > |

| Hong Leong Asia (SGX:H22) | SGD1.02 | SGD763.04M | ✅ 3 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.47 | SGD9.76B | ✅ 5 ⚠️ 0 View Analysis > |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.08 | HK$4.3B | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.99 | HK$45.73B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 3 ⚠️ 1 View Analysis > |

| China Zheshang Bank (SEHK:2016) | HK$2.57 | HK$82.89B | ✅ 4 ⚠️ 1 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.10 | CN¥3.59B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,167 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Kintor Pharmaceutical (SEHK:9939)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kintor Pharmaceutical Limited is a clinical-stage biotechnology company focused on researching, developing, and commercializing therapeutic drugs for dermatology and tumor indications in China, with a market cap of HK$744.70 million.

Operations: Kintor Pharmaceutical Limited has not reported any specific revenue segments.

Market Cap: HK$744.7M

Kintor Pharmaceutical, a clinical-stage biotech firm, is currently pre-revenue with less than US$1 million in revenue. Despite this, it has made significant strides with its KX-826 tincture for androgenetic alopecia, achieving promising phase III trial results indicating strong safety and efficacy. The company recently entered a strategic partnership with Hangzhou ToMax Co. Ltd., aiming to expand its market presence overseas through cosmetics sales. Financially, Kintor has more cash than debt but faces high volatility and limited cash runway if current trends continue. Its board is experienced but the company remains unprofitable with declining earnings over five years.

- Jump into the full analysis health report here for a deeper understanding of Kintor Pharmaceutical.

- Review our historical performance report to gain insights into Kintor Pharmaceutical's track record.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering services such as stockbroking, futures broking, structured lending, investment trading, margin financing, and research across Singapore, Hong Kong, Thailand, Malaysia and internationally with a market cap of SGD1.71 billion.

Operations: The company's revenue primarily comes from securities and futures broking and other related services, amounting to SGD631.69 million.

Market Cap: SGD1.71B

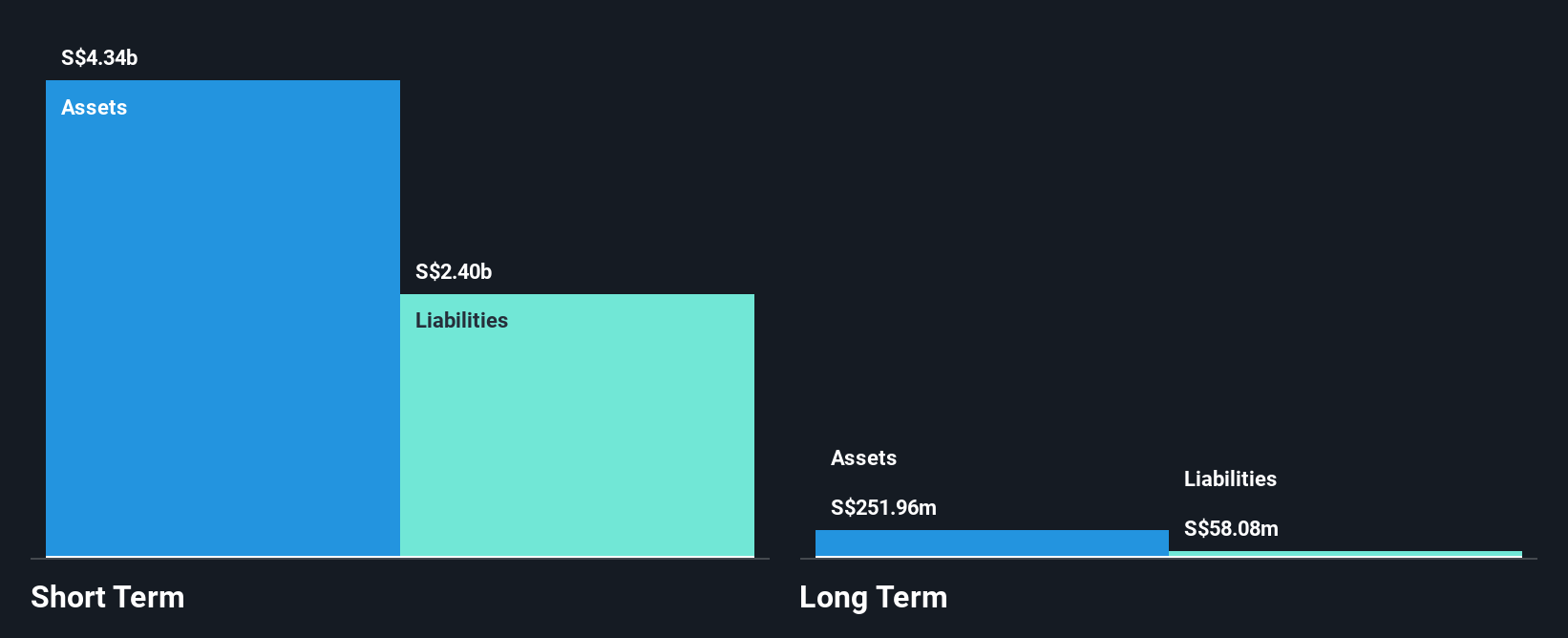

UOB-Kay Hian Holdings Limited's recent earnings report showed a net income increase to SGD224.22 million from SGD170.36 million the previous year, with basic earnings per share rising to SGD0.2442. The company declared an annual dividend of SGD0.1190 per share, reflecting its commitment to shareholder returns despite dividends not being well covered by free cash flows. UOB-Kay Hian has reduced its debt-to-equity ratio over five years and maintains more cash than total debt, though operating cash flow remains negative, indicating potential liquidity concerns. Recent board committee appointments suggest strategic governance adjustments amid management team changes.

- Click here to discover the nuances of UOB-Kay Hian Holdings with our detailed analytical financial health report.

- Gain insights into UOB-Kay Hian Holdings' historical outcomes by reviewing our past performance report.

Jiangsu Fasten (SZSE:000890)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Fasten Company Limited, with a market cap of CN¥1.75 billion, produces and sells steel wires and wire ropes both in China and internationally through its subsidiaries.

Operations: The company does not report specific revenue segments.

Market Cap: CN¥1.75B

Jiangsu Fasten Company Limited, with a market cap of CN¥1.75 billion, remains unprofitable but has made strides in reducing its debt-to-equity ratio from 986.9% to 459.4% over five years. Despite a high net debt to equity ratio of 419.2%, the company maintains a positive cash runway for more than three years due to stable free cash flow levels. However, short-term assets of CN¥545.2 million fall short of covering short-term liabilities totaling CN¥958.7 million, indicating potential liquidity challenges despite not diluting shareholders recently and having an experienced board with an average tenure of 4.8 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Fasten.

- Gain insights into Jiangsu Fasten's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Dive into all 1,167 of the Asian Penny Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal