Se Gyung Hi Tech Co., Ltd.'s (KOSDAQ:148150) 31% Price Boost Is Out Of Tune With Revenues

Those holding Se Gyung Hi Tech Co., Ltd. (KOSDAQ:148150) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 59%.

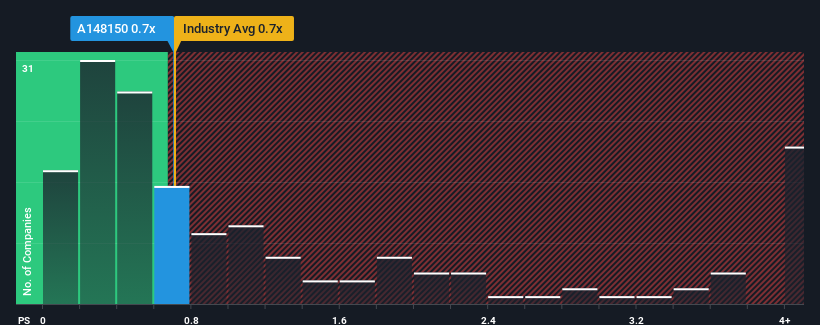

Although its price has surged higher, you could still be forgiven for feeling indifferent about Se Gyung Hi Tech's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Korea is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Se Gyung Hi Tech

How Has Se Gyung Hi Tech Performed Recently?

With revenue growth that's superior to most other companies of late, Se Gyung Hi Tech has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Se Gyung Hi Tech's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Se Gyung Hi Tech's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 56% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 2.9% over the next year. With the industry predicted to deliver 12% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Se Gyung Hi Tech's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On Se Gyung Hi Tech's P/S

Se Gyung Hi Tech appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears that Se Gyung Hi Tech currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Se Gyung Hi Tech that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal