Zhuhai Enpower Electric Co.,Ltd. (SZSE:300681) Stock Rockets 34% But Many Are Still Ignoring The Company

The Zhuhai Enpower Electric Co.,Ltd. (SZSE:300681) share price has done very well over the last month, posting an excellent gain of 34%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 13% over that time.

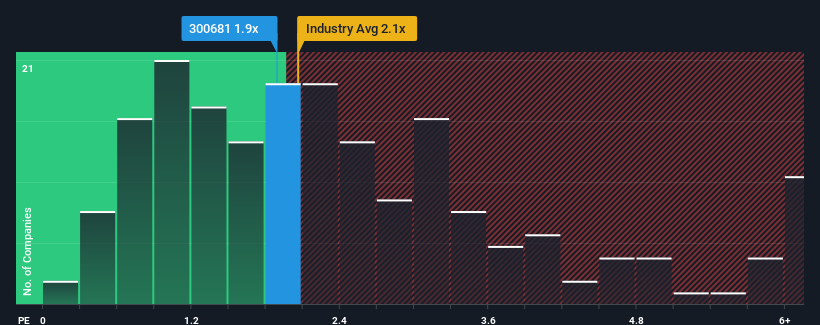

Although its price has surged higher, you could still be forgiven for feeling indifferent about Zhuhai Enpower ElectricLtd's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in China is also close to 2.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Zhuhai Enpower ElectricLtd

What Does Zhuhai Enpower ElectricLtd's P/S Mean For Shareholders?

Revenue has risen firmly for Zhuhai Enpower ElectricLtd recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Zhuhai Enpower ElectricLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhuhai Enpower ElectricLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Zhuhai Enpower ElectricLtd's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 283% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 23% shows it's noticeably more attractive.

With this information, we find it interesting that Zhuhai Enpower ElectricLtd is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Zhuhai Enpower ElectricLtd's P/S?

Its shares have lifted substantially and now Zhuhai Enpower ElectricLtd's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Zhuhai Enpower ElectricLtd's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 2 warning signs for Zhuhai Enpower ElectricLtd that we have uncovered.

If these risks are making you reconsider your opinion on Zhuhai Enpower ElectricLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal