Top 3 Global Dividend Stocks To Consider

Amidst a backdrop of fluctuating global markets, with U.S. consumer confidence dipping and ongoing trade tensions impacting major indices, investors are seeking stability in their portfolios. In such uncertain times, dividend stocks can offer a reliable income stream and potential for growth, making them an appealing option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.52% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.11% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.27% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.55% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.81% | ★★★★★☆ |

Click here to see the full list of 1427 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

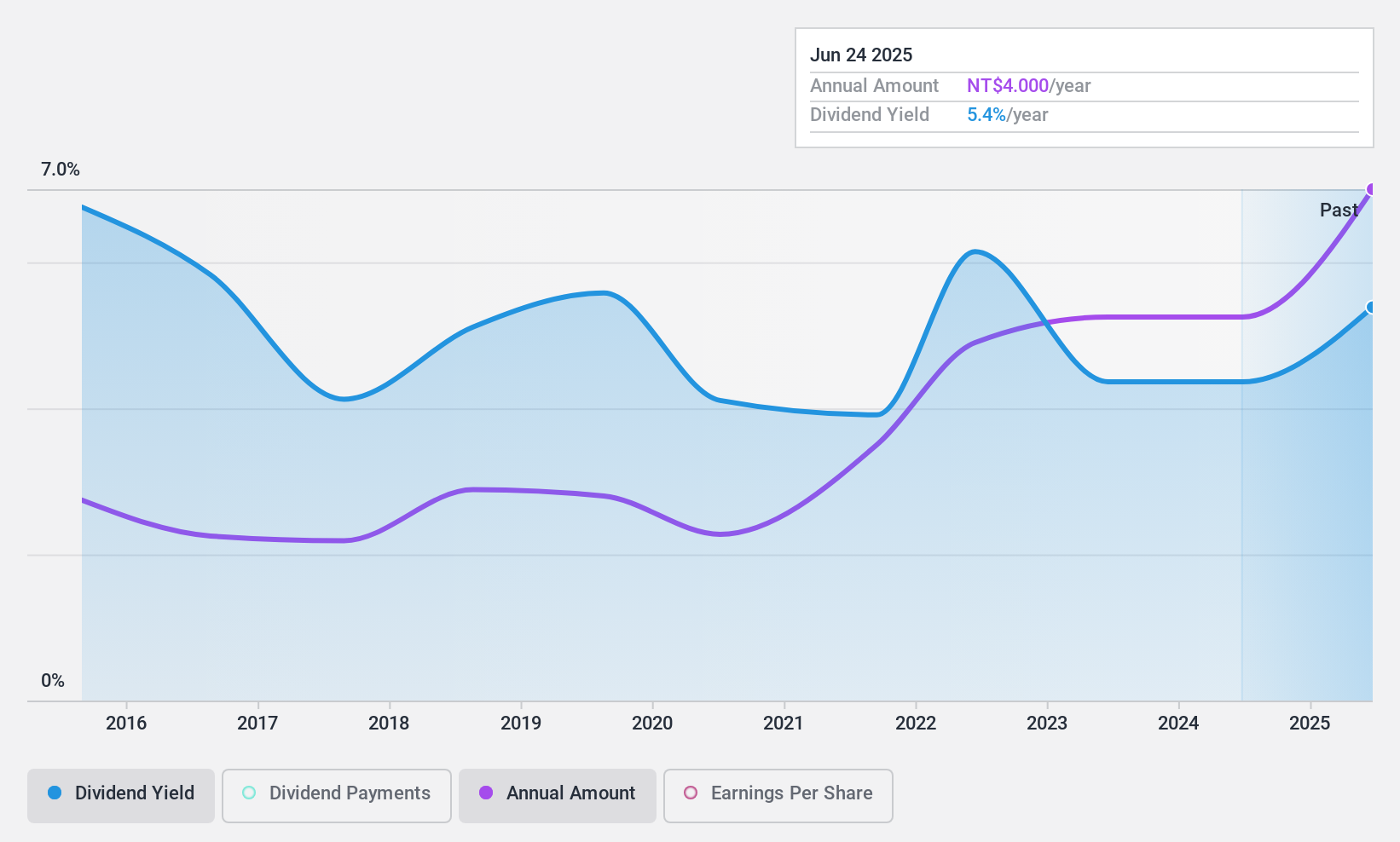

Ardentec (TPEX:3264)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardentec Corporation offers semiconductor testing solutions for memory, logic, and mixed-signal integrated circuits to various clients worldwide, with a market cap of NT$35.21 billion.

Operations: Ardentec Corporation's revenue primarily comes from its main operations, generating NT$8.48 billion, with additional contributions from Ardentec Singapore Pte. Ltd. at NT$625.33 million and Quanzhi Technology (Shares) Company at NT$4.11 billion.

Dividend Yield: 3.3%

Ardentec's dividend yield of 3.25% is below the top quartile in Taiwan, but dividends are sustainably covered by earnings and cash flows with payout ratios of 52.4% and 58.7%, respectively. Despite past volatility, dividends have grown over the last decade. The recent TWD 4 per share dividend announcement suggests a commitment to returns, though share price volatility remains a concern. A private placement could influence future financial stability and dividend reliability.

- Take a closer look at Ardentec's potential here in our dividend report.

- The valuation report we've compiled suggests that Ardentec's current price could be inflated.

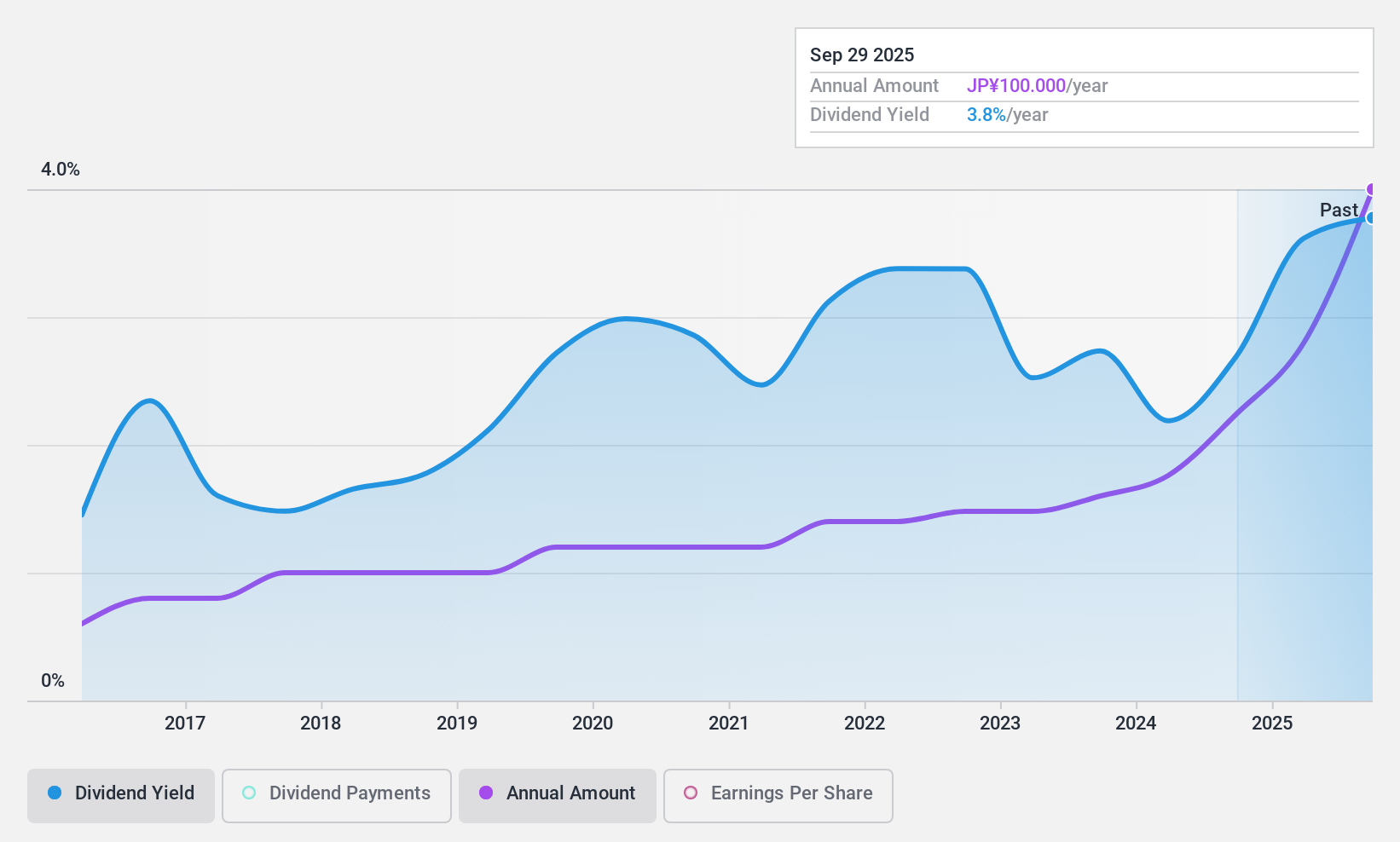

Sato Holdings (TSE:6287)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sato Holdings Corporation manufactures and sells labeling products both in Japan and internationally, with a market cap of ¥71.32 billion.

Operations: Sato Holdings Corporation generates revenue from its Auto-ID Solutions segment, with ¥88.25 billion coming from overseas operations and ¥87.70 billion from its business in Japan.

Dividend Yield: 3.3%

Sato Holdings' dividend yield of 3.35% is below Japan's top quartile, yet it maintains a stable and reliable dividend history over the past decade, supported by a 55.2% earnings payout ratio and a 39.7% cash payout ratio. Recent guidance revision indicates improved financial performance with expected net income of ¥7 billion for FY2025, enhancing dividend sustainability despite large one-off items affecting results.

- Click here to discover the nuances of Sato Holdings with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Sato Holdings shares in the market.

Kamei (TSE:8037)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kamei Corporation is a general trading company with operations in Japan and internationally, and it has a market cap of ¥61.26 billion.

Operations: Kamei Corporation generates revenue through its diverse operations as a general trading company both domestically in Japan and on an international scale.

Dividend Yield: 3.4%

Kamei's dividend is well-supported by a low payout ratio of 8.3% and a cash payout ratio of 8.9%, ensuring strong coverage by both earnings and cash flows. Although its 3.41% yield is below Japan's top quartile, the dividend has been stable and growing over the past decade. Recent share buybacks totaling ¥4.03 billion aim to enhance shareholder value, reflecting Kamei’s commitment to flexible capital management amid evolving market conditions.

- Get an in-depth perspective on Kamei's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Kamei is trading behind its estimated value.

Summing It All Up

- Click here to access our complete index of 1427 Top Global Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal