Our CEO has greatly increased his wealth! Will Moderna (MRNA.US) be the next hot spot in the “AI+ healthcare” investment wave?

The Zhitong Finance App learned that Stephane Bancel, CEO of Moderna (MRNA.US), a leader in the mRNA vaccine field, bought the company's shares in a big way on March 3 with a payment price of 31.04 US dollars for US stocks, with a total value of about 5 million US dollars. According to open market disclosure operations, the CEO purchased 102,821 shares at an average price of US$31.04 per share, worth approximately US$3.2 million. 57,493 shares were subsequently purchased at $31.53 per share, worth approximately $1.8 million.

These public shareholding operations in the secondary market were carried out by Boston Biotech Ventures (Boston Biotech Ventures). Moderna CEO Bancel is the company's main shareholder and sole management member.

Following this increase in holdings, Boston Biotech Ventures held up to 6.6 million Moderna shares.

Boosted by this latest positive news, Moderna's stock price once rose nearly 5% in US after-hours trading on Tuesday. By the close of the US stock market on Tuesday, Moderna's stock price closed at $30.370, lower than the CEO's increase in holdings.

“Capitol Hill God” Pelosi brought fire on his own Tempus AI

For investors who are optimistic about Moderna's stock price prospects, a significant increase in their company's CEO holdings will undoubtedly greatly boost market confidence. More importantly, some investment institutions view the CEO's increase in holdings as Moderna management is optimistic that the company will be in a very favorable position in the “AI+ healthcare” super wave.

At the beginning of this year, Nancy Pelosi, who has the title of “Capitol Hill Stock God,” was newly equipped with Tempus AI (TEM.US). After Tempus AI, which focuses on artificial intelligence technology to drive medical development, became Pelosi's “new favorite,” the stock price rose as high as 70% as of mid-February. Since then, the stock price has weakened somewhat.

Tempus AI can be described as the strongest stock in the “AI+ Healthcare” investment wave since 2025. The company's technology platform combines generative artificial intelligence (that is, generative AI), machine learning (ML), genomics, and clinical data analysis to promote the development of precision medicine, focusing on combining genomic data with clinical data, and using artificial intelligence and big data analysis to provide personalized precise treatment plans, especially in the fields of cancer treatment and personalized medical technology.

Will Moderna be the next target of the “AI+ Healthcare” outbreak?

“Capitol Hill Stock God” Pelosi bought Tempus AI bullish options in batches at the end of last year and the beginning of this year, driving global investors to flock to this “AI+ healthcare” sector company. In contrast, Moderna is far superior to Tempus AI in terms of overall valuation and performance fundamentals, and CEO Bancel increased its holdings of shares rather than options, and the scale of the increase was far higher than Pelosi's allocation to Tempus AI.

Since 2025, the strongest investment line associated with “AI+” has quietly emerged, namely “Capitol Hill Stock God” Pelosi's real money bet, and “AI+ healthcare” covered by Wall Street giant Goldman Sachs in research reports. Artificial intelligence +, or “AI+” for short, refers to a cutting-edge concept that deeply integrates “AI big models/generative AI applications/AI agents” led by technology giants such as OpenAI with various industries to promote industry innovation and development, and productivity innovation.

At the helm of Nvidia, Hwang In-hoon, the “Godfather of AI,” has more than once called “AI+ medical science/biology” “the next amazing revolution” in the field of global technology in various public forums. He even said in a conference that the era where everyone had to learn computers is over; biology and medicine are the future of humanity.

The deep integration of generative AI and the medical/pharmaceutical/pharmaceutical fields has vigorously promoted active R&D progress in many segments, particularly in the areas of new drug discovery, gene editing, disease diagnosis, patient monitoring, and medical image analysis. It is expected that 2025 may result in a large number of commercially promising breakthrough research results related to “AI+ healthcare.” Demis Hassabis, winner of the 2024 Nobel Prize in Chemistry, even made a statement: it is likely that some drugs designed by artificial intelligence will enter clinical trials before the end of this year. Hassabis explained that Isomorphic Labs, which he leads, is focused on shortening the drug development process from ten years or more to “weeks or months.”

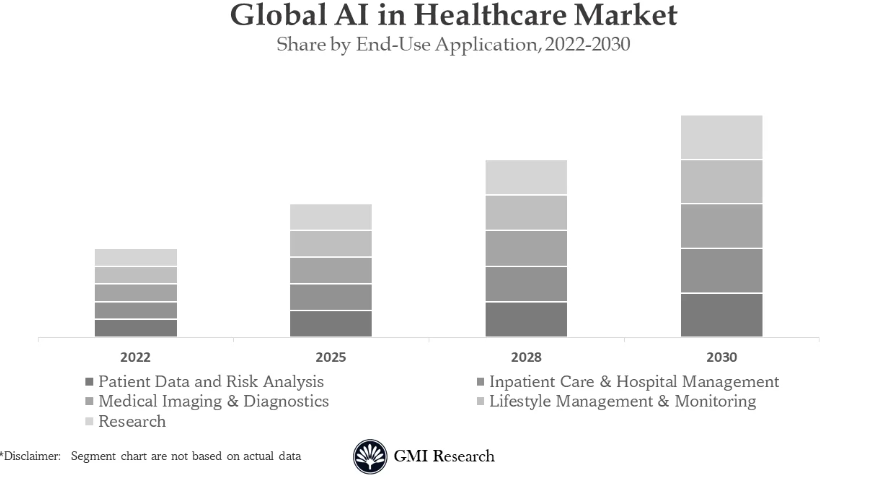

According to GMI Research's latest research report, the healthcare market value incorporating AI technology is only about US$10.4 billion in 2022, and is expected to reach US$189.9 billion by 2030, with a compound annual growth rate (CAGR) of 43.7% during this period. GMI Research said that when analyzing extremely recurrent medical data, AI can often perform tasks in a shorter time and at a lower cost, thereby greatly optimizing the connection between patients, doctors, and hospital managers; and the agency expects AI to be fully applied to fields such as medical imaging and rapid diagnosis, drug discovery, medical surgery assistance robots, gene-level precision medicine, drug simulation and screening, and mRNA sequence prediction, protein structure prediction, etc., to drastically reduce the product innovation cycle and comprehensively improve the accuracy of modern medicine and Reach a wider range of patients in the same amount of time.

For Moderna, the full integration of AI and mRNA flagship businesses has significant potential to boost the company's performance and valuation. It can not only improve product development efficiency, reduce operating costs, but also continuously open up new market opportunities. With the help of large artificial intelligence models, moderna can design and optimize mRNA sequences more efficiently, quickly select more promising vaccines or treatment plans from a large number of candidate molecules, shorten the R&D cycle, and reduce R&D costs. AI can also optimize clinical trial design through big data analysis and predictive models, such as selecting appropriate patient groups more accurately and predicting efficacy and safety, thereby greatly improving trial progress and success rate and speeding up the pace of product launch.

The logic that the market is optimistic about Moderna becoming the target of the “AI+ healthcare” explosion is basically consistent with the logic that Goldman Sachs is optimistic about Abbott. Abbott actively promotes AI+ healthcare, uses artificial intelligence technology to optimize its products and services, and drive innovation in medical technology. For example, Abbott's heart monitoring equipment and medical imaging technology are gradually integrating AI algorithms to improve the accuracy and speed of early diagnosis; Abbott is currently actively using generative AI technology to accelerate the drug development process.

After Oracle Chairman Larry Ellison emphasized the potential of artificial intelligence (AI) in developing mRNA cancer vaccines, market confidence in Moderna did increase. Ellison said artificial intelligence can be used to develop mRNA-based personalized cancer vaccines and early tumor detection.

He explained that soon, artificial intelligence can be used to analyze test fragments aimed at identifying tiny tumor fragments circulating in the blood. After genetically sequencing cancerous molecules, an exclusive individualized cancer vaccine can be developed within about two days. “Using artificial intelligence, you can detect early cancer through blood tests, and use artificial intelligence to view exclusive blood tests, so you can detect cancers that actually pose a serious threat to the body.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal