3 Reliable Dividend Stocks To Consider With Up To 4.8% Yield

As global markets continue to navigate a landscape marked by rising inflation and climbing stock indexes, investors are increasingly seeking stability amidst economic uncertainty. In such an environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance growth with income potential.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

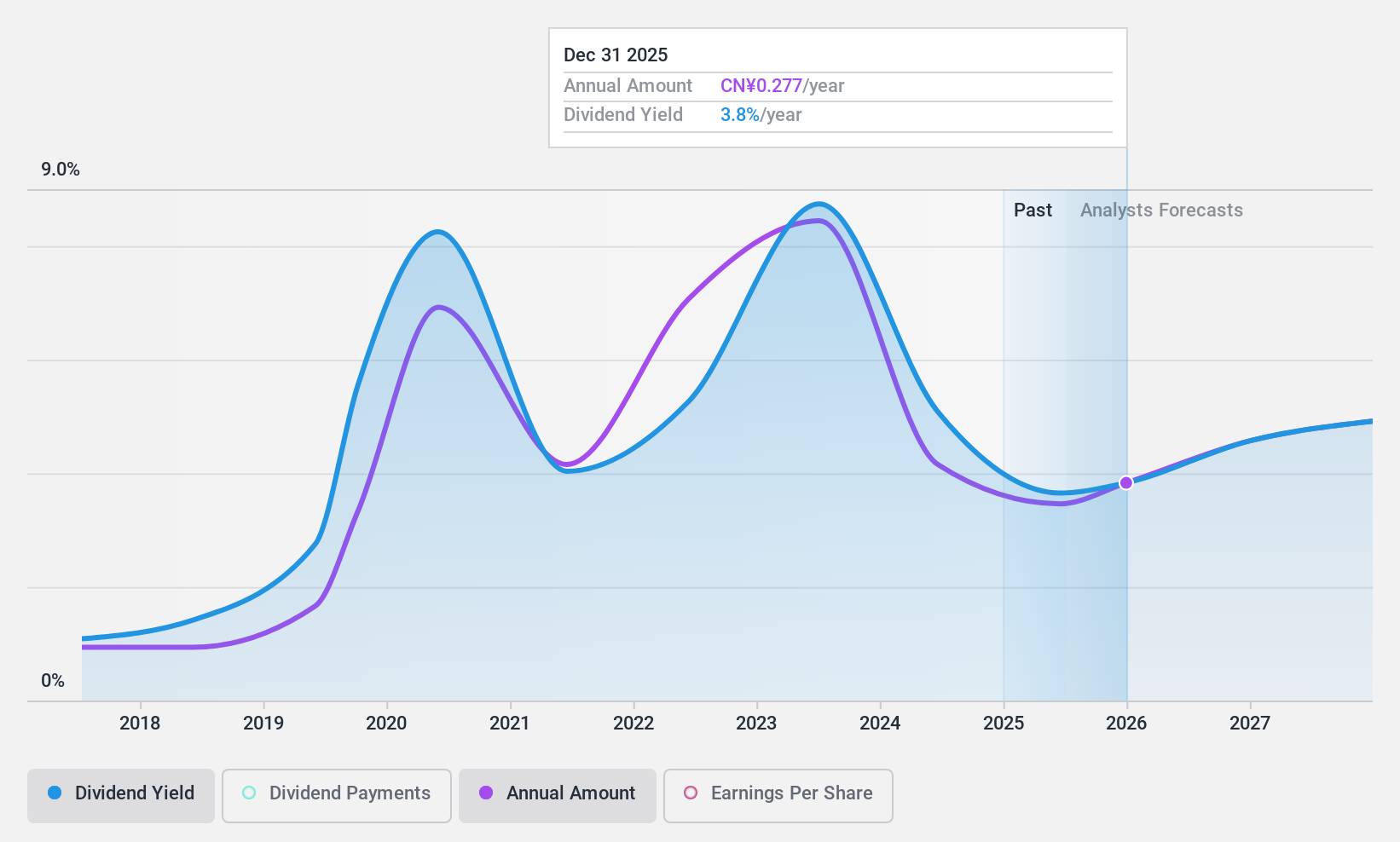

Xiamen Xiangyu (SHSE:600057)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen Xiangyu Co., Ltd. is a company that offers supply chain services in the People's Republic of China, with a market capitalization of approximately CN¥13.72 billion.

Operations: Xiamen Xiangyu Co., Ltd. generates its revenue through various segments, including supply chain services within the People's Republic of China.

Dividend Yield: 4.9%

Xiamen Xiangyu offers a dividend yield of 4.88%, placing it in the top 25% of CN market payers, with dividends covered by earnings (70.1% payout ratio) and cash flows (23.4% cash payout ratio). However, its dividend history is short and volatile, with payments dropping over 20% annually at times. Despite trading slightly below fair value and showing good relative value compared to peers, its unstable dividend track record warrants caution for income-focused investors.

- Navigate through the intricacies of Xiamen Xiangyu with our comprehensive dividend report here.

- According our valuation report, there's an indication that Xiamen Xiangyu's share price might be on the cheaper side.

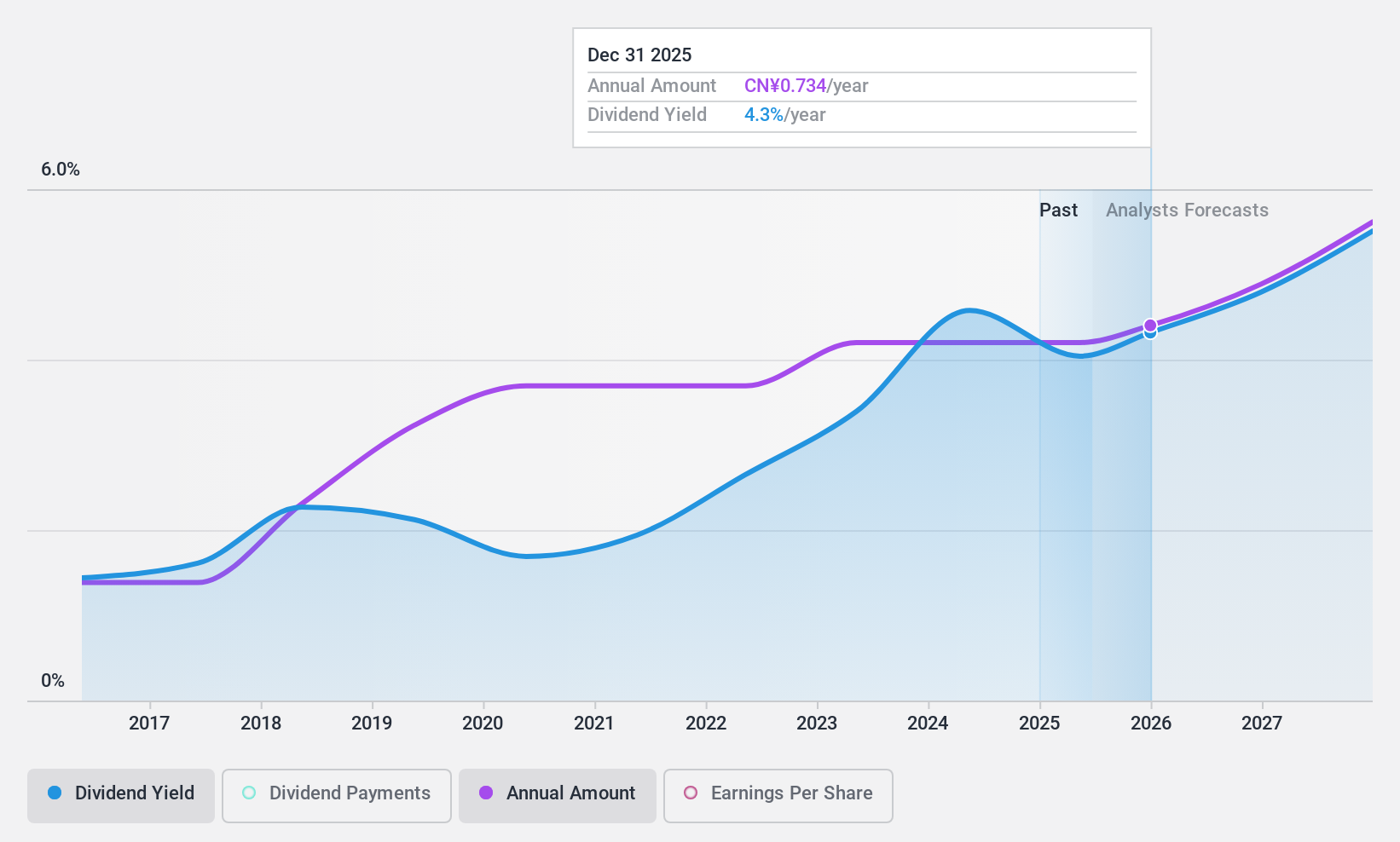

Hefei Meyer Optoelectronic Technology (SZSE:002690)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hefei Meyer Optoelectronic Technology Inc. operates in the field of optoelectronic technology, focusing on developing and manufacturing advanced sorting equipment, with a market cap of CN¥13.33 billion.

Operations: Hefei Meyer Optoelectronic Technology Inc. generates revenue from the production and sales of photoelectric detection equipment, amounting to CN¥2.35 billion.

Dividend Yield: 4.6%

Hefei Meyer Optoelectronic Technology's dividend yield of 4.62% ranks in the top 25% of the CN market, but its sustainability is questionable due to a high payout ratio (97.6%) not covered by earnings. However, dividends are supported by cash flows with an 84.5% cash payout ratio and have been stable over the past decade, showing consistent growth without volatility. The stock's P/E ratio of 21.1x suggests good value compared to the broader market.

- Unlock comprehensive insights into our analysis of Hefei Meyer Optoelectronic Technology stock in this dividend report.

- Upon reviewing our latest valuation report, Hefei Meyer Optoelectronic Technology's share price might be too optimistic.

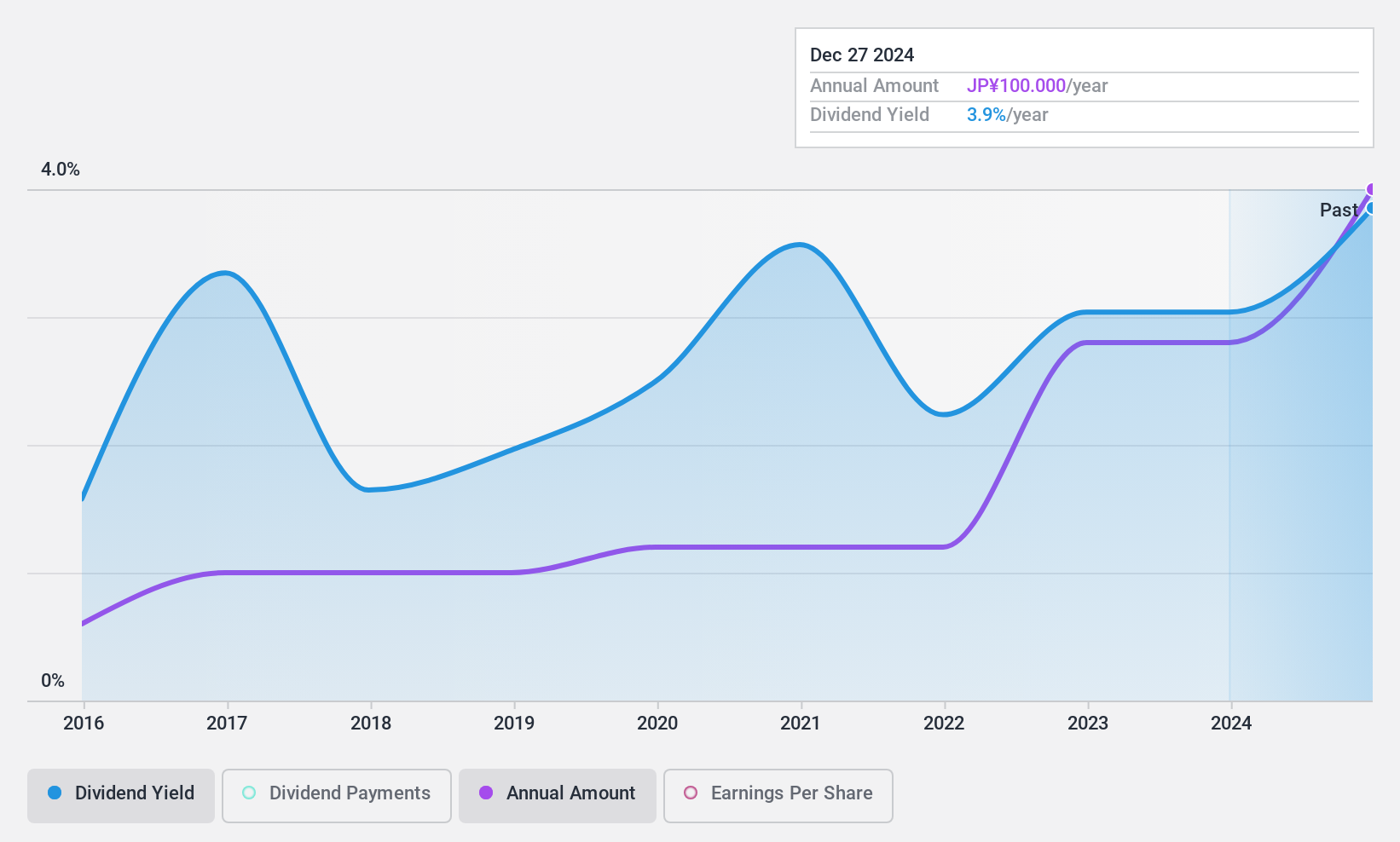

Look Holdings (TSE:8029)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Look Holdings Incorporated operates in apparel-related, production and OEM, and logistics businesses across Japan, Korea, Europe, Hong Kong, China, and the United States with a market cap of ¥16.99 billion.

Operations: Look Holdings' revenue primarily comes from its operations in the apparel-related, production and OEM, and logistics sectors across various international markets.

Dividend Yield: 4.4%

Look Holdings pays a reliable dividend yield of 4.37%, ranking in the top 25% of JP market payers. Its dividends are well-covered by earnings with a payout ratio of 30.2% and supported by cash flows at a cash payout ratio of 79.6%. Over the past decade, dividends have been stable and growing with minimal volatility. The stock trades at 4.4% below its estimated fair value, suggesting potential for value investors ahead of its upcoming earnings release on February 14, 2025.

- Click here to discover the nuances of Look Holdings with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Look Holdings' current price could be quite moderate.

Next Steps

- Gain an insight into the universe of 1970 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal