Discovering February 2025's Undiscovered Gems on None

In the midst of a volatile global market landscape, characterized by the Federal Reserve's steady interest rate policy and competitive pressures from emerging technologies like DeepSeek's AI advancements, investors are navigating choppy waters. As major indices such as the Nasdaq Composite and S&P 500 experience fluctuations driven by earnings reports and geopolitical developments, small-cap stocks present unique opportunities for those seeking potential growth amid uncertainty. Discovering promising investments in this environment often involves identifying companies with robust fundamentals that can withstand economic shifts and capitalize on niche markets or innovative solutions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★★☆

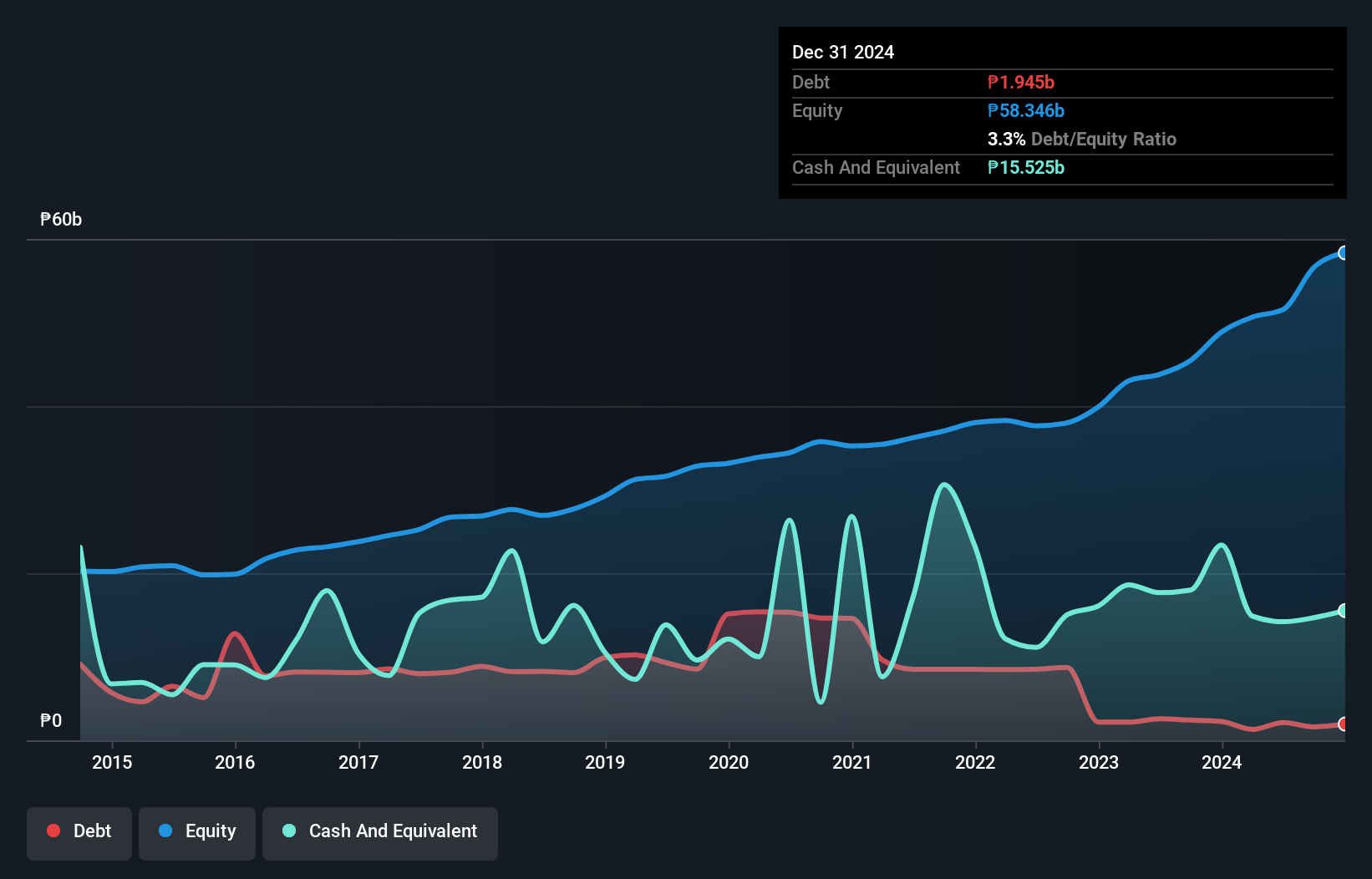

Overview: Asia United Bank Corporation, along with its subsidiaries, offers a range of banking and financial services to individual consumers, MSMEs, and corporations in the Philippines, with a market capitalization of ₱52.05 billion.

Operations: The primary revenue streams for Asia United Bank Corporation include branch banking and commercial banking, generating ₱9.46 billion and ₱4.14 billion respectively. Treasury operations also contribute significantly with ₱3.35 billion in revenue.

Asia United Bank, with total assets of ₱352 billion and equity of ₱56.6 billion, showcases robust growth in the banking sector. Its earnings surged by 38.8% last year, outpacing the industry average of 17.4%. The bank has a solid net interest margin at 4.8%, reflecting its efficient lending practices. Total deposits stand at ₱282 billion against loans of ₱203 billion, supported by low-risk funding sources comprising 95% customer deposits. AUB's allowance for bad loans is sufficient at 2%, indicating prudent risk management despite high non-performing loan levels. Trading below fair value by 18%, it presents potential investment opportunities.

- Navigate through the intricacies of Asia United Bank with our comprehensive health report here.

Understand Asia United Bank's track record by examining our Past report.

New East New Materials (SHSE:603110)

Simply Wall St Value Rating: ★★★★★★

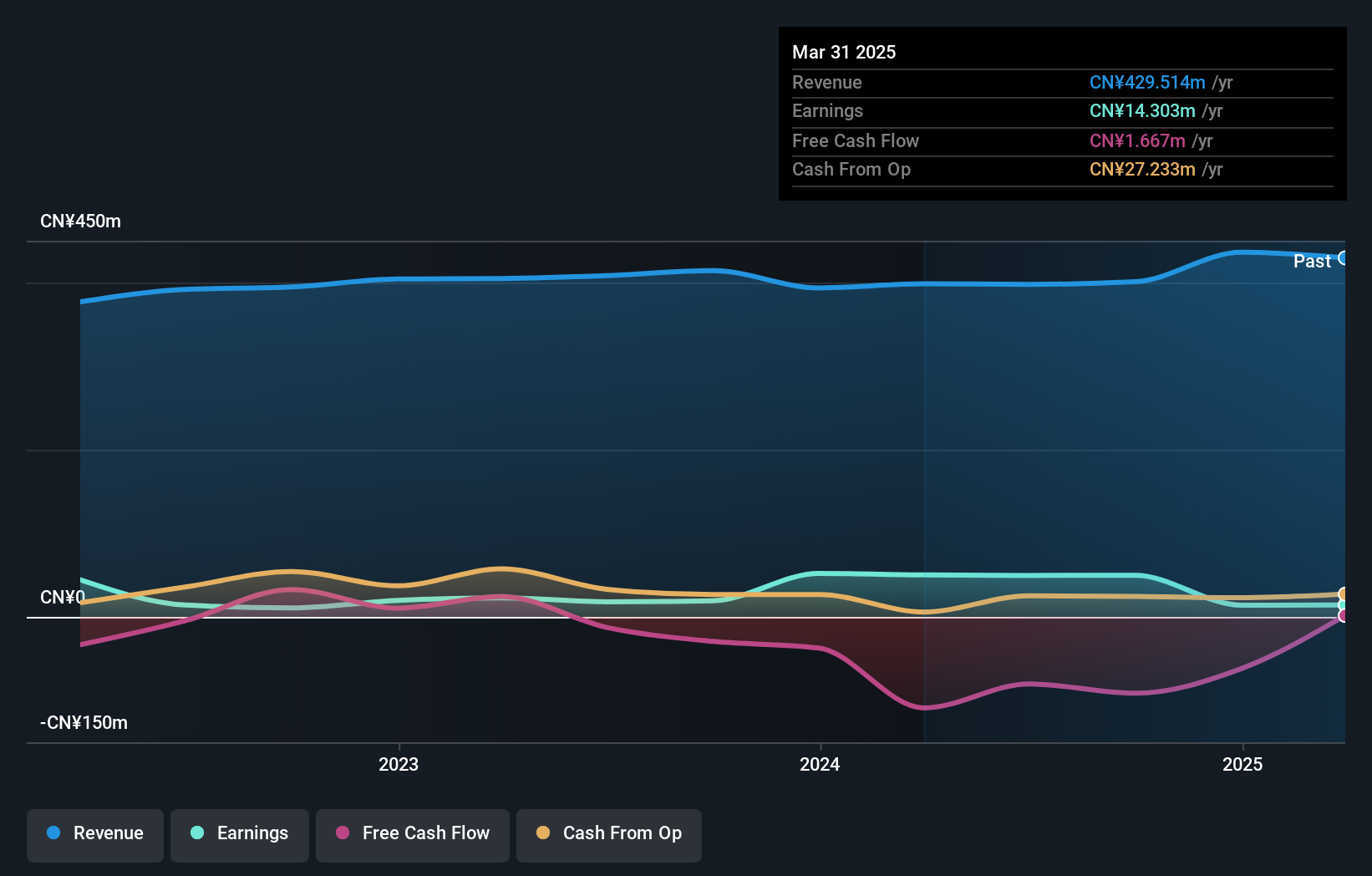

Overview: New East New Materials Co., Ltd specializes in manufacturing and selling raw materials for the flexible and polyurethane adhesives packaging industry in China, with a market cap of CN¥2.93 billion.

Operations: New East New Materials generates revenue primarily from the sale of raw materials for flexible and polyurethane adhesives packaging. The company has experienced fluctuations in its gross profit margin, which was last recorded at 35%.

New East New Materials, a small player in the chemicals sector, has shown impressive earnings growth of 157.6% over the past year, outpacing the industry average of -5.4%. Despite a 9.8% annual decline in earnings over five years, it boasts high-quality non-cash earnings and remains debt-free after reducing its debt from a ratio of 6.3%. The company's recent extraordinary shareholders meeting suggests active engagement with stakeholders. While not free cash flow positive recently, its profitability and lack of debt provide some stability amidst fluctuating capital expenditures like US$115 million last quarter.

- Delve into the full analysis health report here for a deeper understanding of New East New Materials.

Explore historical data to track New East New Materials' performance over time in our Past section.

Shuhua Sports (SHSE:605299)

Simply Wall St Value Rating: ★★★★★★

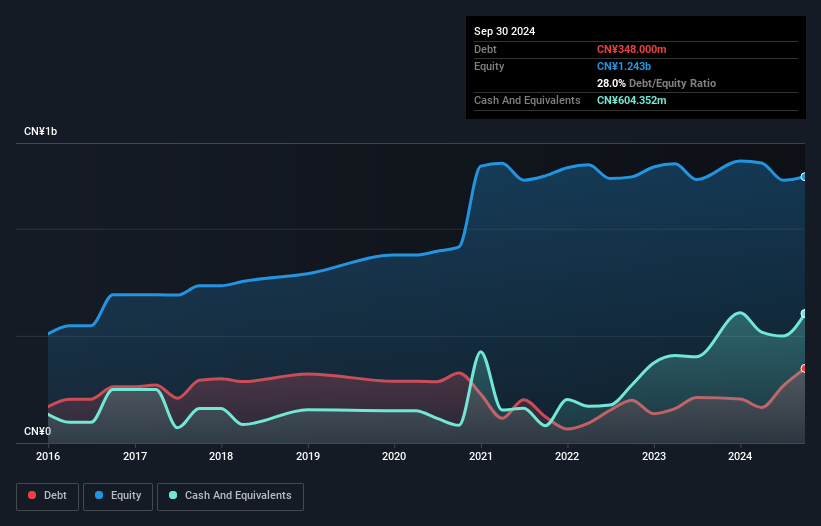

Overview: Shuhua Sports Co., Ltd. is involved in the production and sale of fitness equipment both in China and internationally, with a market cap of CN¥3.33 billion.

Operations: Shuhua Sports generates revenue through the production and sale of fitness equipment in both domestic and international markets. The company's financial performance includes a market capitalization of CN¥3.33 billion, reflecting its position in the industry.

Shuhua Sports, a nimble player in its field, showcases promising financial health with high-quality earnings and a debt-to-equity ratio reduced from 35% to 28% over five years. Earnings growth at 19% last year outpaced the leisure industry's -1%. The company seems to have managed interest payments well, boasting an EBIT coverage of 54 times. Its price-to-earnings ratio of 30 is below the CN market average of 35, suggesting potential value. With free cash flow consistently positive and more cash than debt on hand, Shuhua appears poised for steady growth in the coming years.

- Get an in-depth perspective on Shuhua Sports' performance by reading our health report here.

Assess Shuhua Sports' past performance with our detailed historical performance reports.

Where To Now?

- Click through to start exploring the rest of the 4685 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal