Envipco Holding (AMS:ENVI) shareholders are still up 400% over 5 years despite pulling back 12% in the past week

Envipco Holding N.V. (AMS:ENVI) shareholders might be concerned after seeing the share price drop 17% in the last month. But that doesn't change the fact that the returns over the last half decade have been spectacular. Indeed, the share price is up a whopping 400% in that time. So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Although Envipco Holding has shed €40m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Envipco Holding

While Envipco Holding made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Envipco Holding can boast revenue growth at a rate of 29% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 38% per year in that time. It's never too late to start following a top notch stock like Envipco Holding, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

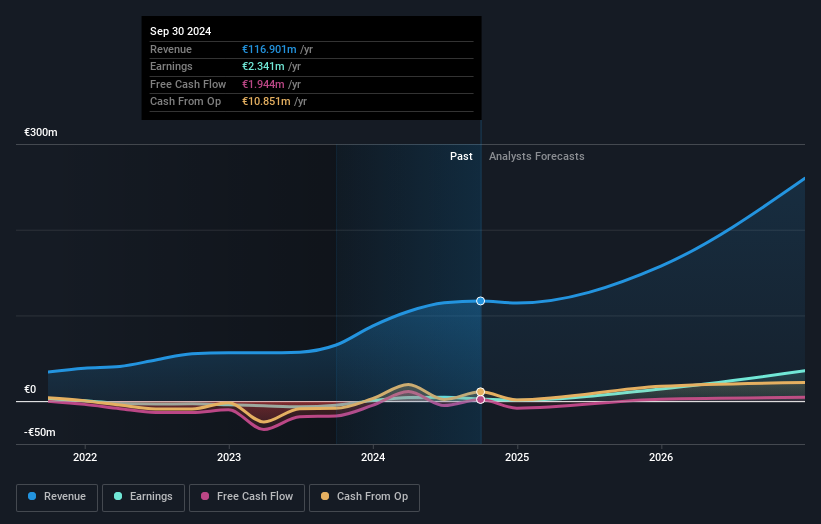

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Envipco Holding has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that Envipco Holding shareholders have received a total shareholder return of 20% over one year. However, the TSR over five years, coming in at 38% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Envipco Holding better, we need to consider many other factors. Even so, be aware that Envipco Holding is showing 1 warning sign in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal