US stock outlook | Futures on the three major stock indexes rose sharply, and Nvidia (NVDA.US) earnings hit hard after the market

1. On February 26 (Wednesday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.34%, S&P 500 futures were up 0.53%, and NASDAQ futures were up 0.80%.

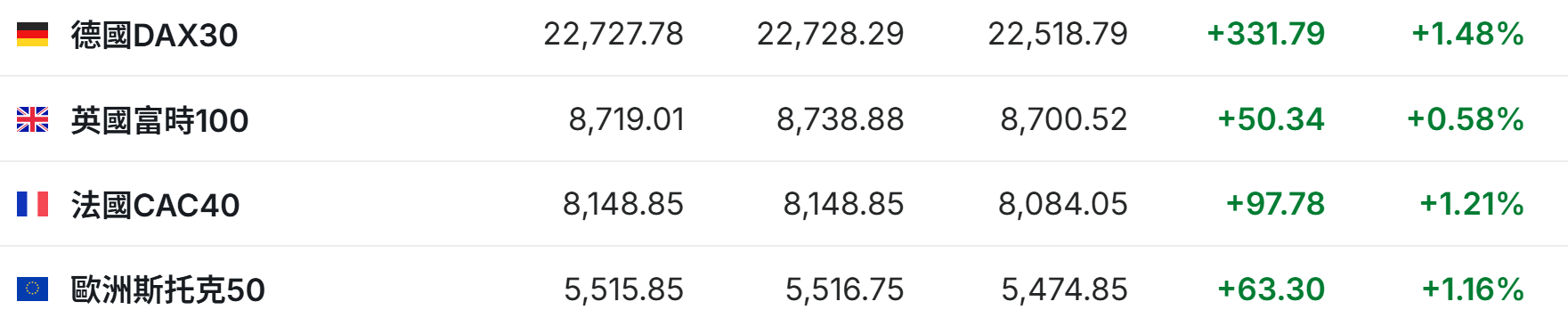

2. As of press release, the German DAX index rose 1.48%, the UK FTSE 100 index rose 0.58%, the French CAC40 index rose 1.21%, and the European Stoxx 50 index rose 1.16%.

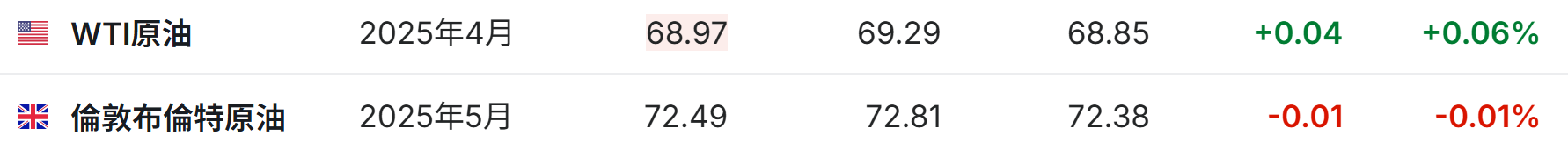

3. As of press release, WTI crude oil rose 0.06% to $68.85 per barrel. Brent crude fell 0.01% to $72.38 per barrel.

Market news

Bank of America warns: the rise in the S&P 500 shows weakness, and Trump may start interfering in the escrow market. Bank of America strategist Michael Hartnett said that at a time when European and Chinese stock markets are performing well, investors are increasingly “skeptical” that there is room for the S&P 500 to rise further. “The longer it takes for the S&P Index to reach a new high, the more difficult it is, and people's doubts increase,” Hartnett said in an interview. “Europe is playing a role, China is playing a role, and even US bonds are starting to play a role.” The strategist recommended international stocks over US stocks this year because he expects the so-called “Big Seven Tech Stocks” to fluctuate after driving the US stock market upward since the beginning of 2023. Although he said investors aren't pessimistic about big tech stocks, these stocks can easily fall if the deal “doesn't continue to work.”

Trump is selling a $5 million “gold card” for immigrants. The funds may be used to reduce the deficit. Trump said he will launch a program to provide residency rights and access to citizenship to foreigners who have invested $5 million. While he is carrying out an all-out crackdown on illegal immigration, this has provided a new path for legal immigration. Trump said that the project, known as the “Gold Card,” will be launched within two weeks. He also said that he doesn't think the US government needs approval from Congress. The full scope of the plan and how it will be implemented is currently unclear. When signing the executive order with Secretary of Commerce Howard Lutnick on Tuesday, Trump said, “We will price this card at around $5 million; it can be treated as a green card.” Lutnick said the move could replace existing EB-5 visas, and his derogation from the program was “completely nonsense.”

Copper prices in New York jumped as Trump studied imposing tariffs on copper. The price of US copper futures climbed after President Trump signed an executive order directing the US Department of Commerce to review possible tariffs on copper. The move is the latest in a series of measures aimed at imposing tariffs on specific industries to reshape global supply chains. Due to a possible gap between US and global prices, there was a major misalignment in the main copper price difference this year. Comex copper futures rose 2.4% at one point, the biggest intraday gain since February 12. After the news broke, the stock prices of copper mining companies listed in the US also rose. The investigation will be carried out in accordance with section 232 of the Trade Expansion Act, which gives the US President broad powers to impose trade restrictions on domestic security grounds. Trump is also using this power to impose 25% tariffs on two other industrial metals — steel and aluminum — which will take effect in March.

Federal Reserve Supervisory Vice Chairman Barr: Monetary policy is inextricably linked to financial stability. Federal Reserve Vice Chairman Michael Barr (Michael Barr) said in his speech on Tuesday that monetary policy and financial stability are “inseparable.” Barr will step down as Vice Chairman of Supervisory Control this Friday while remaining a member of the Federal Reserve. In his last few days as Vice Chairman of Regulation, he emphasized the importance of strong regulation and the independence of the Federal Reserve. Prior to Barr's speech on Tuesday, US President Trump recently issued an executive order seeking to tighten control over independent institutions, including the Federal Reserve's banking supervision and supervision work. Although this executive order will not directly affect the Federal Reserve's monetary policy, it requires agencies to submit to the White House for review and consult with the government on priorities and strategies before issuing draft regulations. Barr said the US Consumer Financial Protection Bureau (CFPB) has brought “huge benefits” to American households.

Has gold reached its peak? Using Buffett's investment rules as a guide, experts sounded the alarm. The price of gold has soared over the past year. However, experts say investors should be cautious. One consultant suggested considering Warren Buffett's rule: “Fear when others are greedy, greedy when others are afraid.” Experts say gold should only account for a small percentage of the investment portfolio, possibly only 1% or 2%, or even less in a diversified portfolio. As of Tuesday, the SPDR Gold Shares Fund (GLD), which tracks gold prices, has risen about 11% in 2025. Over the past year, returns have increased by around 42%. Since this year, the price of gold futures has also risen by about 10%, and is now 36% higher than the same period last year. By contrast, the S&P 500 rose by about 1.5% in 2025 and 17% over the past year.

Individual stock news

Countdown to a huge shock in US stocks? Nvidia (NVDA.US) earnings report or open the “Pandora's Box”, traders hedge risks in advance. Last week, the ratio of open VIX call options to put options was close to the highest level since September 2023. More than 1 million call options changed hands on Tuesday. Investors are beginning to increase their bets that volatility will return, as Nvidia's earnings report to be released after the US stock market on Wednesday may just be the beginning of a series of fluctuations. Although US President Donald Trump's return to the White House and his tariff remarks have so far not alarmed traders, analysts' warnings are getting louder and louder, from Nomura Holdings' Charlie McEligott to Goldman Sachs Group's Scott Rubner. Options platform SpotGamma said, “Nvidia has the potential to influence the entire stock market. There are many catalysts for the momentum to soar over the next few months, including tariffs and the deadline for the US government to shut down.”

Low.US (LOW.US) has Q4 revenue of $18.6 billion and net profit of $1.1 billion. Lowe's fourth-quarter revenue was $18.6 billion. Comparable sales increased by 0.2%. The company's Q4 net profit reached $1.1 billion, with diluted earnings per share (EPS) of $1.99, up from $1.77 in the fourth quarter of 2023. As of January 31, 2025, Lloyd's operates 1,748 stores with a retail area of 195 million square feet. Looking ahead, Lowe's estimates earnings per share for the first quarter of 2026 will be between $12.15 and $12.40, compared to analysts' expectations of $12.48. For revenue for the first quarter of 2026, Lowe's estimates will be between $83.5 billion and $84.5 billion, compared to analysts' expectations of $84.77 billion.

Stellantis (STLA.US) performance declined sharply! Profits plummeted 70% in 2024, and both the North American and European markets suffered setbacks. European auto giant Stellantis released an earnings report on Wednesday saying that profits declined sharply in 2024, and it is expected that it will still be difficult for the company's profits to improve significantly this year. Currently, the carmaker is trying to revive sluggish sales while looking for a new CEO. This multinational corporate group, which owns famous brands such as Jeep, Dodge, Fiat, Chrysler, and Peugeot, had a net profit of only 5.5 billion euros (US$5.77 billion) for the full year of 2024, a sharp drop of 70% from 18.6 billion euros for the whole of 2023, and also lower than analysts' expectations of 6.4 billion euros. The adjusted operating margin was 5.5%, which is at the lower end of the company's guidance range, far lower than 12.8% in the same period last year. Looking ahead, Stellantis expects the adjusted operating margin to reach mid-single digits in 2025.

Thanks to the recovery in the US market, Bud.US (BUD.US) Q4 profit surged 10.1% above expectations. AB InBev's organic EBITDA for the fourth quarter increased 10.1% year over year, higher than analysts' average forecast of 7.95%. Its 8.2% increase for the whole year also exceeded market expectations and the company's own guidance range. In the US market, thanks to the strong sales performance of the two major brands, Michelob Ultra and Busch Light, AB InBev increased its market share and revenue increased by 0.8%. The company's alcohol-free beer Michelob Ultra Zero, which was launched in January of this year, also had a good market response. However, due to continued weak consumption in the Chinese and Argentine markets, AB InBev's sales volume fell 1.9% in the fourth quarter, exceeding analysts' expectations and falling 1.4% for the whole year. Looking ahead, AB InBev predicts that the company's organic EBITDA growth rate will remain between 4% and 8% by 2025.

GOTU.US (GOTU.US) Q4 revenue increased 82.5% year over year, with a net loss of 136 million yuan. Gaotu Q4's revenue was 1,389 million yuan (RMB, same below), up 82.5% year on year; net loss was 136 million yuan, net loss of 120 million yuan for the same period last year. Cash revenue was $2.16 billion, up 69.0% year over year. Net operating cash inflow was 784 million yuan, up 59.4% year on year. In terms of annual results, the company's revenue was 4.554 billion yuan (RMB, same below), an increase of 53.8% year on year; net loss was 1,049 billion yuan, a net loss of 7.3 million yuan for the same period last year. Looking to the future. The company expects revenue for the first quarter of fiscal year 2025 to be between 1,408 billion yuan and 1,428 million yuan, or a year-on-year increase of 48.7% to 50.8%.

Apple (AAPL.US) forcibly levied a 27% “backlink tax” and was questioned by the court: take the lead in price increases or is it a compliant operation? An Apple executive said in court that the impact on Apple's profits was a key factor in its decision to charge developers a 27% fee to guide customers to make payments outside of the App Store, although this move could violate court orders. US District Judge Yvonne Gonzalez Rogers (Yvonne Gonzalez Rogers) is determining whether Apple has complied with her 2021 order, which requires Apple to provide consumers with more choices. The lawsuit ended a long-standing battle over Epic Games Inc.'s allegation that Apple was trying to monopolize the lucrative mobile app market. At hearings that began last year, judges repeatedly questioned whether Apple was taking sufficient measures to promote competition.

There is no “excess data center”! Meta (META.US) is rumored to be preparing a giant data center worth 200 billion US dollars. Meta Platform (Meta.us) is discussing the construction of a new data center campus for its artificial intelligence project, with a potential cost of more than $200 billion, according to The Information on Tuesday, citing people familiar with the matter. According to the report, Meta executives have notified data center developers that the company is considering building data centers in states such as Louisiana, Wyoming, or Texas, and senior leaders have already visited potential locations this month. Since OpenAI launched ChatGPT in 2022, companies from all walks of life have strived to incorporate artificial intelligence into their products and services, so investment in artificial intelligence has surged. Meta didn't immediately respond to a request for comment. Last month, Meta CEO Mark Zuckerberg said the company plans to spend $65 billion this year to expand its artificial intelligence infrastructure.

Fearing a “cliff-style” decline in European sales, Tesla (TSLA.US) bought some of the assets of a bankrupt German parts manufacturer. Despite Tesla's “trouble” in Germany, the US carmaker said on Tuesday that it would buy some of the assets of the bankrupt German high-tech parts manufacturer Manz AG, including its factory, equipment and more than 300 employees in Reutlingen, Germany. Manz AG said its bankruptcy administrator signed an acquisition agreement with Tesla's subsidiary Tesla Automation GmbH on Monday. The parties agreed not to disclose the purchase price, and the completion of the transaction was subject to merger control laws. Manz AG added that approximately 100 employees will lose their jobs and will not be transferred to Tesla Automation GmbH. The deal marks the expansion of Tesla's business in Germany, where the company already operates a gigafactory near Berlin.

Key economic data and event forecasts

21:00 Beijing time: Revised monthly US construction permit rate for January (%).

23:00 Beijing time: Changes in US EIA crude oil inventories for the week ending February 21 (10,000 barrels), and the total annualized sales of new homes in the US after the January seasonal adjustment (10,000 households).

23:10 Beijing time: US corporate bond market distress index for the four weeks to February 21 - overall market average.

23:30 Beijing time: Changes in US EIA natural gas inventories for the week ending February 21 (100 million cubic feet)

21:30 Beijing time: 2027 FOMC voting committee and Richmond Federal Reserve Chairman Barkin delivered a speech on the topic “The Past and Present Life of Inflation”.

The next day at 01:00 a.m. Beijing time: 2027 FOMC voting committee and Atlanta Federal Reserve Chairman Bostic delivered a speech on economic prospects and the property market.

Performance Forecast

Thursday morning: Nvidia (NVDA.US), Synopsys (CRM.US), Synopsys (SNPS.US), Snowflake (SNOW.US), eBay (EBAY.US), C3.ai (AI.US)

Thursday pre-market: Norwegian Cruise Line (NCLH.US), Zaiding Pharmaceuticals (ZLAB.US), Daxin Energy (DQ.US)

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal