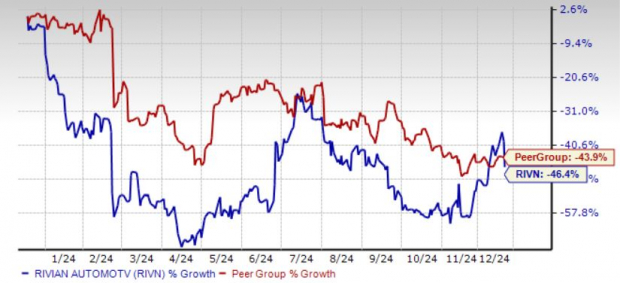

RIVN Shares Plunge 46% YTD: How to Play the Stock for 2025?

Shares of California-based electric vehicle (EV) maker Rivian Automotive RIVN are having a rough run on the bourses this year. Year to date, the stock is down 46%. Much of the decline is part of the broader struggles in the EV space. Lofty expectations for rapid adoption have been tempered by reality. Limited charging infrastructure, high vehicle prices and economic uncertainties have slowed EV demand. Adding to the complexity, the potential expiration of federal EV tax credits and an unfriendly stance toward EVs by President-elect Donald Trump have cast a shadow on what was once one of the most hyped EV startups.

Just yesterday, Rivian shares tanked 11% after analysts at Baird cut the price target on the stock from $18 to $16, expressing skepticism about its near-term growth. With Rivian’s stock trading far below its 52-week high of $24.62 and a short interest exceeding 20% of its float, investors are left wondering: Is it time to buy the dip, hold on, or exit?

YTD Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

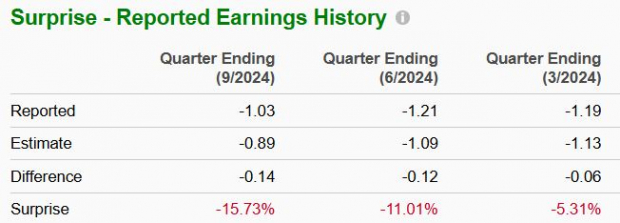

RIVN’s Disappointing 2024 Results

Rivian’s financial results in 2024 have been underwhelming. In each of the three trailing quarters, Rivian reported earnings miss. Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Image Source: Zacks Investment Research

The net loss in the first nine months of 2024 widened year over year to more than $4 billion. Production and supply chain difficulties hit RIVN this year, because of which it lowered its 2024 production guidance to 47,000-49,000 vehicles in October from 57,000 units projected earlier. This also implies a contraction of 16% at the midpoint of the guidance on a year-over-year basis.

This slowdown is concerning, as the company should ideally be in growth mode. While Rivian maintained its 2024 delivery outlook of 50,500-52,000 units, this represents only modest growth from 2023 levels. The company also lowered its adjusted EBITDA forecast for the year, with projected losses of $2.83-$2.88 billion compared with the prior forecast of a loss of $2.7 billion.

Potential Growth Drivers for Rivian

Despite the current challenges, Rivian has some promising long-term growth drivers.

Its strategic partnership with Volkswagen VWAGY could provide a significant boost. VWAGY has committed to investing up to $5.8 billion in Rivian, including $2.3 billion in 2024 and additional funding by 2028 based on milestones. This partnership aims to enhance Rivian’s technology and expedite production timelines.

Second, Rivian is expanding its portfolio with the R2, R3 and R3X models. The R2, a midsize SUV slated for a 2026 release, is expected to be priced at $45,000—nearly half the cost of Rivian’s current R1 lineup. This lower price point aims to attract budget-conscious buyers and broaden Rivian’s customer base. If executed well, these models could significantly boost the company’s market share.

Third, the company is focused on reducing costs and improving profitability. RIVN aims to achieve gross profit by fourth-quarter 2024—a critical milestone that could instill investor confidence. Material costs for the R1 lineup are expected to fall 20% next year, while costs for the R2 models could decline 45%. The Zacks Consensus Estimate for 2025 bottom line implies a year-over-year improvement of 38.5%.

Finally, a $6.6 billion loan from the U.S. Department of Energy will fund Rivian’s new manufacturing facility in Georgia, bolstering production capacity. However, the first construction phase isn’t expected to be completed until 2028, making this a longer-term catalyst.

What Should Investors Do Now?

While Rivian’s strategic initiatives are promising, are they enough to buy the stock? We don’t think so. The company faces significant near-term headwinds now. As it is, like most EV players, it has been burning cash. Rivian’s cash and cash equivalents fell to $5.4 billion at the end of third-quarter 2024 from $7.9 billion at the end of 2023. The company’s ongoing expansion and production ramp-up will likely result in continued cash burn, delaying profitability. It is likely to remain unprofitable in the next few years as it works to scale its production and navigate the increasingly competitive EV market.

On top of that, the potential expiration of the federal electric vehicle tax credit ($7,500 for new EVs and $4,000 for used ones) could further challenge EV adoption—at a time when affordability is already curbing broader demand for these vehicles.

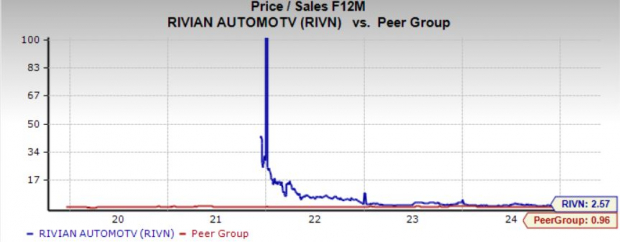

Rivian’s P/S ratio remains elevated compared to industry peers, making the stock less attractive from a valuation standpoint.

Image Source: Zacks Investment Research

And then, there are execution risks. While the Volkswagen partnership is promising, the success of this collaboration is contingent on meeting aggressive targets, and the history of failed joint ventures in the auto industry tempers optimism. For instance, both Volkswagen and Rivian have faced setbacks in their collaborations with Ford F in recent years. Rivian and Ford abandoned their plans to co-develop EVs just two years after Ford acquired a 12% stake in the startup in 2019. Similarly, Volkswagen's $2.6 billion partnership with Ford to advance autonomous vehicle technology failed to materialize as intended. While VWAGY and Rivian have high expectations for the joint venture, only time will tell if they bear fruit.

For current shareholders, holding the stock could be a reasonable strategy, given Rivian’s long-term potential. However, new investors should wait until the company demonstrates tangible progress in improving bottom line and scaling production. The regulatory landscape and broader EV market trends also need to stabilize before Rivian becomes a buy for 2025.

RIVN stock carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F): Free Stock Analysis Report

Volkswagen AG Unsponsored ADR (VWAGY): Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN): Free Stock Analysis Report

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal