Undiscovered Gems Featuring 3 Promising Small Caps With Strong Metrics

In the current global market landscape, small-cap stocks have faced headwinds as major indices like the S&P MidCap 400 and Russell 2000 posted declines amid geopolitical tensions and concerns over consumer spending. Despite these challenges, opportunities exist for discerning investors who focus on companies with strong financial metrics and resilience in uncertain economic environments. Identifying such promising small-cap stocks can be particularly rewarding when they demonstrate robust fundamentals despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| Toho | 69.92% | 3.85% | 59.41% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| YagiLtd | 38.98% | -8.93% | 16.36% | ★★★★★☆ |

| Luxchem Corporation Berhad | 12.60% | -1.14% | -3.40% | ★★★★★☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Hangzhou Heatwell Electric Heating Technology (SHSE:603075)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou Heatwell Electric Heating Technology Co., Ltd. specializes in the development and production of electric heating products, with a market cap of CN¥7.97 billion.

Operations: Hangzhou Heatwell Electric Heating Technology generates its revenue primarily from the sale of electric heating products. The company's net profit margin is 15.2%, reflecting its efficiency in converting sales into actual profit.

Hangzhou Heatwell Electric Heating Technology, a smaller player in the market, shows potential with its earnings growth of 5.5% over the past year, outpacing the Consumer Durables industry's -1.9%. The company boasts high-quality earnings and maintains a healthy financial position with more cash than total debt. Its price-to-earnings ratio stands at 28.1x, which is attractive compared to the CN market's 38.1x, suggesting it might be undervalued in its sector. With positive free cash flow reported recently at CNY140 million and no concerns over interest coverage, Heatwell seems poised for steady performance ahead.

Hunan Valin Wire & CableLtd (SZSE:001208)

Simply Wall St Value Rating: ★★★★★☆

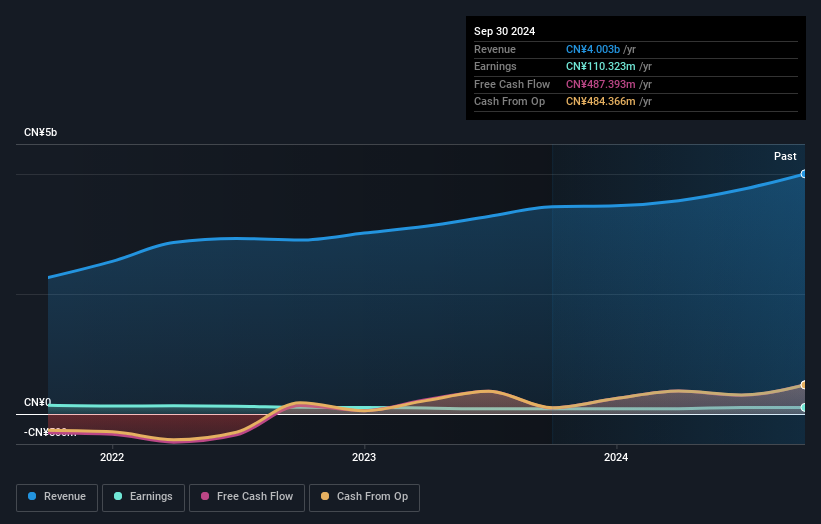

Overview: Hunan Valin Wire & Cable Co., Ltd. is involved in the research, development, production, and sales of wires and cables in China with a market capitalization of CN¥5.50 billion.

Operations: Valin Wire & Cable generates revenue primarily from the sales of wires and cables. The company's net profit margin is 8.5%, reflecting its profitability after accounting for all expenses.

Hunan Valin Wire & Cable has shown impressive earnings growth of 24.4% over the past year, outpacing the Electrical industry average of 1.3%. The company demonstrates high-quality earnings and is trading at a significant discount, 73.9% below its estimated fair value, suggesting potential undervaluation. However, its debt to equity ratio has increased slightly from 52% to 54.8% over five years, though it maintains a satisfactory net debt to equity ratio of 12.7%. Recent shareholder meetings have focused on director elections and extending resolutions related to share offerings, indicating active governance adjustments amidst these financial dynamics.

- Dive into the specifics of Hunan Valin Wire & CableLtd here with our thorough health report.

Understand Hunan Valin Wire & CableLtd's track record by examining our Past report.

IFE Elevators (SZSE:002774)

Simply Wall St Value Rating: ★★★★★★

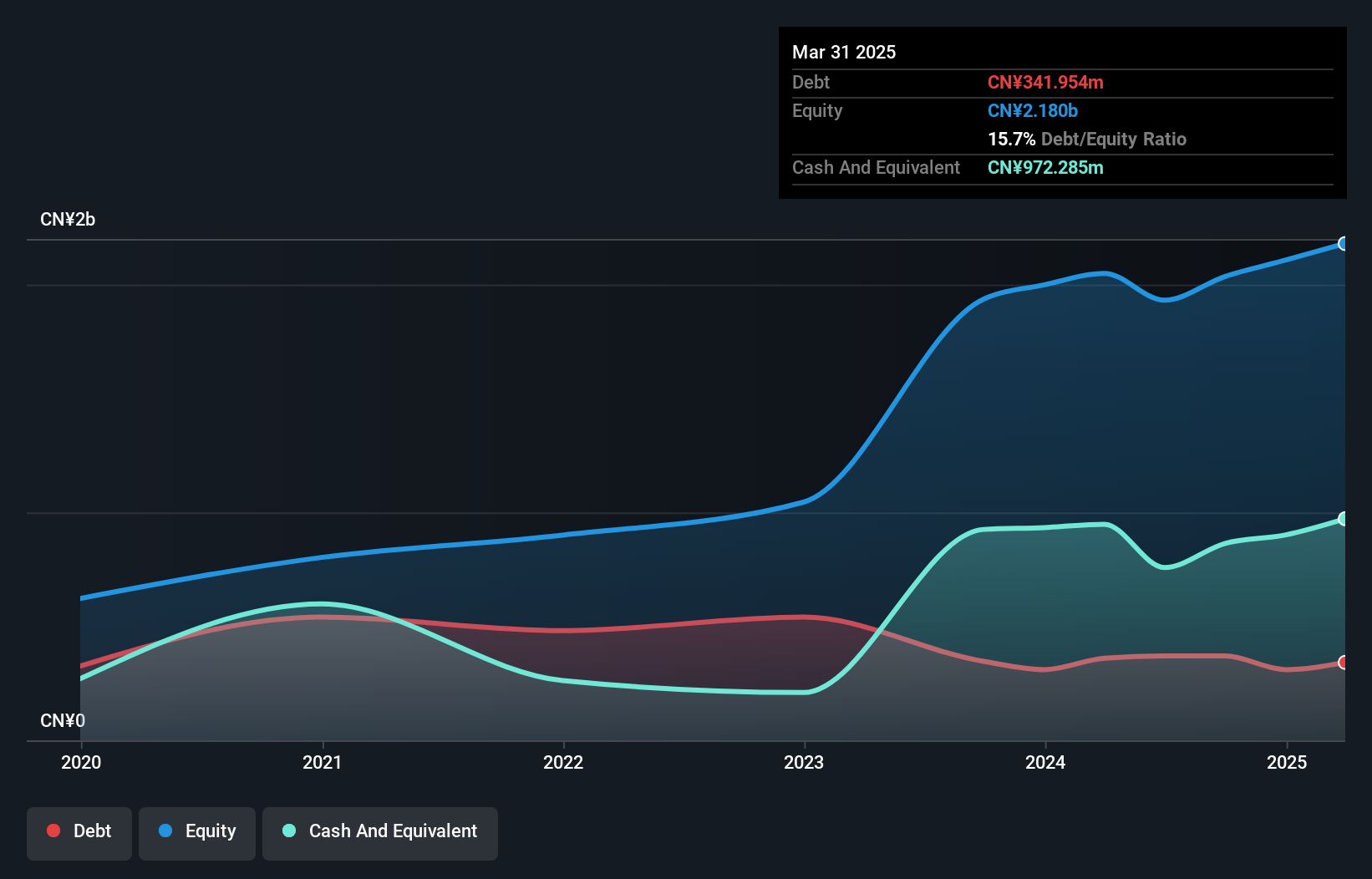

Overview: IFE Elevators Co., Ltd. is engaged in the design, manufacture, installation, and maintenance of lifts, escalators, and moving walkways both in China and internationally with a market cap of CN¥2.69 billion.

Operations: IFE Elevators generates revenue primarily through the design, manufacture, installation, and maintenance of elevators and escalators. The company's financial performance is influenced by its cost structure related to production and service delivery. Its net profit margin reflects the efficiency of its operations in managing expenses relative to income generated.

IFE Elevators, a smaller player in the machinery sector, has shown notable resilience with an 8.4% earnings growth over the past year, outpacing its industry peers who saw a -0.06%. The company operates debt-free, eliminating concerns about interest coverage and enhancing financial stability. Its price-to-earnings ratio of 20.1x is attractively lower than the CN market average of 38.1x, suggesting potential undervaluation. Despite not being free cash flow positive recently, IFE's high level of non-cash earnings indicates quality profits that could support future growth initiatives without immediate liquidity pressures.

Key Takeaways

- Investigate our full lineup of 4760 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal