Asian Dividend Stocks To Consider In March 2025

As global markets navigate heightened uncertainty, with central banks holding rates steady amidst mixed economic data, Asian markets have shown varied performances. In this environment, dividend stocks in Asia present a compelling option for investors seeking income stability and potential growth.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.83% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.05% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.75% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.17% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.96% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.76% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.73% | ★★★★★★ |

Click here to see the full list of 1129 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Kasikornbank (SET:KBANK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kasikornbank Public Company Limited, along with its subsidiaries, offers commercial banking products and services both in Thailand and internationally, with a market cap of THB388.57 billion.

Operations: Kasikornbank's revenue segments include Retail Business at THB71.38 billion, Corporate Business at THB85.94 billion, Muang Thai Group Holding Business contributing THB12.55 billion, and Treasury and Capital Markets Business and World Business Group generating THB30.63 billion.

Dividend Yield: 5.8%

Kasikornbank's dividend strategy reflects both opportunities and challenges for investors. The bank's dividend payments have been volatile over the past decade, yet recent announcements indicate a significant payout increase, including a special dividend of THB 2.50 per share. Despite a high level of non-performing loans at 3.7%, dividends remain well covered by earnings with a current payout ratio of 47%. Trading below fair value enhances its appeal amidst growing earnings forecasts.

- Click to explore a detailed breakdown of our findings in Kasikornbank's dividend report.

- According our valuation report, there's an indication that Kasikornbank's share price might be on the cheaper side.

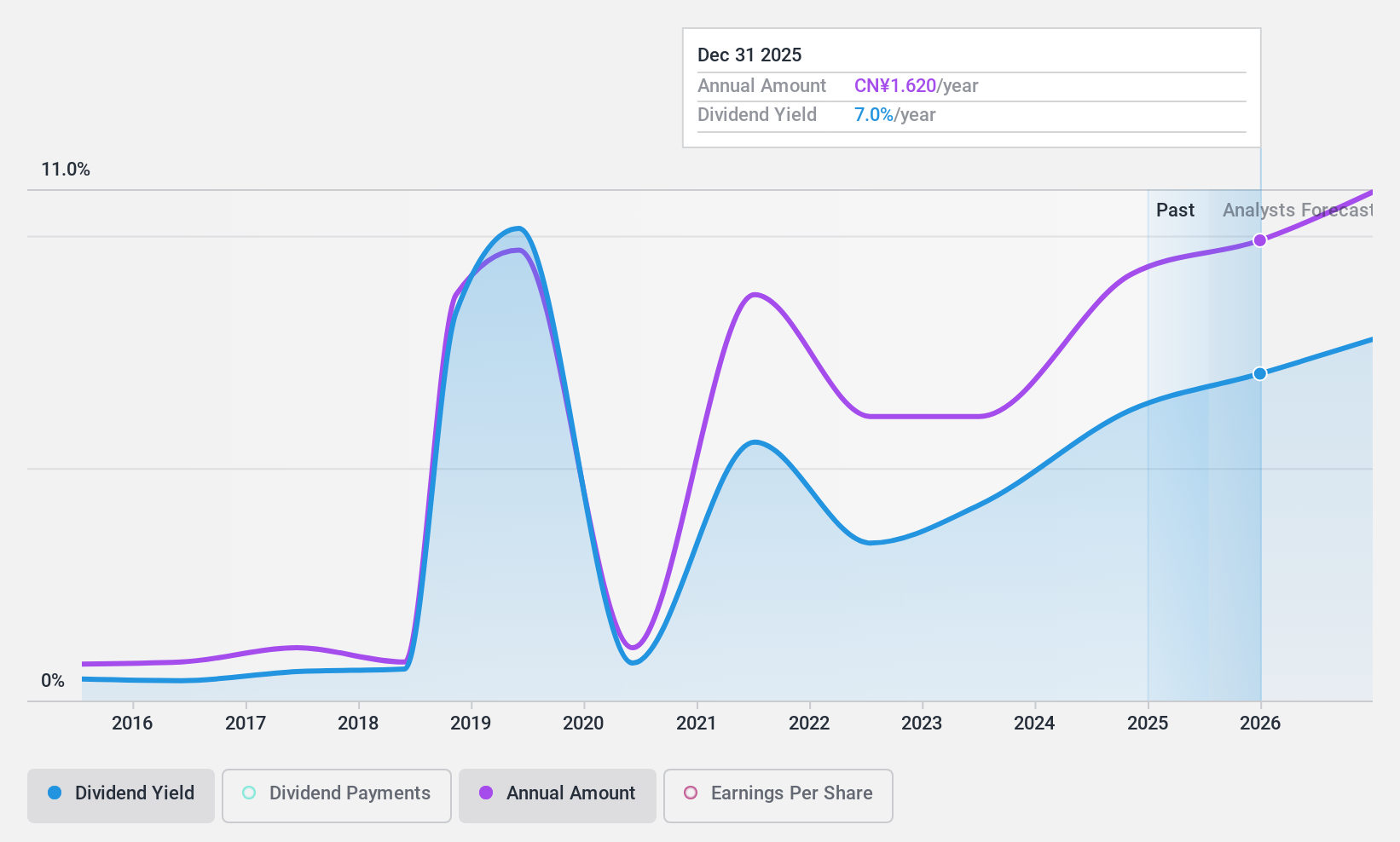

Kingclean ElectricLtd (SHSE:603355)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kingclean Electric Co., Ltd is a Chinese company that manufactures and sells home appliances, kitchen appliances, and garden tools under the KingClean brand, with a market capitalization of CN¥16.52 billion.

Operations: Kingclean Electric Co., Ltd generates its revenue primarily from the Appliance & Tool segment, amounting to CN¥9.57 billion.

Dividend Yield: 5.2%

Kingclean Electric Ltd's dividend yield of 5.21% ranks in the top 25% of Chinese dividend payers, yet it faces sustainability challenges with a cash payout ratio of 114.8%, indicating dividends are not well covered by cash flows. Despite trading at a favorable P/E ratio of 14.2x compared to the broader market, its dividends have been volatile and unreliable over the past decade, though earnings have shown recent growth.

- Navigate through the intricacies of Kingclean ElectricLtd with our comprehensive dividend report here.

- Our expertly prepared valuation report Kingclean ElectricLtd implies its share price may be lower than expected.

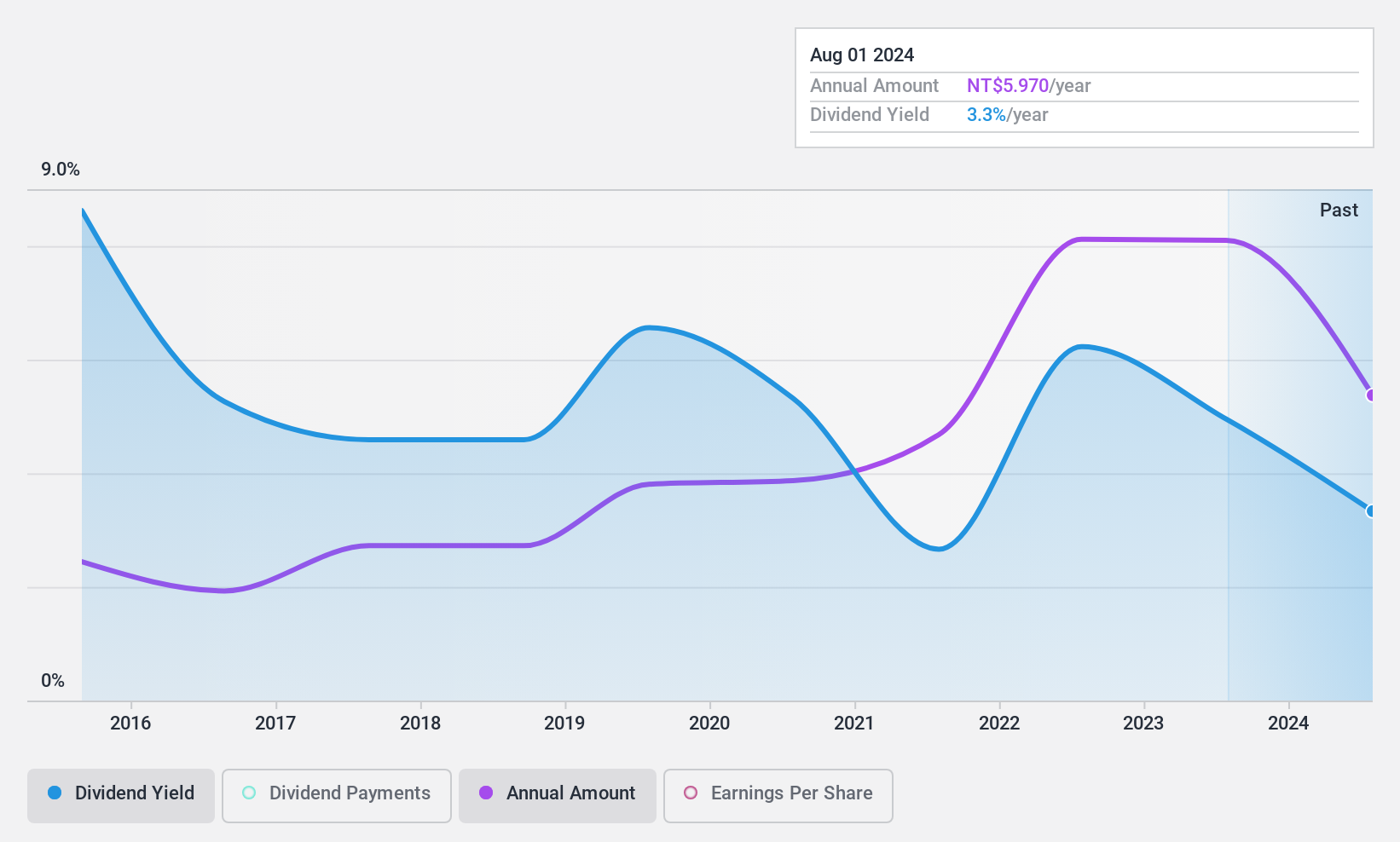

Anpec Electronics (TPEX:6138)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anpec Electronics Corporation designs, tests, produces, and markets mixed-signal power chips and sensors in Taiwan and internationally, with a market cap of approximately NT$13.95 billion.

Operations: Anpec Electronics Corporation generates its revenue primarily from the semiconductors segment, which accounts for NT$6.09 billion.

Dividend Yield: 4.2%

Anpec Electronics announced a total cash dividend of TWD 8.60 per share for 2024, supported by an earnings payout ratio of 80.9% and a cash payout ratio of 55.5%, indicating coverage by both earnings and cash flows. Despite a recent increase in net income to TWD 720.09 million, its dividend yield of 4.23% remains below the top quartile in Taiwan, and historical volatility suggests potential instability in future payments.

- Delve into the full analysis dividend report here for a deeper understanding of Anpec Electronics.

- Upon reviewing our latest valuation report, Anpec Electronics' share price might be too pessimistic.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1126 Top Asian Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal