There's Reason For Concern Over Hind Rectifiers Limited's (NSE:HIRECT) Massive 41% Price Jump

Despite an already strong run, Hind Rectifiers Limited (NSE:HIRECT) shares have been powering on, with a gain of 41% in the last thirty days. The last month tops off a massive increase of 218% in the last year.

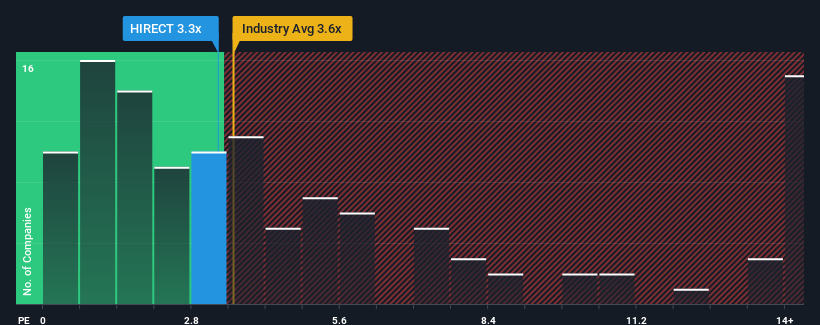

In spite of the firm bounce in price, it's still not a stretch to say that Hind Rectifiers' price-to-sales (or "P/S") ratio of 3.6x right now seems quite "middle-of-the-road" compared to the Electrical industry in India, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Hind Rectifiers

How Has Hind Rectifiers Performed Recently?

Recent times have been quite advantageous for Hind Rectifiers as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hind Rectifiers will help you shine a light on its historical performance.How Is Hind Rectifiers' Revenue Growth Trending?

In order to justify its P/S ratio, Hind Rectifiers would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 45%. The strong recent performance means it was also able to grow revenue by 68% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 34% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Hind Rectifiers is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Hind Rectifiers appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hind Rectifiers' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you take the next step, you should know about the 5 warning signs for Hind Rectifiers (1 is a bit unpleasant!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal