The aura of “American exceptionalism” has faded away! US stocks and the US dollar all fell out of favor

The Zhitong Finance App learned that at a time when the aura of “American exceptionalism” is gradually fading, the US stock market is lagging behind the world. Just a few weeks ago, investors were still cheering for Trump's return to the White House, betting that his tax cuts and tariff policies would stimulate economic growth, thereby boosting US stocks and the US dollar. This is also the so-called “Trump deal.” But now, this optimism is rapidly deteriorating due to intermittent trade wars, large-scale cuts in the number of government employees and government spending by the Ministry of Government Efficiency under Musk, and a series of data showing that the economy is weakening.

Investors are also turning their attention away from US stocks to other markets. Germany's plan to increase spending on a large scale announced last week is seen as a major change in European policy formulation, boosting the yield on the Eurozone stock market, foreign exchange market, and government bonds. Furthermore, the emergence of Chinese artificial intelligence startup DeepSeek has raised questions about America's dominance in the field of technology.

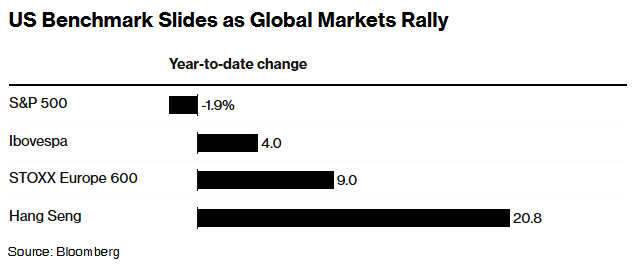

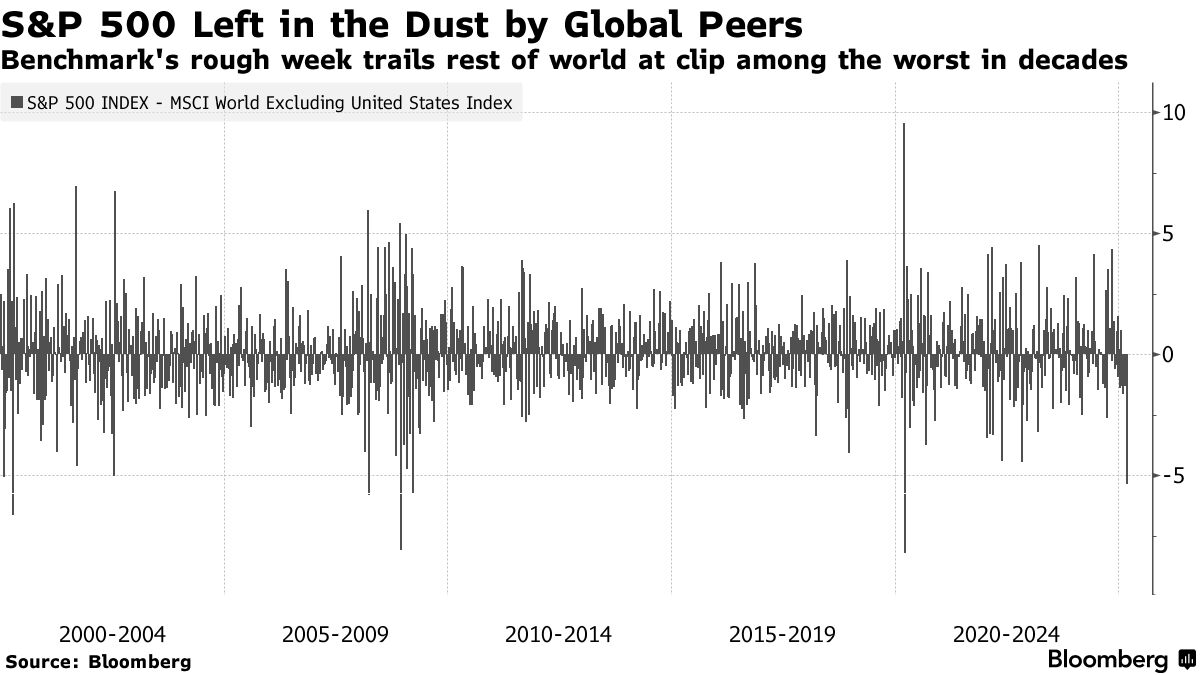

Taken together, the aura that has dominated the US economy and market exceptionalism for more than a decade seems to be faltering. The once unstoppable S&P 500 experienced its worst performance compared to the rest of the world's stock markets in the last week in less than a month to reach a new all-time high. The share of US stocks in global stock market capitalization has also declined since peaking at more than 50% at the beginning of this year.

So far this year, the so-called “Big Seven US stocks” have fallen 11% in total. Driven by this, the performance of US stocks lags behind the Chinese stock market and the European stock market. The disappointing performance of some key US companies has dampened investors' enthusiasm for some of last year's “big winners.” Daniel Skelly, head of Morgan Stanley's wealth management market research and strategy team, said that these factors are unlikely to permanently remove the US from the position of the world's largest and strongest stock market, but he said that the current transformation may still have room to continue, and “this rotation may continue for the next 6 or even 12 months.”

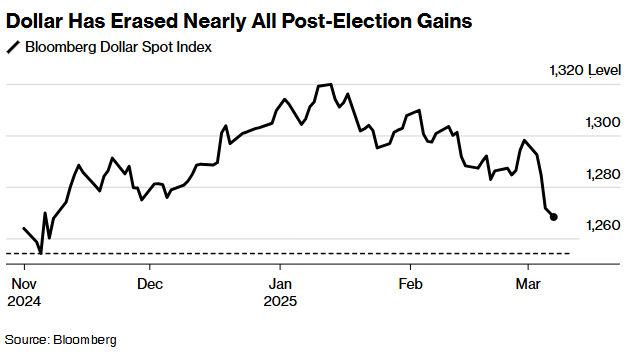

Meanwhile, the US dollar began to weaken after its best quarter since 2016. Currently, the US dollar index is down nearly 4% from the peak reached in January this year, the lowest level since the beginning of November last year. Most of this decline occurred last week, and the bearish voice about the US dollar is getting louder.

The trend of the euro is an important factor driving the weakening of the US dollar. The euro rose nearly 5% last week, the best weekly performance since 2009, in anticipation that Germany and the EU plan to increase defense and infrastructure spending would boost the Eurozone economy. Deutsche Bank and J.P. Morgan said that the EU's commitment to implementing deep and lasting fiscal stimulus could further boost the euro. The derivatives market illustrates the huge swings in market sentiment. Demand to hedge against the dollar's rise is shrinking, and options traders' bullishness about the euro is close to the highest level in more than four years.

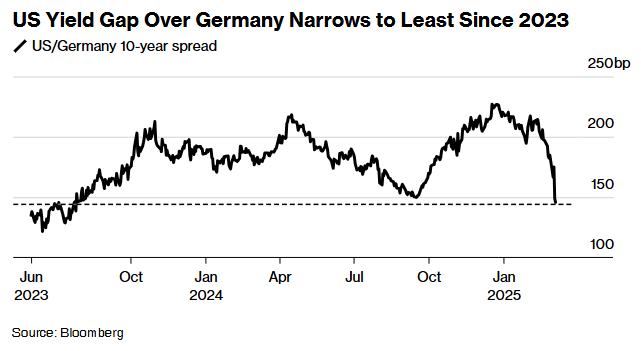

Furthermore, US bond yields fell sharply as investors bet that the weakening outlook for the US economy would require the Federal Reserve to cut interest rates to provide more support. However, as investors expect that the German government's easing of the “debt brake” will lead to a significant increase in government borrowing, the yield on German government bonds has risen sharply. This led to an abrupt reduction in the US long-term bond yield premium on Germany to its lowest level since 2023, and could weaken the relative appeal of US Treasury bonds.

Considering the uncertainty of Europe's economic growth and inflation prospects, investors still have some doubts about whether German treasury bond yields can continue to rise sharply. But for now, this highlights the different trajectories of the two markets. For international investors, they also need to consider volatility when evaluating whether to invest in US bonds. Monica Defend, head of the Amundi Investment Institute, said that holding long-term US bonds “is usually a safe haven,” but “now it's a tactical transaction because US bonds are too volatile.” In her opinion, gold and yen provide investors with a better safe haven.

Peter Tchir, head of macro strategy at Academy Securities, said: “This is the first time you have a compelling reason to invest outside of the US market. Previously, capital flowed into the US without much consideration, but this may be reversing, or at least changing.”

Most importantly, the US economy has gone from being seemingly unshakable to a source of concern. The US non-farm payrolls data for February released last Friday were mixed, but J.P. Morgan economists said in a report to customers after the February non-farm payroll data was released that they thought “due to the extreme policies of the US government” the possibility of a recession this year is 40%. US Treasury Secretary Bessent warned that as the US government shifts the basis of economic growth to the private sector, this will be a “detox period.”

Although market sentiment may change rapidly — after all, it only took about three weeks for the S&P 500 index to return to its all-time high after being hit hard by the DeepSeek shock at the end of January this year, as long as investors continue to deal with policy crackdowns from the White House and uncertainty surrounding America's dominance in technology, they have more and more reasons to look beyond the US. Troy Gayeski, chief market strategist at FS Investments, said, “American exceptionalism will continue to exist, but it will definitely be hit hard.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal