Foreign media forecast: the Bank of Japan is more hesitant, and the pace of interest rate hikes may slow down

The Financial Times Monetary Policy Radar (Monetary Policy Radar) team published on Monday its forecast for the Bank of Japan's interest rate hike next year and beyond. The full text is as follows.

At its December meeting, the Bank of Japan decided not to raise interest rates from the current 0.25% level. Faced with uncertainty surrounding the intensity of wage growth and the policies of the incoming Trump administration, it has also become more hesitant about tightening policies.

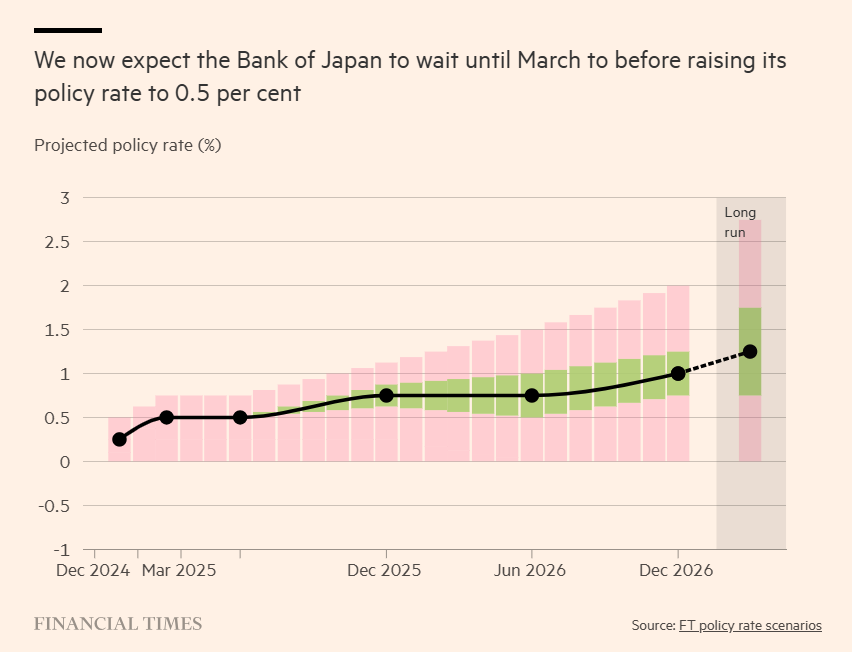

We correctly predicted that if the yen did not weaken, the Bank of Japan was unlikely to further tighten monetary policy in December, but were surprised by the additional caution shown by Governor Kazuo Ueda. As a result, the core scenario we have drawn about Japan's monetary policy is consistent with reality, but the pace of interest rate hikes is now expected to be slower than the November forecast.

What needs to be stated is that there are significant two-way risks in our predictions, and we generally lack confidence in the exact pace of the Bank of Japan's austerity policy.

It is important to remember that the Bank of Japan is still tending towards austerity and wants to normalize interest rates. The biggest problem is the speed of interest rate hikes, which will be very slow in almost every possible situation.

We believe that the three most important issues affecting the pace of monetary tightening in Japan are the yen exchange rate at the next meeting in January, evidence that the virtuous cycle between wages and prices continues, and possible external pressure from the Trump administration.

We believe that the Bank of Japan is likely to seek to keep interest rates unchanged until next March meeting. At that time, it will obtain the initial results of the spring salary negotiations (“Spring Dow”), just like the same month this year. We expect interest rates to be raised twice until next December, then only once more in 2026, and the policy interest rate will remain at 1% — this can be considered close to a neutral level for Japan.

However, the prospects for interest rate hikes after 2025 are highly uncertain. It is best to think of our forecast as a broad prediction of the Bank of Japan's path towards neutral interest rates. Possible events in the next two years may still push the central bank off track.

January 2025 meeting

Kazuo Ueda said that although the Bank of Japan is on the path of austerity, it wants assurances that it can safely raise interest rates without a repetition of the financial turmoil in the summer of 2024, and that it can better understand economic trends.

This kind of security guarantee is unlikely to arrive when the Bank of Japan holds an interest rate setting meeting in late January, because the Trump administration will only be in office for a few days at that time, and the “Spring Battle” results have not yet been announced.

Our core scenario now predicts that the Bank of Japan will keep interest rates unchanged in January next year, but our confidence in this forecast is low because we think it is highly dependent on the yen exchange rate.

If the dollar rises above 160 against the yen again, and there are signs that the dollar may rise further, then concerns about rising import prices will increase and will push the Bank of Japan to raise interest rates.

We think the Bank of Japan is more willing to wait until next year. If it believes that exchange rate pressure requires it to act early, it will send a signal before the January meeting. This will help prevent a recurrence of the turmoil following an unexpected rate hike in late July 2024.

| interest rate | probability | scenario | picturing |

| 0.5% | 30% | Hawk | The Bank of Japan raised interest rates as the weak yen raised concerns that imported inflationary pressure would rise again |

| 0.25% | 65% | neutrals | The Bank of Japan continues to wait for more evidence of Trump 2.0's impact and wage growth, and avoids being forced to tighten monetary policy due to weak yen |

| 0.1% | 5% | pigeons | The Bank of Japan cuts interest rates in an unlikely situation where the economy suddenly weakens |

March 2025 meeting

The Bank of Japan's interest rate decision in March will depend on its actions in January. If it keeps interest rates unchanged at the beginning of the year, we think it will seek an opportunity to take a step towards normalizing interest rates in March.

To raise interest rates at this meeting, the Bank of Japan needs to prove that economic activity remains steady, that the new Trump administration does not pose a direct threat to the Japanese economy, and that the company plans to raise wages drastically in spring. This is our core scenario.

There is a moderate possibility that some of these conditions could not be fully met, leading the Bank of Japan to decide to wait further before raising interest rates again.

| interest rate | probability | scenario | picturing |

| 0.75% | 5% | Hawk | Rapid wage growth and a sharp depreciation of the yen prompted the Bank of Japan to choose continuous interest rate hikes |

| 0.5% | 65% | neutrals | The Bank of Japan raised interest rates in March because the Bank of Japan received the necessary guarantees that wages would increase reasonably and economic activity remained stable, and Trump would not pose a serious risk to the Japanese economy |

| 0.25% | 25% | pigeons | The Bank of Japan maintains an austerity bias but decided to wait for more information on wages and economic activity at the beginning of Trump's return to the US presidency |

June 2025 Meeting

By the summer of 2025, we expect the Bank of Japan to ensure interest rates remain at 0.5%, 25 basis points lower than our core scenario last month. This reflects greater caution on the part of officials and the greater risk of the Trump administration disrupting the Japanese economy.

The weakening confidence in Japan's economic outlook is likely to be reflected in weak wage growth and lower growth in economic activity than currently anticipated. If this impact is significant, there is a high risk that the Bank of Japan will keep interest rates at 0.25% instead of raising interest rates further.

And if the virtuous cycle between wages and prices seems stable before summer, we think the Bank of Japan has a reasonable chance to put aside recent prudence and use this opportunity to normalize interest rates and reduce interest rates to 0.75% by June.

| interest rate | probability | scenario | picturing |

| 0.75% | 20% | Hawk | Wage and inflation trends are in line with the Bank of Japan's expectations, enabling it to normalize more quickly |

| 0.5% | 40% | neutrals | The Bank of Japan's assessment mission. After spring wage negotiations, wage and inflation trends are on track, but hopes to slowly normalize interest rates |

| 0.25% | 30% | pigeons | The Bank of Japan continues to keep interest rates unchanged to cope with the development of weak wages and inflation or the increased risk of external shocks such as trade tariffs |

December 2025 meeting

Our core scenario is that by the end of 2025, the Bank of Japan will raise interest rates a total of four times during this cycle, and the policy interest rate will reach 0.75% by the end of the year. The path to this level has been slower than we predicted in November, which reflects the Bank of Japan's more cautious behavior.

We believe that in a year of considerable economic uncertainty, the risk of this forecast is strongly inclined to decline, as economic confidence and the will of Japanese companies to continue to raise wages and prices may easily be weakened.

Upside risk, on the other hand, consists of two situations. In a more disheartening situation, the depreciation of the yen and the hawkish Federal Reserve will force the Bank of Japan to raise interest rates to prevent imported inflation. Another high interest rate scenario comes about when growth will grow faster and wages and prices will continue to form a good cycle, which will also enable the Bank of Japan to achieve the goal of normalizing interest rates.

| interest rate | probability | scenario | picturing |

| 1% | 15% | Hawk | The inflationary pressure caused by higher-than-trend growth and the depreciation of the yen exceeded the Bank of Japan's expectations, forcing interest rates to rise faster |

| 0.75% | 45% | neutrals | The Bank of Japan assesses that wage and inflation trends are still on track and may take another step towards normalization in the second half of 2025 |

| 0.25%-0.5% | 30% | pigeons | The Bank of Japan continues to keep interest rates unchanged to cope with the development of weak wages and inflation or the increased risk of external shocks such as trade tariffs |

June 2026 Meeting

Our core scenario remains that interest rates reach 0.75% by mid-2026. This is more likely to happen than at the end of 2025, as the Bank of Japan may either raise interest rates to 0.75% at the end of 2025 and then stay the same in 2026, or delay doing so until early 2026.

We don't have enough confidence in this view, but we think the Bank of Japan may want to raise interest rates once or twice within the next year to bring interest rates close to 1%, which is a reasonable neutral range. However, the Bank of Japan's ambitions may also be undermined, that is, interest rates will fall below this level for a long time.

| interest rate | probability | scenario | picturing |

| 1%-1.5% | 15% | Hawk | The Bank of Japan believes the virtuous cycle of wages and prices will strengthen and seek a more normal range of interest rates |

| 0.75% | 45% | neutrals | The Bank of Japan assesses that after spring wage negotiations, wage and inflation trends are on track and continue to push up interest rates very slowly |

| 0%-0.25% | 25% | pigeons | The Bank of Japan continues to keep interest rates unchanged to cope with the development of weak wages and inflation or the increased risk of external shocks such as trade tariffs |

December 2026 Meeting

By the end of 2026, our neutral interest rate forecast for the Bank of Japan is still 1%. The Bank of Japan will continue to raise interest rates very slowly, and it can be said that it has reached a neutral interest rate by the end of 2026.

As it stands, this is simply an indicative path, because we think other events are significantly more likely to push the Bank of Japan off track than the possibility that the central bank will gradually normalize interest rates. We believe that risk is more inclined to the downside, and will continue to hold this view until there is clear evidence that the Japanese economy needs to continue to raise interest rates. This is consistent with the experience of this century.

| interest rate | probability | scenario | picturing |

| 1.25% - 1.5% | 20% | Hawk | The Bank of Japan believes the virtuous cycle of wages and prices will strengthen and seek a more normal range of interest rates |

| 1% | 30% | neutrals | The Bank of Japan assesses that after spring wage negotiations, wage and inflation trends are on track and continue to push up interest rates very slowly |

| 0.25%-0.75% | 30% | pigeons | The Bank of Japan continues to keep interest rates unchanged to cope with the development of weak wages and inflation or the increased risk of external shocks such as trade tariffs |

Long-term interest rate prospects

Over the long term, we estimate the neutral interest rate to be around 1.25%, which is in line with the November forecast, but we have very little confidence in it.

| interest rate | probability | scenario | picturing |

| 1.75%-2.75% | 20% | Hawk | The Bank of Japan successfully escaped decades of weak growth and inflation, so higher neutral interest rates are needed. Since inflation is significantly above target, higher nominal interest rates are needed to maintain the same long-term monetary policy stance |

| 0.75%-1.75% | 40% | neutrals | The neutral interest rate is low, similar to the yield on very long-term Japanese treasury bonds. This interest rate is very low, given that it has been difficult for Japan to fully raise the inflation rate for a long time. The path to a neutral interest rate is likely to be bumpy and out of range for a long time |

| 0%-0.7% | 20% | pigeons | Ben fell back into the low inflation trap and failed to drive domestic inflation and wage growth |

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal