The Market Lifts Zhejiang Walrus New Material Co., Ltd. (SZSE:003011) Shares 47% But It Can Do More

The Zhejiang Walrus New Material Co., Ltd. (SZSE:003011) share price has done very well over the last month, posting an excellent gain of 47%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

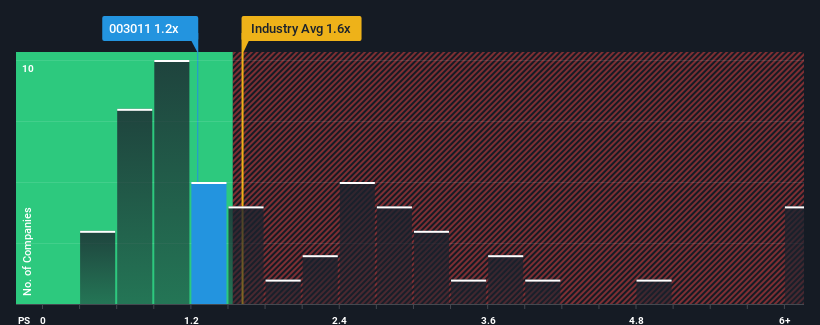

Even after such a large jump in price, it's still not a stretch to say that Zhejiang Walrus New Material's price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Building industry in China, where the median P/S ratio is around 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Zhejiang Walrus New Material

How Has Zhejiang Walrus New Material Performed Recently?

Zhejiang Walrus New Material could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Zhejiang Walrus New Material's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Zhejiang Walrus New Material?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Zhejiang Walrus New Material's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. As a result, revenue from three years ago have also fallen 7.7% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 30% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 21%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Zhejiang Walrus New Material's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Zhejiang Walrus New Material's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Zhejiang Walrus New Material currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Zhejiang Walrus New Material with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal