There's No Escaping SIL Investments Limited's (NSE:SILINV) Muted Earnings Despite A 28% Share Price Rise

The SIL Investments Limited (NSE:SILINV) share price has done very well over the last month, posting an excellent gain of 28%. The annual gain comes to 122% following the latest surge, making investors sit up and take notice.

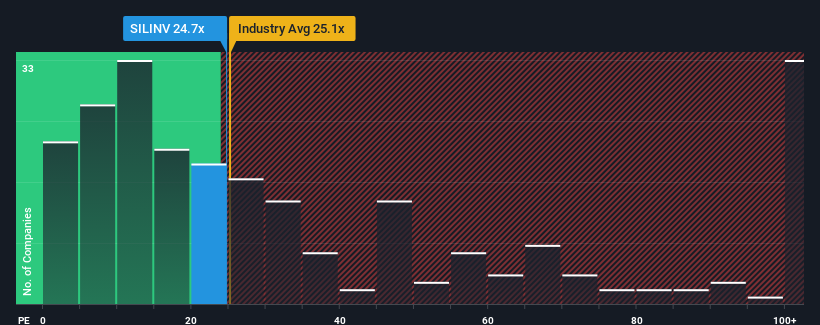

Although its price has surged higher, SIL Investments may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 24.7x, since almost half of all companies in India have P/E ratios greater than 34x and even P/E's higher than 65x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For example, consider that SIL Investments' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for SIL Investments

Is There Any Growth For SIL Investments?

In order to justify its P/E ratio, SIL Investments would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 7.1% decrease to the company's bottom line. Even so, admirably EPS has lifted 78% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that SIL Investments' P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From SIL Investments' P/E?

The latest share price surge wasn't enough to lift SIL Investments' P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that SIL Investments maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for SIL Investments that we have uncovered.

You might be able to find a better investment than SIL Investments. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal