Earnings Not Telling The Story For ANTA Sports Products Limited (HKG:2020)

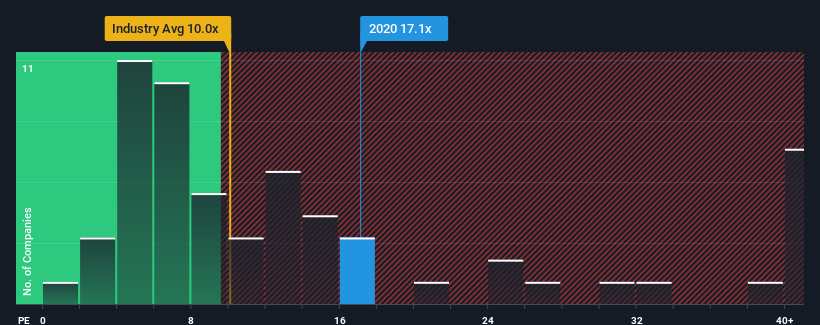

With a price-to-earnings (or "P/E") ratio of 17.1x ANTA Sports Products Limited (HKG:2020) may be sending very bearish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

ANTA Sports Products certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for ANTA Sports Products

Does Growth Match The High P/E?

ANTA Sports Products' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 46%. The strong recent performance means it was also able to grow EPS by 72% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 7.7% each year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 12% each year growth forecast for the broader market.

In light of this, it's alarming that ANTA Sports Products' P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of ANTA Sports Products' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for ANTA Sports Products with six simple checks.

Of course, you might also be able to find a better stock than ANTA Sports Products. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal