CICC: Some Thoughts on Another Surge in Hong Kong Stocks

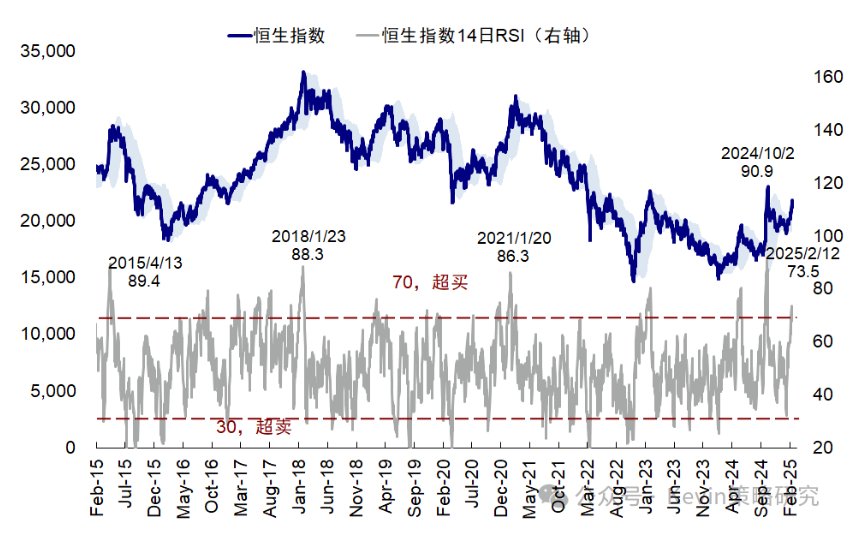

The Zhitong Finance App learned that as of today (closing on February 12), the overall Hong Kong stock market is technically overbought (RSI is 74%), but short sales have declined from the previous few days, indicating that some differences are decreasing or being pushed out due to the rise. The equity risk premium was reduced to 6.5% (6.7% when it peaked in May 2024 and 6% when it was high in October last year). Overall, emotions are overdrafted in the short term, but they're definitely not the ultimate.

Next, there are two ways to go: First, continue the structure. The industry narrative is unfalsified; it's better to have a structured bull market. Second, further spread to the overall market requires two conditions. One is that technological changes and solutions to the overall macro-deleveraging and contraction problems have led to a sharp rise in total factor productivity and natural interest rates; the other is the increase in macro-aggregate policy coordination.

CICC's main views are as follows:

After an adjustment yesterday, Hong Kong stocks surged again today. The real estate-related news in the afternoon also boosted the performance of real estate stocks. The market is paying more attention to the next space. We have combined some of the latest data and updated some information as follows for your reference.

As of today (close of February 12), Hong Kong stocks are technically overbought (RSI is 74%), but short sales have declined from previous days, indicating that some differences are decreasing or being pushed short due to the rise. The equity risk premium was reduced to 6.5% (6.7% when it peaked in May 2024 and 6% when it was high in October last year).

So looking at it as a whole, it can be concluded that emotions are overdrawn in the short term. But isn't that extreme? That's definitely not the ultimate. Where is the October mood? If we “move” the high level of excitement in early October, the Hang Seng Index corresponds to 23,000 points. It's not impossible, but it's difficult.

So are there any foreign purchases? The data currently available can only be seen as of last week (this week's data updated on Friday). The conclusion is that there is no long-term foreign investment (holding type, most important), and short-term foreign investment (such as passive capital, transaction capital) should be available, but the biggest problem with the latter is that it is not sustainable, just like the wave at the end of September.

There are a few interesting points about this rise, which are also misunderstandings. In fact, this time, the overall market is still a structured market, and it is a more extreme structured market. There is only a 20% stock performance index of more than 20% (the 924 market has an individual stock outperformance index of more than 60%). However, it is possible to rely on these small groups of individual stocks to drive up the overall index and outperform A-shares. The main reasons are: 1) the overall market of Hong Kong stocks is small; 2) Hong Kong stocks have more software stocks and big companies, and there are no A-shares; 3) In terms of index construction, the Hang Seng Series Index artificially limits the weight limit of individual stocks to 8%, so it will make small and medium-sized companies drive the index more effectively.

Next, there are two ways to go: First, to continue the structure. The industry narrative is unfalsified. It's better to have a structured bull market, similar to smartphones, consumer electronics, semiconductors, new energy, or the Seven Sisters of US stocks after 2012, but this needs to be based on continuous implementation by the industry. If it can't be realized, it's either the speculation that spreads around this main line, or it's just holding on to big manufacturers, which are the most likely to be realized.

Second, further spread to the overall market, but two conditions are needed: 1) technological changes and solutions to the overall macroeconomic deleveraging and contraction issues, resulting in a sharp rise in total factor productivity and natural interest rates; 2) macro-aggregate policies are being strengthened, such as today's real estate news, but will the current popularity of AI and the relative moderation of tariffs lead to total volume policies not being too urgent? Observation is required.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal