The five-year shareholder returns and company earnings persist lower as Jinxin Fertility Group (HKG:1951) stock falls a further 10% in past week

Jinxin Fertility Group Limited (HKG:1951) shareholders will doubtless be very grateful to see the share price up 53% in the last month. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. In fact, the share price has tumbled down a mountain to land 76% lower after that period. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Since Jinxin Fertility Group has shed HK$1.0b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Jinxin Fertility Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

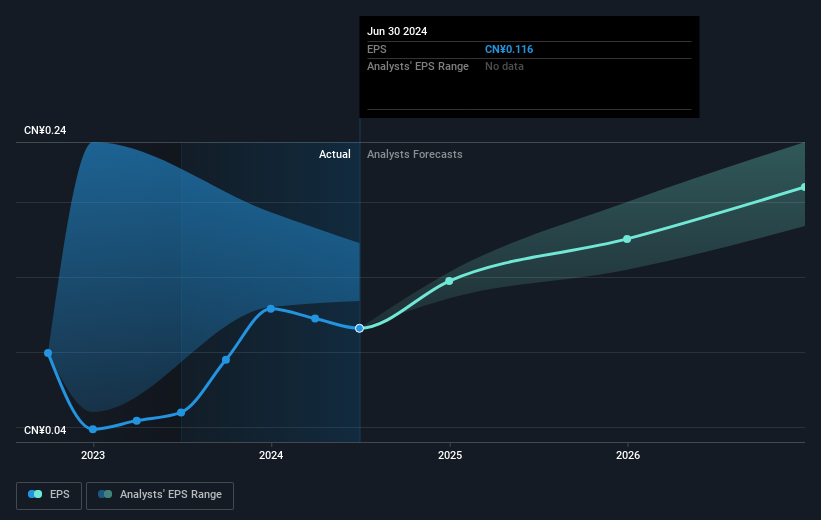

During the five years over which the share price declined, Jinxin Fertility Group's earnings per share (EPS) dropped by 4.6% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 25% per year, over the period. So it seems the market was too confident about the business, in the past.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Jinxin Fertility Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Jinxin Fertility Group shareholders are down 6.4% for the year (even including dividends), but the market itself is up 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 12% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Jinxin Fertility Group is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal