Asian Market Insights: Jacobio Pharmaceuticals Group Among 3 Promising Penny Stocks

As global markets grapple with economic uncertainties, including policy risks and inflation concerns, investors are increasingly looking toward Asia for opportunities. Penny stocks, though often considered niche investments, can offer significant growth potential when backed by strong financials. In this article, we explore three promising penny stocks in Asia that combine financial strength with the potential for long-term success.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.40 | SGD9.48B | ★★★★★☆ |

| Bosideng International Holdings (SEHK:3998) | HK$3.86 | HK$44.24B | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.87 | HK$647.93M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.31 | HK$831.57M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.22 | THB2.53B | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.475 | SGD452.86M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.03 | CN¥3.51B | ★★★★★★ |

| Playmates Toys (SEHK:869) | HK$0.61 | HK$719.8M | ★★★★★★ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.16 | HK$4.42B | ★★★★★★ |

| China Zheshang Bank (SEHK:2016) | HK$2.38 | HK$80.36B | ★★★★★★ |

Click here to see the full list of 1,163 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Jacobio Pharmaceuticals Group (SEHK:1167)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jacobio Pharmaceuticals Group Co., Ltd. is an investment holding company focused on the in-house discovery and development of oncology therapies, with a market cap of HK$2.29 billion.

Operations: Jacobio Pharmaceuticals Group Co., Ltd. has not reported any revenue segments.

Market Cap: HK$2.29B

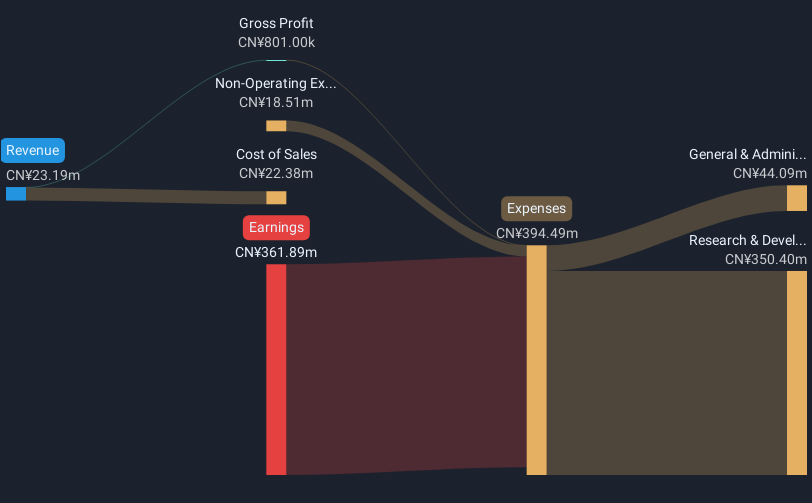

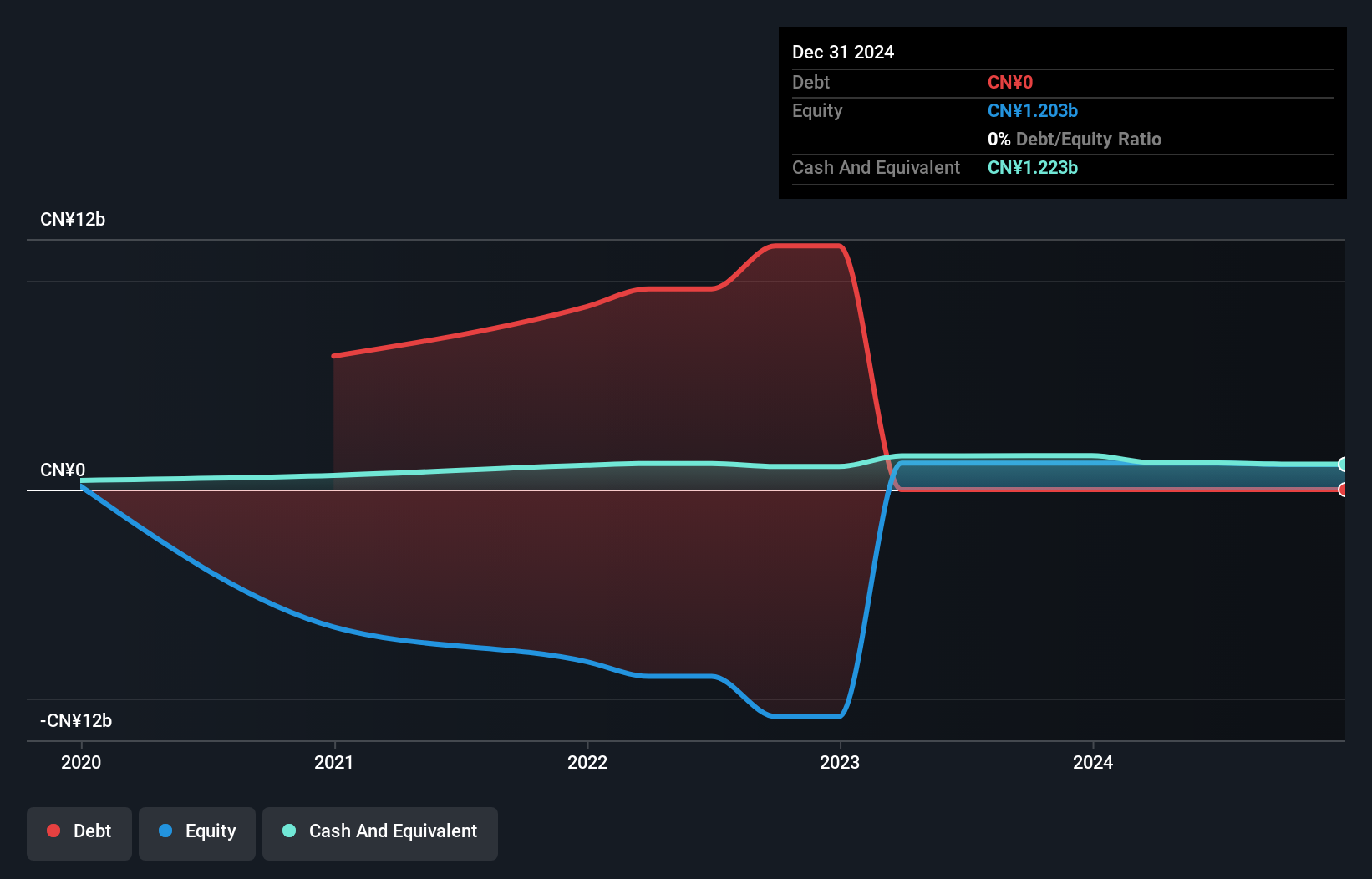

Jacobio Pharmaceuticals Group, with a market cap of HK$2.29 billion, is pre-revenue and focuses on oncology therapies. Recent announcements highlight promising data from its KRAS G12C inhibitor glecirasib and BET inhibitor JAB-8263, both showing potential in clinical trials. The company has a strong cash position with short-term assets of CN¥1.1 billion exceeding liabilities and sufficient cash runway for over three years based on current free cash flow trends. Despite high volatility and unprofitability, Jacobio has reduced losses at 28.7% annually over five years, indicating progress in financial stability without significant shareholder dilution recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Jacobio Pharmaceuticals Group.

- Gain insights into Jacobio Pharmaceuticals Group's future direction by reviewing our growth report.

Fenbi (SEHK:2469)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fenbi Ltd. is an investment holding company that offers non-formal vocational education and training services in the People's Republic of China, with a market cap of HK$6.23 billion.

Operations: The company's revenue is primarily derived from tutoring services, generating CN¥2.47 billion, and sales of books, contributing CN¥648.46 million.

Market Cap: HK$6.23B

Fenbi Ltd., with a market cap of HK$6.23 billion, is generating significant revenue from tutoring services and book sales in China. Despite facing intensified competition, the company expects to maintain profitability with a projected net profit increase due to reduced employee expenses. Fenbi's financial stability is supported by its debt-free status and strong asset position, as short-term assets significantly exceed liabilities. The company's return on equity is high at 30.3%, reflecting efficient use of capital, while trading well below estimated fair value suggests potential undervaluation. Recent board changes indicate ongoing strategic adjustments within the company’s leadership structure.

- Click here to discover the nuances of Fenbi with our detailed analytical financial health report.

- Examine Fenbi's earnings growth report to understand how analysts expect it to perform.

Hong Leong Asia (SGX:H22)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Asia Ltd. is an investment holding company that manufactures and distributes powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and internationally with a market cap of SGD822.89 million.

Operations: The company's revenue is primarily derived from its Powertrain Solutions segment at SGD3.55 billion and Building Materials segment at SGD682.33 million.

Market Cap: SGD822.89M

Hong Leong Asia Ltd., with a market cap of SGD822.89 million, has shown robust revenue growth, reporting sales of SGD4.25 billion for 2024, up from the previous year. The company's earnings grew by 34.5%, supported by its Powertrain Solutions and Building Materials segments. Despite a low return on equity at 6.2%, its debt is well covered by operating cash flow and interest payments are adequately managed with strong EBIT coverage. Recent expansions in China through new subsidiaries indicate strategic growth efforts, while dissolutions of dormant entities streamline operations and focus resources more effectively on core business areas.

- Get an in-depth perspective on Hong Leong Asia's performance by reading our balance sheet health report here.

- Learn about Hong Leong Asia's future growth trajectory here.

Taking Advantage

- Unlock our comprehensive list of 1,163 Asian Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal