TD Securities shouts: Silver will continue to outperform gold next year!

Silver is the most exciting investment target in the entire commodity market this year. TD Securities commodity strategists expect silver to outperform gold again in 2025.

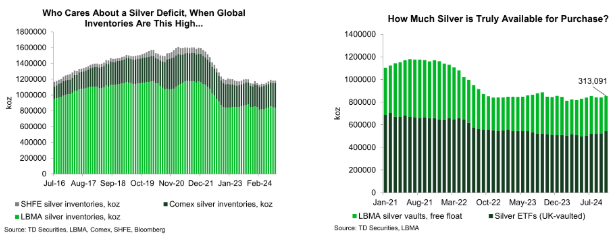

In its 2025 commodity outlook report, TD Securities analysts said that strong economic growth in the US and China in the second half of 2025 will stimulate demand and tighten the undersupplied silver market, and excess inventory will be digested over the next year.

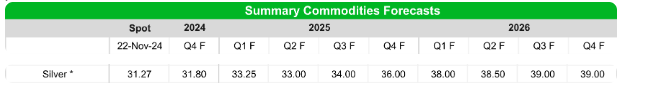

They wrote, “As Asian demand recovers, the silver market is likely to face supply constraints. We expect the metal to average $36 per ounce in the last few months of next year, which will make it a commodity leader as the gold to silver ratio will challenge yearly lows. How the new Trump administration handles the promises of the Inflation Reduction Act, climate, and tariff issues will be a key factor affecting silver's performance.”

The analyst added, “The silver squeeze you can participate in is the most exciting deal in the entire commodities market in 2024.”

They still believe that this precious metal has huge potential for growth in the coming year, and said, “There is no doubt that the rise in silver in the past year is mainly related to the rise in gold, but we have noticed that the current situation is explosively convex, which indicates the imminent erosion and eventual exhaustion of freely circulating stocks.”

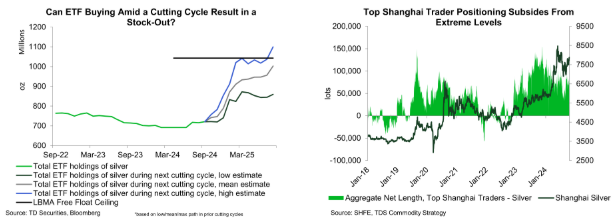

TD Securities believes that the ETF buying activity that usually accompanies the Fed's interest rate cut cycle “may drastically shorten the time it takes for existing silver stocks to dry up.”

They said, “This is far from a typical cycle, with additional room for growth associated with potential threats to the independence of the Federal Reserve that could further enhance the attractiveness of precious metals investments. ETF buying activities are a key catalyst for potentially draining stocks in the London bullion market, as they erode the supply of 'freely purchasable' metals in the world's largest treasury systems.”

They warned, “If ETF purchases follow the average path of the Federal Reserve in a typical easing cycle, then the entire 'free circulation' of the London bullion market will almost be eroded. In fact, the metals currently available for purchase are insufficient to meet ETF purchases similar to the unusual pandemic-era interest rate cut cycle.”

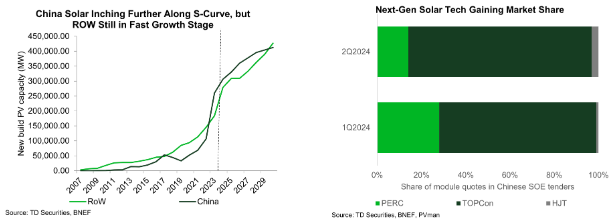

At the same time, as investment demand grew, booming demand for solar energy also provided basic support for silver prices, as this demand continued to exceed expectations.

TD Securities said, “Weak traditional industrial demand has brought a countercurrent to the decline in free circulation, but a strong US economy may stop these industries from weakening further. At the same time, global solar installations are still in a healthy phase, and production capacity needs to be greatly increased in the future.”

They pointed out, “While the Trump administration may not be conducive to the growth of domestic solar production capacity, the rest of the world is still moving towards a significant increase in production capacity.”

The analyst said, “Most importantly, the price of silver has remained high for some time, but we have not seen any signs of 'monsters' showing a hideous face. Customs data shows that there has been no increase in exports associated with global private treasury holdings, which indicates that we have yet to reach the execution price that could drive private treasury holdings into the market.”

TD Securities believes that even though silver has been at a high level for many years, the market price still hasn't reached the level of “any pressure relief valve we have determined to pour into the market.”

They concluded, “The current situation requires higher prices to release inventory from unconventional sources. This is the most convex transaction in the commodities market, and in the silver market, the fund's position (position position) appears to be more clear and easier to understand and analyze than in the gold market. As a result, we expect silver to outperform gold by a large margin in the future.”

TD Securities's detailed forecast shows that spot silver traded at $33.25 per ounce in the first quarter of 2025, $33 in the second quarter, $34 in the third quarter, and peaked at $36 per ounce in the fourth quarter. They are more optimistic about their 26-year outlook, and they expect silver to trade between $38 and $39 per ounce in 2026.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal