Tesla (TSLA.US) believers flock to the bottom: they are flocking to double as long as Tesla's high-leverage ETF

The Zhitong Finance App learned that since becoming DOGE (US Government Efficiency Department) leader, Tesla CEO Elon Musk has drastically reformed and streamlined the federal government structure, causing the US civil service and the Democratic Party and non-MAGA Republican groups to collectively oppose him and DOGE and demand that Trump restrain Musk. In addition, Musk also used his commercial and political influence to interfere in European politics and elections. These factors all caused demonstrations and protests against Tesla's electric cars to break out around the world and refuse to buy them, which eventually led to the stock price of “electric vehicle leader” Tesla (TSLA.US) plummeting by more than 30% during the year.

However, for investors who have continued to be bullish on Tesla's stock price for a long time, a very unexpected trend that can also be said to be an extremely favorable catalyst surfaced: the fanatical fans of Musk and loyal Tesla followers bought 2 times as much as Tesla's high-leverage ETF. This large-scale “fancy bottoming” often means that these Tesla bulls are betting that Tesla's stock price is about to see a huge rebound.

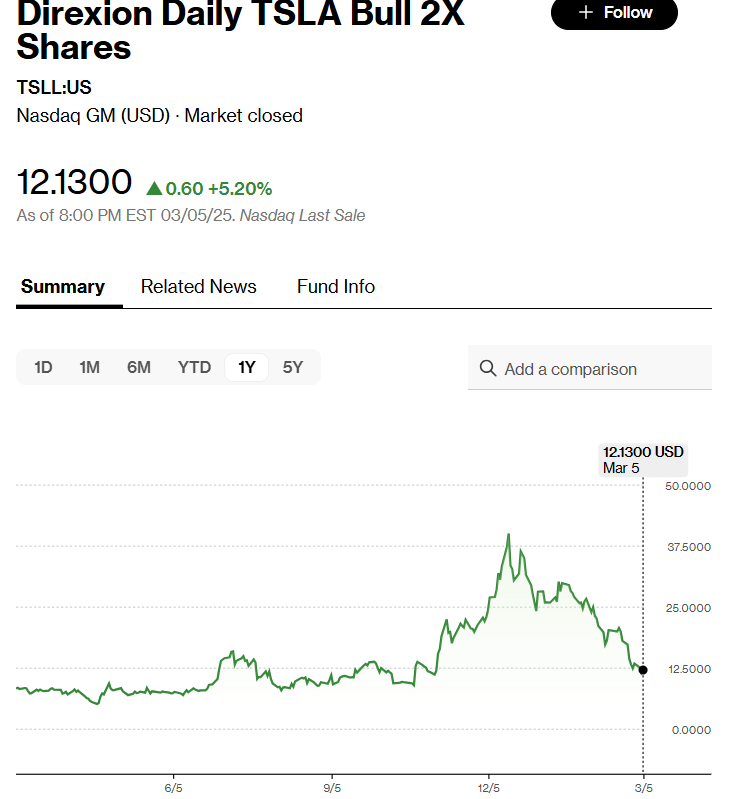

Despite this 2X Tesla leveraged ETF — DireXion Daily TSLA Bull 2X Shares (TSLL.US) — falling 54% during the year, this double Tesla leveraged ETF fund has continued to attract crazy inflows of billions of dollars in recent days, indicating that believers who are extremely bullish on Tesla stock may generally think that the tech giant's current plight is a temporary rather than a structural downside risk.

In the past month, the value of this ETF almost fell short, while Tesla's stock price fell by 28.7% during the same period, highlighting the much more severe decline experienced by leveraged ETFs during the sharp decline in their underlying shares. However, investor capital continues to pour into this leveraged ETF.

According to statistics from etf.com, Direxion Daily TSLA Bull 2X Shares, which aims to provide double the daily investment income of Tesla stock, attracted net capital inflows of up to 1.3 billion US dollars during the past month, attracting a cumulative total of 2 billion US dollars during the year, even though the ETF plummeted 47.1% monthly and nearly 54% during the year.

“When Tesla's stock price pulls back as it is now, we usually see a large inflow of capital from leveraged products (such as TSLL) that are 2 times longer.” Ed Egilinsky, managing director from Direxion, said. “Our leveraged and inverse ETFs are designed for short-term/active high-frequency quantitative trading. Obviously, some traders believe Tesla's stock price is about to bottom out and rise sharply.”

As capital continues to flow in, Tesla's fundamentals are facing multiple headwinds, and the source of these headwinds is basically closely related to the giant's CEO Musk. Recent statistics show that Tesla's global sales have slowed sharply or even declined markedly. Among them, overall deliveries to the European market plummeted 50% year on year in January. In Germany, Tesla's sales plummeted 60% in the same month due to Musk's public intervention in the German election, while overall electric vehicle sales in Germany surged by more than 50%.

Right now, it can be said that the whole of Europe is co-staging an “anti-Tesla storm” with the US, partly because Europeans are dissatisfied with Musk's frequent interference in European politics and Musk's growing influence in the political and business circles. Sales in China are also not optimistic. According to statistics from the China Passenger Vehicle Association, Tesla's sales volume in China, its largest market, fell 49% year-on-year last month.

Short-term high-frequency traders looking for excess profits amidst Tesla's sharp fluctuations

“Due to TSLL's massive inflow of capital last week and massive outflow of TSDD, the data shows that most traders are trying to copy Tesla to obtain excess profits in the short term.” Aniket Ullal, senior vice president of CFRA and head of ETF research and analysis, pointed out. “They probably think Tesla is oversold.”

While TSLL attracted billions of dollars, the reverse ETF — that is, the GraniteShares 2x Short TSLA Daily ETF (TSDD.US), which shorted Tesla by 2 times — experienced a capital outflow of $13.1 million in the past month, even though the ETF surged 69.2% during the same period and 74.2% during the year.

“After Tesla's stock price plummeted by 30%, traders who focus on fast short-term high-frequency operations tend to bet on a TSLL rebound.” Noah Damsky, head of Marina Wealth Advisors, said. “Given the strong market performance over the past decade, investors have formed a habit of betting on a sharp rebound in stock prices after a sharp drop, especially tech giants such as Tesla and Nvidia.”

Electric vehicle leader Tesla is facing increasingly fierce competition from Chinese and European electric vehicle manufacturers, and CEO Musk's series of crazy political actions are alienating some physical electric vehicle customers and stock investors who once preferred Tesla.

“Tesla shares are currently under huge volatility and downward pressure, including weak US consumer spending, tariff uncertainty, increased competition for electric vehicles, and a slowdown in delivery volume growth.” Egilinsky explained. “Investor sentiment dominated by differences about Musk's increasingly controversial image and relationships with current government officials may also affect stock prices.”

Despite the challenges, some market observers still see huge potential for Tesla's fundamentals and valuation recovery. A team of analysts from CFRA believes that the decline in Tesla's stock price mainly reflects known sales difficulties, and these have basically been digested by the market, and the company's tariff exposure is smaller than that of rivals such as traditional American auto giants Ford and General Motors. They also anticipate that the US government's upcoming autonomous driving regulations may be an important catalyst for stock prices.

Tesla's long-term growth prospects are not limited to existing models. Damsky from Marina Wealth Advisors pointed to multiple future growth engines, including “battery energy storage, solar energy systems, and fully driverless taxi (Robotaxi) /fully autonomous driving (FSD) software systems,” and emphasized that these ambitious “futuristic projects” made investors pay more attention to Tesla's future growth potential rather than current difficulties and sales difficulties.

Daimo and Wedbush, which have the title of “Tesla Super Bulls”, insist on being bullish. The latter is even optimistic that Tesla will break $600

Tesla's stock price plummeted nearly 30% in February due to a sharp drop in electric vehicle sales, which further fueled investors' concerns about CEO Musk's involvement in politics. However, Morgan Stanley analyst Adam Jonas, who has been bullish on Tesla's stock price for a long time, reiterated on Monday that as Tesla diversifies into the field of artificial intelligence (AI) and robotics, the company's stock price will rise sharply to $430, emphasizing the subscription revenue brought about by fully driverless FSD and the growth in demand for Tesla models, as well as the Tesla brand's Robotaxi autonomous taxi network spread all over the world, so Tesla's valuation is expected to continue to expand. In contrast, Tesla's stock price is currently hovering around $279.

According to Nvidia CEO Huang Renxun and many other tech leaders, as well as Wall Street fund managers such as “Sister Mu Tou,” the Tesla FSD based on completely unmanned operation may be the most advanced intelligent driving system in the world. However, at present, the biggest hidden danger lies in the FSD in the US and Chinese markets, and the RoboTaxi regulatory review process based on the FSD system. If positive progress is delayed, it may push Tesla's stock price into a bear market trajectory.

Last month, Dan Ives, a senior analyst at Wedbush Securities, another Wall Street investment agency that has supported Tesla for a long time, reiterated his rating of Tesla's “better than the market” and a target price of $500 or more.

Wedbush said that with the Trump administration's progress on future L3 and L4 autonomous driving, and FSD reviews and formal approval processes based on complete unmanned control, which is probably much earlier than during the Biden administration, the agency is becoming more and more confident in delivering “narrative logic” to Tesla's needs in 2025 and beyond. $550 is Wedbush's basic bullish target for Tesla, which means that according to the agency, Tesla's sharp rise to break through the benchmark of $550 in the next 12 months is a probable event. Wedbush's “bull market target stock price” for Tesla, that is, the most optimistic share price for Tesla, has been raised to 650 US dollars.

“We estimate that artificial intelligence and autonomous driving alone could bring Tesla a historic business opportunity of at least $1 trillion, not to mention the larger Tesla Robotaxi network and Optimus Prime robots in the future. We fully expect Tesla's key regulatory progress bars to be rapidly advanced under the impetus of the White House led by Trump. In the new Trump era, the federal regulatory spider web that Musk has encountered over the past few years with regard to autonomous driving technology/fully autonomous driving (FSD) will be greatly simplified.” Ives and his team said.

Ives and his team from Wedbush believe that as Tesla's fully autonomous driving (FSD) layout gradually takes shape, and Tesla's delivery volume and stable global demand for electric vehicles, Tesla's market value is expected to reach $2 trillion by the end of 2025. Furthermore, they also emphasized that the $650 “bull market price target” conservatively assumes that the Tesla humanoid robot Optimus Prime does not contribute value, and that the Optimus Prime robot is viewed by Tesla's helm Musk as the “core catalyst” of Tesla's market capitalization expansion story.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal