Guangzhou Sanfu New Materials Technology Co.,Ltd's (SHSE:688359) 33% Price Boost Is Out Of Tune With Revenues

Those holding Guangzhou Sanfu New Materials Technology Co.,Ltd (SHSE:688359) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 49% in the last twelve months.

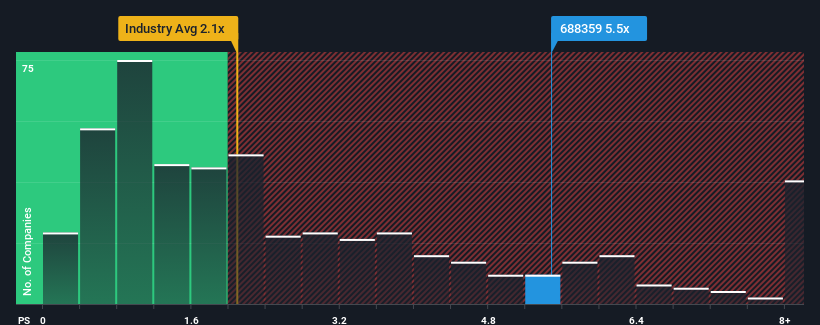

Following the firm bounce in price, you could be forgiven for thinking Guangzhou Sanfu New Materials TechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.5x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Guangzhou Sanfu New Materials TechnologyLtd

What Does Guangzhou Sanfu New Materials TechnologyLtd's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Guangzhou Sanfu New Materials TechnologyLtd has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Guangzhou Sanfu New Materials TechnologyLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Guangzhou Sanfu New Materials TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. The latest three year period has also seen an excellent 61% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 21% shows it's noticeably less attractive.

With this in mind, we find it worrying that Guangzhou Sanfu New Materials TechnologyLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Guangzhou Sanfu New Materials TechnologyLtd's P/S?

Guangzhou Sanfu New Materials TechnologyLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Guangzhou Sanfu New Materials TechnologyLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Guangzhou Sanfu New Materials TechnologyLtd (of which 2 make us uncomfortable!) you should know about.

If these risks are making you reconsider your opinion on Guangzhou Sanfu New Materials TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal