Marvell Technology (NasdaqGS:MRVL) Shares Fall 23% Despite Positive Q4 Earnings Turnaround

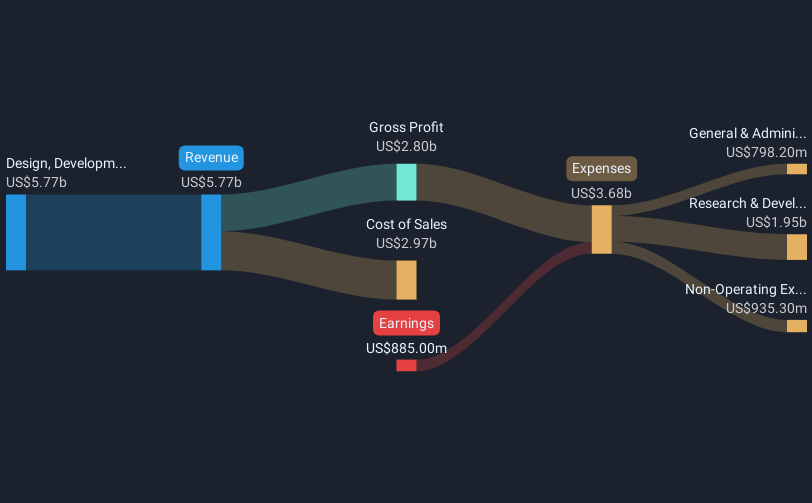

Marvell Technology (NasdaqGS:MRVL) recently revealed a significant increase in sales and a shift from a net loss to income in its Q4 earnings report. Despite announcing innovations in 2nm silicon aimed at AI and cloud solutions, the company's stock plunged 23% over the last week. Factors contributing to this drop could include investor reactions to the broader market trends, as major indices like the Nasdaq and S&P 500 experienced notable declines during the week, reflecting investor concerns about the overall economic environment. Additionally, even with modest guidance for the upcoming quarter, expectations for Marvell's future performance may not have been sufficient to counteract existing market pessimism. The broader semiconductor sector, despite Broadcom's strong earnings and market rally, faced a challenging week, and Marvell's stock mirrored these adversities despite its positive outlook on AI-driven growth.

Get an in-depth perspective on Marvell Technology's performance by reading our analysis here.

The last five years have witnessed Marvell Technology's shares growing impressively with a total return, including share price and dividends, of 249.11%. This significant growth contrasts with its underperformance against the US Market and the Semiconductor industry over the past year. A series of product-related announcements illustrates the company's focus on innovation, evident from the launch of its first 2nm silicon IP for AI and cloud infrastructure, targeting 25% market share in accelerated compute by 2028. Moreover, their collaboration with AWS, revealed in December 2024, highlights its strategic push towards AI advancements.

In addition to product expansions, Marvell Technology has shown robust financial management through share repurchases and dividends, returning substantial value to its shareholders. As of December 2024, the company executed a significant share buyback of 73.76 million shares, representing 12.61% of its total share count. A quarterly dividend of US$0.06 per share, announced in December 2024, further indicates its commitment to rewarding long-term investors.

- Analyze Marvell Technology's fair value against its market price in our detailed valuation report—access it here.

- Explore the potential challenges for Marvell Technology in our thorough risk analysis report.

- Is Marvell Technology part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal